Yowie says a $20m takeover bid is rubbish, but let us look at it first

Food & Agriculture

Food & Agriculture

Yowie (ASX:YOW) says a $20m takeover offer from one their shareholders is not good enough for them to agree to.

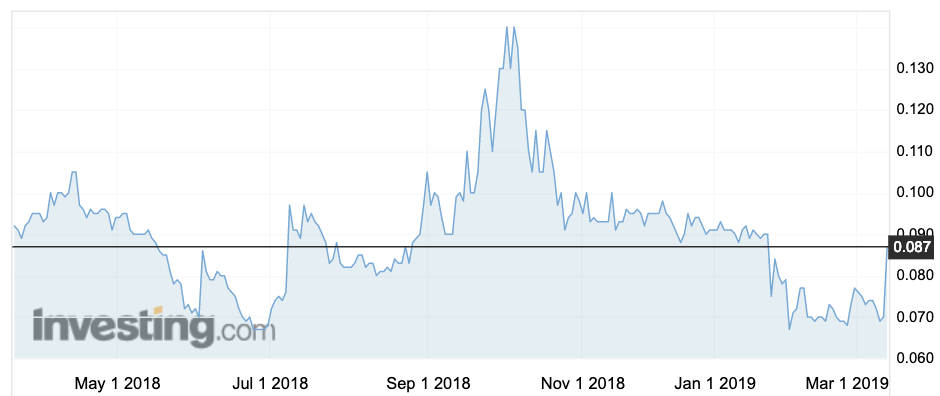

Keybridge Capital (ASX:KBC) is offering 9.2c a share for the struggling chocolatier, a 31.4 per cent premium to the Tuesday closing price of 7c.

The struggling chocolatier is asking its shareholders to sit tight until they can make a recommendation, but said if it were to go ahead on the terms proposed this morning, the recommendation is a strong ‘reject’.

“The board considers the unsolicited approach by KBC to be highly opportunistic. The advised bid price of 9.2 cents fundamentally undervalues Yowie’s business, brand, intellectual property and significant cash balance.

Keybridge’s off-market offer comes a year after one of their co-investors told Stockhead they were just building a position in an undervalued brand.

Keybridge, alongside associate investors Bentley Capital (ASX:BEL) and Aurora Funds Management-controlled HHY Fund, built a combined 19.998 per cent stake in Yowie by February last year.

Bentley Capital director William Johnson told Stockhead they’d identified Yowie as a good, but undervalued brand, and a market overreaction to a series of bad news made it a good buy.

Mr Johnson would not comment at the time on the possibility of Yowie — which makes chocolates in the shape of a mythical Aussie ape-like creature — being a takeover target.

Keybridge says it currently holds 6.051 per cent and has a ‘relevant interest’ in a further 12.182 per cent held by Aurora Funds Management. In January the group lifted their stake again, Keybridge to its current share of 18 per cent and Bentley, which owns a stake in the former, to 22.6 per cent.

Their stated plan in 2018 was to get Yowie back on track after a surprise sales decline and an even more surprising bill from a US customer for retrospective payments based on stock adjustment over two years.

But today the patience ran out.

“Yowie has consistently failed to structure or conduct its business operations in a profitable manner and that Yowie has incurred significant losses in the ordinary course of its business,” Keybridge said as justification for the bid.

“Given those matters, Keybridge wishes to increase its stake in Yowie to a level where it is able to exert material influence (via the appointment of its nominees as directors to reflect its relevant interest in Yowie) for the Yowie board to conduct a review of the company and its operations, assets and liabilities and examine all possible strategic directions for Yowie to maximise its available assets.”

But Yowie has not underperformed badly since that surprise sales downgrade over a year ago.

Revenue for the half year to December 31 slid 4 per cent to $7.7m compared to the prior corresponding period, but they slashed the loss by three quarters to $871,442.

They blamed the revenue slide on rising competition in the US — the same reason they cited a year ago for disappointing sales.

Keybridge is structuring the deal in two ways:

Yowie shares rose 29 per cent to an intraday high of 9c.