Bitcoin tries to hold; MicroStrategy buys more; Tether resumes printing

Coinhead

Coinhead

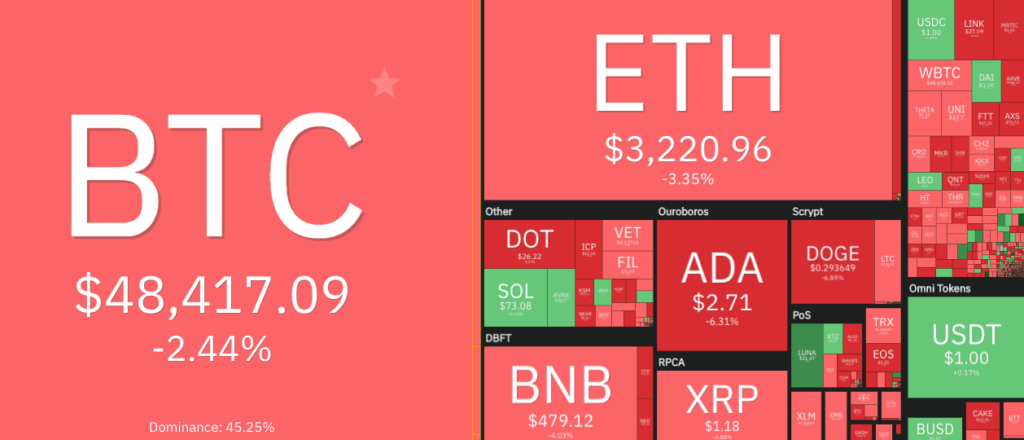

It’s a red day so far in the crypto market and all eyes have been on Bitcoin to see if it can hold US$48K – a line of support that’d keep it in the short-term bullish picture.

At the time of writing, the entire market cap is down 0.84% and sitting at US$2.02 trillion. Bitcoin (BTC) is losing its grip as we tap the keys, back down under US$49K again to US$48.4K.

Analysts believe it needs to hold a level around US$48K or just above to remain in a decent position to regroup for further positive price momentum.

#BTC is still technically retesting this current area as support

Downside wicking is possible but what's more important is continued Daily candle closing above ~$48350 for BTC to set itself up for further upside$BTC #Crypto #Bitcoin pic.twitter.com/FtvclBfIgx

— Rekt Capital (@rektcapital) August 24, 2021

However, if it does lose US$48K, Dutch trader Michaël van de Poppe is at least one analyst who thinks the drop from there could be pretty steep – to somewhere around US$44K or even as low as $US41.4K. These are zones he’s been watching for a while now.

Market showing a little less momentum as the past period.

That's not bad. Would be quite good actually, if #Bitcoin establishes a new higher low around the $44K region.

— Michaël van de Poppe (@CryptoMichNL) August 24, 2021

If, however, you simply can’t get by a day without some pretty extreme hopium for a Bitcoin and crypto “supercycle”, then this might tide you over…

#BTC #Crypto THE REAL BUBBLE IS COMING!

In May 2020 (#BTC was $8k), I put out a call for a relatively straight shot to the 60k's

Even I'm amazed by the precision here. But, the key takeaway now is if/when this line is broken, we are QUICKLY going to never-never land

SEE CHART! pic.twitter.com/BXUZqv7iwT

— Mr. Anderson (@TrueCrypto28) August 24, 2021

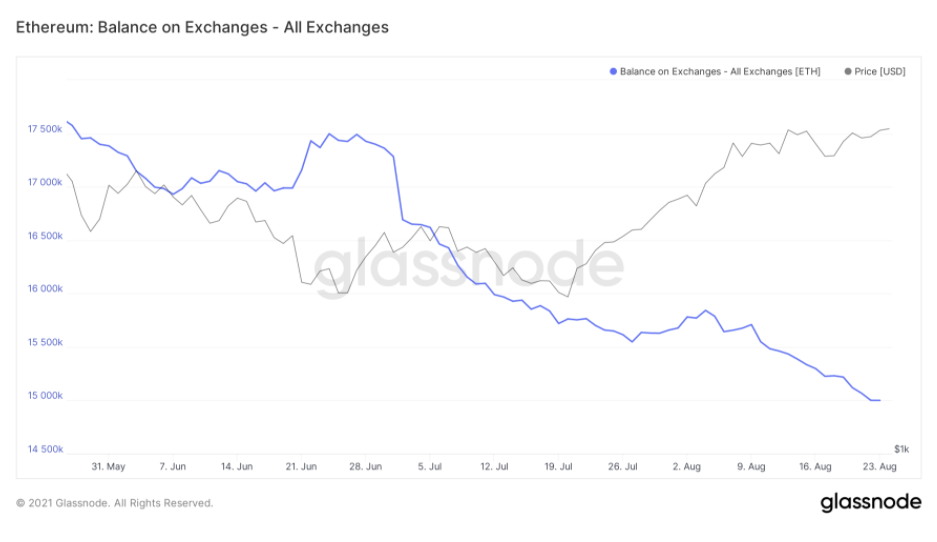

Ethereum (ETH), meanwhile, is down 3.35% in the past 24 hours and changing hands for US$3,220 at press time.

In the aftermath of the EIP-1559 gas-fee-burning protocol going live earlier in August, some analysts and observers are predicting an incoming “supply shock” for the no.2 crypto to reflect in the price chart soon.

A reducing ETH supply on cryptocurrency exchange wallets, coupled with the increasing number of ETH disappearing from circulation in general, is a potential recipe for supply-blasting bullish momentum.

In other top coin news, Cardano (ADA) has currently lost some of its powerful momentum from the past few days, and has pulled back 8.06% at press time, to US$2.68. It’s perhaps unsurprising at this point, considering the run it’s been on just lately, rallying 190% in just over a month, rocketing from about US$1 to nearly US$3.

One thing to note, Cardano recently secured a listing on Japanese exchange Bitpoint, and trading for ADA will finally be live on it from tomorrow (August 25). Watch for some potential further price-spike action on the token. Which direction, though, is difficult to gauge, especially with the indecisive state of the market today.

At press time, some notable coins still doing quite well compared to this time yesterday include: Terra (LUNA) +9.96%; Quant (QNT) +7.41%; and Avalanche (AVAX) +7.26%.

And on the flip side of that, some solid projects pushing into double-digit red territory at the moment include: Energy Web Token (EWT) -12.96%; Wax (WAXP) -10.23%; and Helium (HNT) -9.27%.

MicroStrategy, led by possibly the most bullish of all Bitcoin bulls, Michael Saylor, has meanwhile found another US$177 million behind the couch – adding 3,907 more BTC to its holdings.

The tech-focused business intelligence company, more known as a Bitcoin hoarder to you and me probably, now holds almost 109,000 of the OG coins in its treasury. This amounts to about US$5.29 billion at the current price.

MicroStrategy has purchased an additional 3,907 bitcoins for ~$177 million in cash at an average price of ~$45,294 per #bitcoin. As of 8/23/21 we #hodl ~108,992 bitcoins acquired for ~$2.918 billion at an average price of ~$26,769 per bitcoin. $MSTRhttps://t.co/8jUlJImJbO

— Michael Saylor⚡️ (@saylor) August 24, 2021

MicroStrategy made its first Bitcoin purchase in August 2020 and has shown a slavering appetite for the round orange dish ever since, consistently adding to its holdings.

And Saylor is a spruiker through and through, posting bullish sentiment about Bitcoin on a daily basis, and encouraging other companies to add it to their balance sheets.

Despite paper losses suffered on its holdings during a Q2 crypto market decline, looking at the chart below, it’s hard to argue with what’s become more of a macro strategy for MicroStrategy.

MicroStrategy Performance

Aug. 23, 2021Since the start of their #Bitcoin treasury program:$MSTR +433%$BTC +334%$NASDAQ +40.8% pic.twitter.com/eqDwAi8Zl7

— ecoinometrics (@ecoinometrics) August 24, 2021

The world’s largest stablecoin, Tether (USDT), has begun printing once again after a two-month break that was beginning to concern various astute crypto onlookers.

According to Coindesk, Tether had minted a minimum of US$2.3 billion USDT as of Aug. 1 and had a market cap of US$65 billion. USDT’s market cap levelled out at US$62 billion between June and July, with industry experts attributing lack of demand to the rise of competing stablecoin USDC, China’s crypto crackdown, and a spreading narrative about Tether’s supposed vulnerability.

$2.83B of Tether printed since August 1st.

Probably nothing.

— Will Clemente (@WClementeIII) August 23, 2021

The Tether rebound in demand could be indicative of general bullish sentiment returning to the market as well as surging trade from Solana (SOL) and Terra (LUNA) in recent weeks, which are big USDT trading pairings.

It could also have something to do with an effort from the stablecoin project to provide more transparency about its reserve holdings of commercial paper (CPs) and certificates of deposit (CDs).

Tether's breakdown of reserves is out (with S&P ratings), as well as more info from other stablecoin issuers.

The community has all the info they need to choose the stablecoin right for them.

And #Tether has grown 3B since our interview.

People choose daily, it's a free world 🦁 https://t.co/BJ0wyyKGtt— Paolo Ardoino (@paoloardoino) August 24, 2021

• Following Monday’s CryptoPunk purchase by Visa, the generative avatar project saw a daily sales record for the highest volume of NFTs sold, topping US$86 million.

• Canadian Bitcoin miner Blockstream is now valued at US$3.2 billion, securing US$210 million in investment from UK private equity, and Bitfinex operator iFinex.

• Crypto exchange FTX has bought the naming rights for another US sports venue – the University of California’s Cal Memorial Stadium – in a 10-year, US$17.5 million deal.

• Crypto borrowing and lending platform Celsius has reported its holdings of digital assets have crossed the US$20 billion mark, increasing 1,900% in less than a year.