A new price era for Bitcoin? Pantera Capital predicts ‘shallower’ bear markets

Coinhead

Coinhead

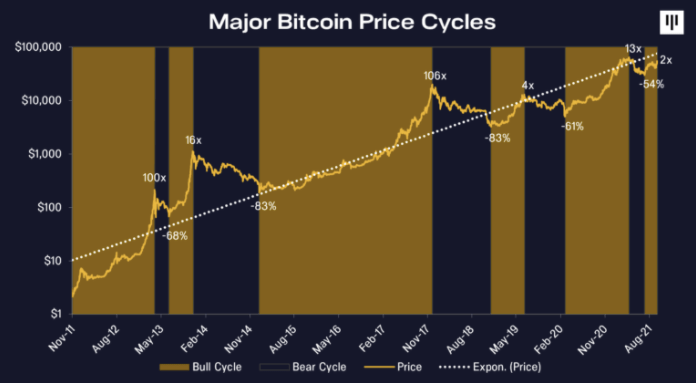

Could Bitcoin’s notorious 80 per cent crashes signalling multi-year bear markets be behind us? Dan Morehead, CEO of hedge fund Pantera Capital, believes so.

Morehead expressed his thoughts on where he thinks the cryptocurrency market is broadly heading in a new report released by the California-based investment and venture capital firm. And the comments have attracted attention amid a price surge for Bitcoin, which has just enjoyed its highest weekly-close price ever – around US$61,500.

“I long advocated that as the market becomes broader, more valuable, and more institutional, the amplitude of prices swings will moderate,” wrote the prominent venture capitalist.

“While we’ve had two down 83% bear markets already, I believe those are a thing of our primordial past. Future bear markets will be shallower. The previous two have been -61% and -54%.”

This doesn’t mean it’s all moons and Lambos, however. Morehead also said that he believes there will be less dramatic upside for Bitcoin in the future.

“Unfortunately, there’s no free lunch, he continued. “The flipside is we probably won’t see any more of the 100x-in-a-year rallies either.”

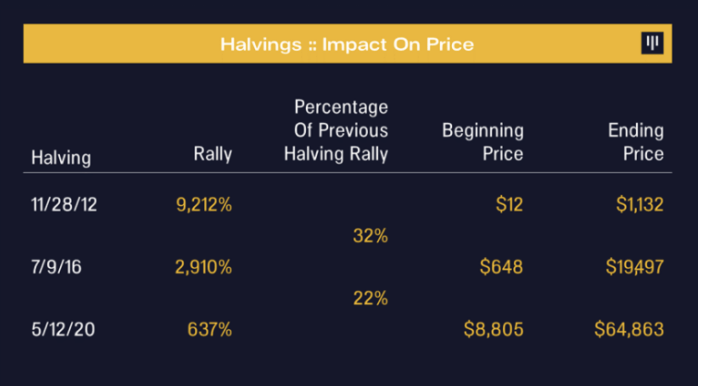

The report predicts that each subsequent Bitcoin “halving” will likely taper off in impact as the ratio of reduction in the supply of new Bitcoins from previous halvings to the next decreases.

A Bitcoin halving, by the way, is an event scheduled into a blockchain protocol that serves to halve the reward of proof-of-work miners that operate in the network. Halvings reduce the rate at which new coins are created, effectively reducing the supply. Bitcoin’s halving event happens roughly every four years. In the past, Bitcoin halvings have subsequently resulted in price surges.

The Pantera report plays into the idea of diminishing returns and lengthening cycles that some crypto data analysts, such as Benjamin Cowen, believe is happening over time. If the theory plays out, it could mean more sustained and steady growth for Bitcoin and, consequentially other cryptos, over a longer period of time, with less heart-pounding volatility.

“I believe we are done with the four-year halving cycle – and on to the next price era,” said Morehead.

At the time of writing, Bitcoin (BTC) is currently changing hands for US$61,917, having rallied 13.7 per cent in the past week on the back of strong Bitcoin US-based exchange-traded fund (ETF) approval rumours.

The US Securities and Exchange Commission has now green-lit two Bitcoin futures-backed ETFs (ProShares and Valkyrie), and the market is bracing itself for potential short-term volatility in the coming days, especially if trading for the ETFs officially launch.

Morehead, in his Pantera report, did however express caution regarding this event, citing the old Wall Street adage: “buy the rumour, sell the fact”.

“Will someone please remind the day before the bitcoin ETF officially launches? I might want to take some chips off the table,” he wrote.

#bitcoin at $61,000 is 2x from where we mark the start of this new bull market in July.

For perspective, the median bull cycle went up 15x over 300 days.

More thoughts on the state of the market here: https://t.co/g46sxp7Qe6 pic.twitter.com/Iy96sJvZzO

— Dan Morehead (@dan_pantera) October 15, 2021

Despite some speculation about how the ETF trading has potential to coincide with a bull-cycle top, it’s still pretty clear, though, that Morehead is extremely bullish on Bitcoin and cryptocurrencies more generally.

“I think we’re still in the early innings of a multi-decade transformation that’s going to have a huge impact on literally billions of people,” he said recently at the SALT Conference in September. The same conference in which Ark Invest CEO Cathie Wood predicted a US$500K Bitcoin within the next five years.