Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday November 6

Had to pick the right time today to go long and I had to up the size and go all in and pray I didn’t need to double down.

When you look at the charts, you will see that I left a bit on the table in BHP, as boy did they have a strong rally.

WBC set the tone in the banks and the market overall, with some good results and a 72c dividend announcement.

So, on the back of that CBA went through the $100 barrier and reached a high of $101.26 having touched $99.75 just after the opening.

Weebit Nano came out pre market and announced that they had received U$100,000 in a royalty revenue cheque and they became a good mover hitting a high of $4.45, though I managed to get involved twice at below $4.00.

A strange stock that one!

Up $1,150 thanks mainly to Weebit.

Recap

Bought 4,000 BHP @ 45.02

Bought 2,000 WBT @ 3.90

Sold 2,000 WBT @ 4.05 ($300 profit)

Bought 5,000 FMG @ 23.11

Sold 4,000 BHP @ 45.12 ($400 profit)

Bought 5,000 WBT @ 3.97

Sold 5,000 WBT @ 4.04 ($350 profit)

Sold 5,000 FMG @ 23.13 ($100 profit)

Tuesday November 7

A double whammy day of an RBA rate call announcement at 2.30pm and then the Melbourne Cup at 3.00pm.

What is a day trader meant to do?

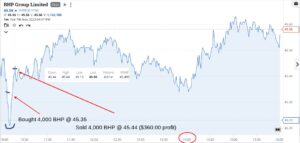

Well, the only thing I could think of was to play around in the iron ore plays, so I went early in to BHP.

Timing was off but eventually came good and just like yesterday, went a bit all in.

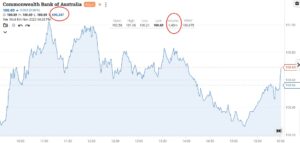

When the RBA rate rise came in, CBA initially fell but then got caught in a bear squeeze, as this bit of news was 99.9% known by everyone. So someone was caught wrong-footed – see chart.

Up $360 and nothing from the gee-gees as not really a punter, outside of my little bubble world of shares.

Recap

Bought 4,000 BHP @ 45.35

Sold 4,000 BHP @ 45.44 ($360 profit)

Wednesday November 8

After yesterday’s excitement of the Melbourne Cup everything seemed less exciting.

The Optus outage didn’t affect me but it did make me think that when I was long of RIOs and BHP, what happens if the ASX stops or something else out of my control, so I was very happy to get out and just sit back.

I couldn’t believe RIOs which were $123 last week and $121.81 yesterday, trading in the $117s.

CBA closed plus 68c at $100.69, with a low of $100.21 and a high of $101.06 on 1.4m shares of which 690,000 went through in the 4.10pm match up.

Plus $460 for the day and hopefully Optus will be back to normal tomorrow.

Recap

Bought 1,000 RIO @ 117.81

Bought 2,000 BHP @ 44.28

Sold 1,000 RIO @ 118.19 ($380 profit)

Sold 2,000 BHP @ 44.32 ($80 profit)

Thursday November 9

WBC go ex div today, which gives me an opportunity to have two goes in them, as for some reason, they collapse like an English cricket team at the crease, with 30 mins to go.

This allows me to go ‘all in’ and ride them till just before the close.

CBA act like we are in a bull market and hit $103 at their high for the day. Their range was in fact, $101.10 to $103 and last at $102.11 on just over 3m shares going through.

Plus $465 on a day where my entire watch list was in blue, bar three stocks. I think that going ‘all in’ may get me into trouble tomorrow. Must get my brain to control my fingers a bit more!

Recap

Bought 3,000 WBC @ 21.11

Sold 3,000 WBC @ 21.19 ($240 profit)

Bought 5,000 WBC @ 21.165

Sold 5,000 WBC @ 21.21 ($225 profit)

Friday November 10

A bit of a nothing day today, though having touched $103 yesterday, CBA trade in the $101 zone and it takes me three goes to get my average down to a level where I can have a bit of a chance for a win, but with no luck today.

The oil price was down, so waited and had a go in Woodside but the good oil ran out for me at the death as my P/L coughed and sputtered home.

If it wasn’t for RIOs, I would have had a much rougher result and below $121 they gave me a chance. At $120.60 I was in and stuck them on a limit of $121 and stuck to it. Took a bit of time but finally they did it.

So down $60 today plus brokerage and overall up $1,975 gross or $1,406 net for the week, which included a rate rise and the Melbourne Cup both on the same day.

Recap

Bought 1,000 CBA @ 101.72

Bought 1,000 CBA @ 101.33

Bought 2,000 WDS @ 32.17

Bought 1,000 RIO @ 120.65

Bought 2,000 CBA @ 101.18

Sold 1,000 RIO @ 121.00 ($350 profit)

Sold 4,000 CBA @ 101.32 (-$130 loss)

Sold 2,000 WDS @ 32.03 (-$280 loss)