Each week, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday December 4

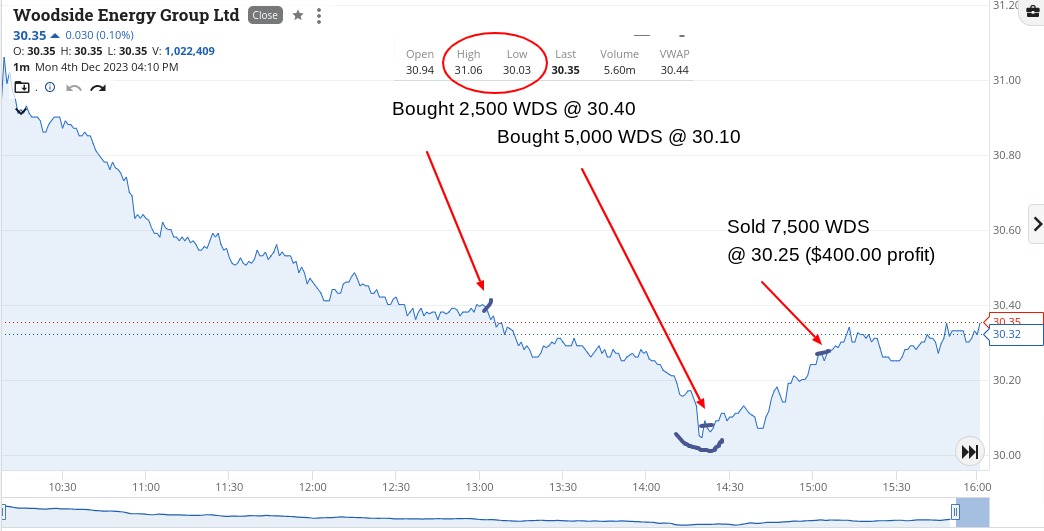

WDS had a high of $31.06, so when I got stuck into them at $30.40, I thought I was safe. But oh no!

They fell another 30c or so before I had to really double down. I had to adjust my original sell limit ($30.60) and went down to $30.30 and waited. Of course, if I had just left them alone, I would have been ok but oh no.

I had to start watching them didn’t I and as they hovered around the $30.23/24 level, I decided to adjust it down to $30.25 and out they went. Ten mins later they went through the $30.30 level and hit $30.40 before coming back down to (my) earth.

I tell you what though, watching CSL is amazing.

I’ve nicknamed it my manic child, as it moves so fast. It’s like it goes along ok and then has some orange-coloured drink and then goes manic.

$4.27 is the spread between their high of the day and their low of the day and 270,000 went through in the 4.10pm session, where they fell 80c from their 4.00pm close.

Had a little dabble in SYA and lost $50, which is a lot less than those who took them in their last placement price of 15c. I thought I could churn them out in the 4.10 session for a $100 profit, but not so.

Up $880 and Santa is back on.

Recap

Bought 2,500 WDS @ 30.40

Bought 50,000 SYA @ 0.057

Bought 5,000 WDS @ 30.10

Bought 500 CSL @ 264.05

Sold 7,500 WDS @ 30.25 ($400 profit)

Sold 500 CSL @ 265.11 ($530 profit)

Sold 50,000 SYA @ 0.056 ($50 loss)

Tuesday December 5

RBA interest rate decision comes out at 2.30pm today and everyone is expecting nothing to happen.

Nothing did happen, so all this waiting around came in as a very dull day indeed.

Just to give me something to do, I just bought 100 CSL only, as figured the most I could lose would be $200.

In the end I made $49 and today was a ‘billy don’t be a hero’ kind of day. See charts for more info.

Recap

Bought 100 CSL @ 263.54

Sold 100 CSL @ 264.03 ($49 profit)

Wednesday December 6

Much stronger day today, with things like CBA threatening to break the $106 barrier, which it eventually did and didn’t look back.

However, I was having fun with EVN, who had a massive placement go through overnight and the stock opened down 12% or 50c or so.

So two things: News already out and $3.80 was the placement price. I actually didn’t read the full announcement, just the headline, hence the first purchase was for 3,000.

Having dipped the toe in, read the full announcement and topped up by another 7,000.

Very rare to see the moons line up for me in such a way – and it got exciting.

Much more so than yesterday.

Now, every 1c movement is +/- $100 and this certainly gets the heart pumping. In between all of this, snuck in 1000 WTC at below $67 and some WDS at below $29.50.

WDS eventually came good and with WTC, I just closed them out for a small profit so I didn’t have to watch anything, as all positions were now closed out.

Watched them go up by another $1 or so, though I was happy with my EVN punt. So happy, that when they were trading in the $3.53 level again in the afternoon, I just passed on them, so I could just wallow in my locked in profits.

Up $840 and a very happy chappy.

Recap

Bought 3,000 EVN @ 3.58

Bought 7,000 EVN @ 3.56

Bought 1,000 WTC @ 66.94

Bought 2,000 WDS @ 29.43

Sold 10,000 EVN @ 3.60 ($340 profit)

Sold 2,000 WDS @ 29.53 ($200 profit)

Bought 10,000 EVN @ 3.53

Sold 10,000 EVN @ 3.55 ($200 profit)

Sold 1,000 WTC @ 67.03 ($90 profit)

Thursday December 7

Sitting around and staring at my phone, wondering what to do, when WBT pop up as a faller. My last punt started in 5000.

Today started in 1000.

Then good old CBA fell below the $106 level. I stared, I waited and I thought. Surely they will test the $106 level and maybe break it on the upside.

Well, I thought too much about all of this as I went in, double the usual size and put them on at $106.10 to sell.

Too much time on my hands had me watching them hit $106 and then come back to my buying level. So I had a profit. Then I had breakeven, less the commission and back up to $106.

So, in my wisdom, I adjusted my limit down to $105.99 and got taken out.

What happened next is a textbook market kicking you in the nuts.

Dabbled in CSL and then had a punt in RIOs as a rebound trade, after CBA broke my heart and left me at the trading altar.

I will let CBA’s chart tell my story. Up $395, after CSL stood me up, profit wise.

Recap

Bought 1,000 WBT @ 3.80

Bought 2,000 CBA @ 105.89

Bought 1,000 WBT @ 3.78

Sold 2,000 CBA @ 105.99 ($200 profit)

Sold 2,000 WBT @ 3.84 ($100 profit)

Bought 500 CSL @ 266.64

Bought 1,000 RIO @ 127.48

Sold 1,000 RIO @ 127.72 ($240 profit)

Sold 500 CSL @ 266.35 ($145 loss)

Friday December 8

Overnight there was a bit of news coming through – Santos and Woodside are looking at a possible merger.

This news whacked WDS a bit more than I thought they deserve and as they started to rise, I thought I should jump on for the ride.

RIOs just fell for no reason, other than they did and I thought it a bit swift and sharp.

Both trades gave me some nice profits to end the day and the week on.

Was happy to be out and on the beach by 11.30am, as this weekend is going to be a hot one.

Up $760 today and $2924 gross or $2,383 net for the week and that’s after a quiet one on RBA’s Tuesday rate day.

Recap

Bought 2,000 WDS @ 29.21

Bought 1,000 RIO @ 127.66

Sold 2,000 WDS @ 29.42 ($420 profit)

Sold 1,000 RIO @ 128.00 ($340 profit)