The Queensland government has formally awarded Authority to Prospect to coal seam gas explorer Armour Energy’s (ASX: AJQ) joint venture with Australia Pacific LNG (APLNG).

While APLNG, which is a joint venture of Sinopec, ConocoPhillips and Origin Energy, will operate the tenure, Armour will be free to market its proportion of produced gas.

Scroll down for more ASX small cap energy news>>>>

Armour anticipates the first gas will be delivered within two years and it will be exclusively to Australian domestic customers. The company told shareholders this morning it is currently identifying potential customers – specifically energy companies which will onsell to Australian homes and businesses.

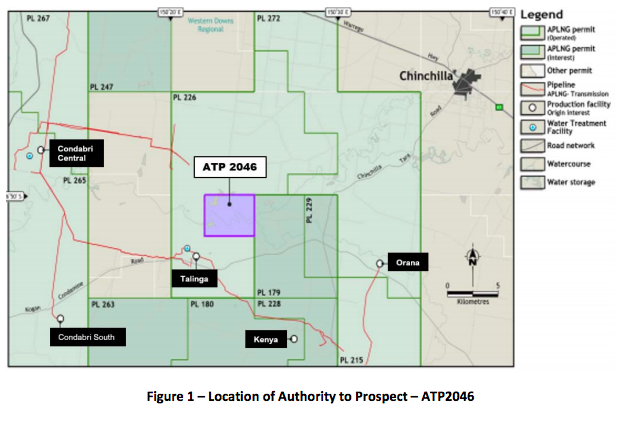

The project lies 22km south-west of Queensland town Chinchilla.

CEO Roger Cressey said the project was rapidly moving ahead and consequently, he was excited.

“We see this concept for local gas development as a tremendous boost to the State in terms of the local energy supply, local manufacturing and local jobs, whether these jobs are a part of the gas field’s development or within the downstream manufacturing sector which has clearly expressed a need for certainty around obtaining reliable and affordable long-term gas supply options for their business needs.”

Cressey declared the project a “unique approach to gas supply to Australian manufacturers”. He also noted Queensland people made up 42 per cent of its shareholders.

In other ASX small cap energy news today…

Sundance Energy (ASX: SUD) have sold its assets in Dimmit County Texas for US$29.5 million. The package included 19 oil wells which produced 1,051 barrels of energy per day in Q1 2019. Sundance CEO Eric McCrady declared the sale had been completed at an attractive price and added to the company’s liquidity position.

Two weeks after its South Marsh Island well turned out to be a failure, Metgasco (ASX: MEL) told shareholders this morning it had “concluded its financial exposure” to the project. It will pay $1.75 million to joint venture partner Byron Energy (ASX: BYE) and has exercised its options in the company. Despite the project failure, the company told shareholders the options exercise was “commercially attractive in its own right”.

Whitebark Energy (ASX: WBE) has expanded its position at its Wizard Lake project in Canada. It has acquired 320 acres, thus taking its total gross area to 3,705 acres. The company estimates at least 20 wells lie within its new acquisition.

Carnavon Petroleum (ASX: CVN) is preparing to drill a third well at its Dorado project. The well is 800 metres north west of the first well and drilling is to confirm the reservoir’s potential. The company’s plan is to undertake tree tests of the site and anticipates “a significant amount of new data to further characterise the Dorado field”.