ASX Small Caps and IPO Weekly Wrap: Everything sank except gold. What a mess.

An empty lifeboat, floating on a sea of gold... it'd be quite poetic if it wasn't so wanky. Pic via Getty Images.

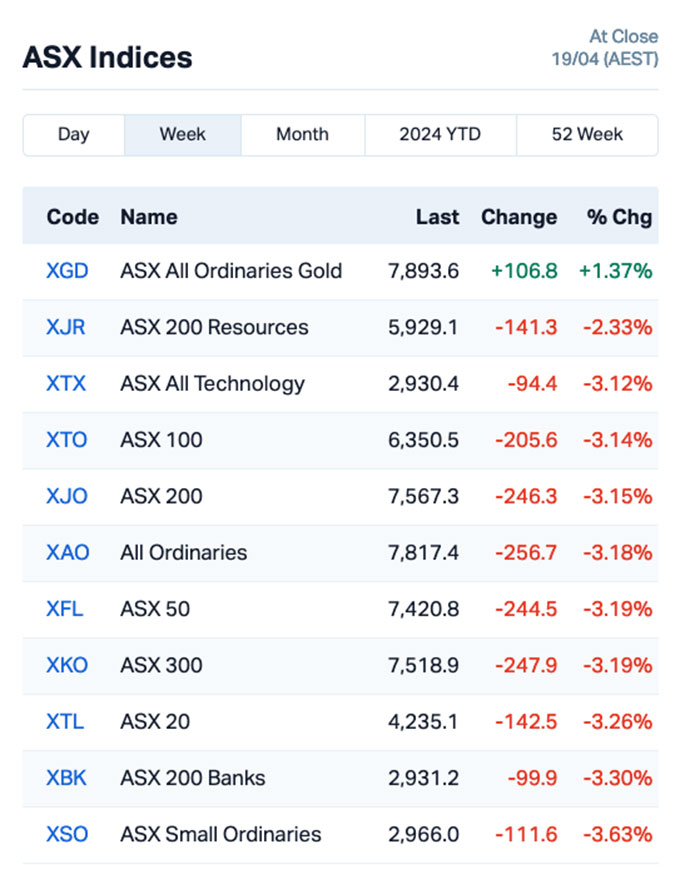

- The ASX 200 ended the week down alarmingly, on -3.15pc

- Goldies were the only thing that proved resistant to the sell-off

- Who won the Small Caps race? Read on to find out…

This week has not been a pleasant one on the ASX, as local investors grappled with a highly sub-standard attitude on Wall Street, and growing tensions in the Middle East that boiled over this morning when Israel started lobbing missiles at … *checks notes* … it says here “everyone”.

Predictably, that’s had an effect on how things played out locally today, but even that upheaval was just another drop in the bucket of negative sentiment that markets here, and overseas, have been feasting out of since Monday.

Truth be told, it’s all a bit grim – and if the Middle East brouhaha keeps getting worse, then it’s only going to get grimmer. With the weekend approaching, the ASX will have a couple of days to take stock and figure out what the short term moves are likely to be best.

But in the meantime, we’re left with a week of solid losses, and our own kinds of wounds to lick between now and Monday morning.

WHAT THE SECTORS DID

Just like last week and the week before that, Utilities caught the best of the action, mirroring last week’s market leading performance to finish the five-session streak as the only sector above break-even.

But that wasn’t by all that much – less than 1.0% last time I checked – but well out ahead of the next best performers Consumer Staples and Materials, both of which dumped more than -2.5% in value.

Predictably, the goldies were the only chunk of the market that made headway this week, but even that was modest, as the chart below shows – along with the rest of the detritus of a very difficult week on the bourse.

I’m going to have to leave that there, because deadline is upon me, other work is piling up and one of my dear, sweet children is about to learn an ill-timed lesson about why Daddy shouts a lot when they pick an utterly pointless argument with him this late on a Friday afternoon.

Probs best we just rule a line under this week and hope Monday dawns a bit brighter for everyone.

So… which Small Cap officially won the week? Let’s find out together…

SMALL CAP WINNERS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| NRZ | Neurizer Ltd | 0.006 | 100% | $7,507,054 |

| LYN | Lycaon Resources | 0.3 | 67% | $12,556,032 |

| MKL | Mighty Kingdom Ltd | 0.005 | 67% | $3,828,561 |

| WMG | Western Mines | 0.275 | 67% | $22,524,955 |

| FXG | Felix Gold Limited | 0.082 | 64% | $17,613,285 |

| ERL | Empire Resources | 0.003 | 64% | $3,060,682 |

| DCG | Decmil Group Limited | 0.28 | 60% | $43,564,124 |

| BVR | Bellavista Resources | 0.18 | 57% | $9,426,085 |

| OPN | Oppenneg | 0.006 | 50% | $6,775,078 |

| TAR | Taruga Minerals | 0.009 | 50% | $6,354,241 |

| FRE | Firebrick Pharma | 0.079 | 49% | $15,210,473 |

| BUR | Burley Minerals | 0.076 | 49% | $8,760,928 |

| EXR | Elixir Energy Ltd | 0.135 | 45% | $130,254,784 |

| SNS | Sensen Networks Ltd | 0.029 | 45% | $22,463,503 |

| RNX | Renegade Exploration | 0.014 | 40% | $14,051,376 |

| DRO | Droneshield Limited | 1.12 | 39% | $690,484,044 |

| LV1 | Live Verdure Ltd | 0.84 | 39% | $98,972,331 |

| LSA | Lachlan Star Ltd | 0.073 | 38% | $16,605,856 |

| SDV | Scidev Ltd | 0.37 | 37% | $64,533,197 |

| NIM | Nimy Resources | 0.06 | 36% | $7,723,298 |

| NPM | Newpeak Metals | 0.015 | 36% | $1,699,179 |

| ENR | Encounter Resources | 0.36 | 33% | $155,242,429 |

| GTI | Gratifii | 0.006 | 33% | $9,672,270 |

| LPE | Locality Planning | 0.072 | 33% | $12,794,513 |

| NGS | NGS Ltd | 0.008 | 33% | $1,507,364 |

| RIL | Redivium Limited | 0.004 | 33% | $8,192,564 |

| SRY | Story-I Limited | 0.004 | 33% | $1,505,619 |

| TD1 | Tali Digital Limited | 0.002 | 33% | $6,590,311 |

| BET | Betmakers Tech Group | 0.13 | 31% | $110,956,211 |

| FTZ | Fertoz Ltd | 0.034 | 31% | $8,758,711 |

| RTG | RTG Mining Inc. | 0.034 | 31% | $35,809,439 |

| X2M | X2M Connect Limited | 0.051 | 31% | $11,468,845 |

| CHW | Chilwa Minerals | 0.28 | 30% | $11,468,750 |

| BFC | Beston Global Ltd | 0.0065 | 30% | $13,979,328 |

| MZZ | Matador Mining Ltd | 0.076 | 29% | $38,824,920 |

| FHS | Freehill Mining Ltd. | 0.009 | 29% | $26,962,600 |

| TGN | Tungsten Min NL | 0.096 | 28% | $75,495,770 |

| NXS | Next Science Limited | 0.435 | 28% | $137,096,698 |

| CUF | Cufe Ltd | 0.014 | 27% | $14,899,461 |

| GBZ | GBM Rsources Ltd | 0.014 | 27% | $15,036,956 |

| DY6 | Dy6Metalsltd | 0.052 | 27% | $1,495,201 |

| RCL | Readcloud | 0.057 | 27% | $8,626,066 |

| LU7 | Lithium Universe Ltd | 0.024 | 26% | $10,292,422 |

| CMO | Cosmo Metals | 0.054 | 26% | $6,825,300 |

| TWR | Tower Limited | 0.79 | 25% | $282,715,570 |

| AMD | Arrow Minerals | 0.005 | 25% | $47,398,532 |

| IPT | Impact Minerals | 0.02 | 25% | $57,294,078 |

| M4M | Macro Metals Limited | 0.015 | 25% | $45,248,935 |

| AOA | Ausmon Resorces | 0.0025 | 25% | $2,647,498 |

| BGT | Bio-Gene Technology | 0.075 | 25% | $15,102,118 |

The best of the bunch this week turned out to be NeuRizer (ASX:NRZ), which came back from a two-month voluntary suspension on 15 April, after a very bumpy period that saw a proposed partnership fall through, and the company fall foul of the ASX for not filing necessary reports.

Things are looking a little happier for the company, banking a +100% gain for the week in a very difficult market.

Little WA explorer Lycaon Resources (ASX:LYN) also performed well, after scoring land access to drill its Stansmore project in WA’s West Arunta region earlier this week.

The company said it was hoping to replicate some of that success at Stansmore, which is prospective for both niobium and rare earths, with technical director Thomas Langley saying the approval is a pivotal step in its efforts to test the high order magnetic target at the site.

And Mighty Kingdom (ASX:MKL) ended the week on a very positive position, after earlier informing the market that it had completed the shortfall bookbuild for the retail component of its 5 for 1 pro-rata accelerated renounceable entitlement offer, announced on 15 March 2024, with the company adding that the offer has raised gross proceeds of approximately $6.25 million.

With the price up at a solid gain for the week, MKL went into a trading halt ahead of a proposed capital raise to take advantage of its current elevated price.

SMALL CAP LAGGARDS THIS WEEK

| Code | Company | Price | % Week | Market Cap |

|---|---|---|---|---|

| OSX | Osteopore Limited | 0.095 | -68% | $1,239,443 |

| DUB | Dubber Corp Ltd | 0.059 | -56% | $34,859,943 |

| CT1 | Constellation Tech | 0.001 | -50% | $1,474,734 |

| KTA | Krakatoa Resources | 0.012 | -33% | $5,665,287 |

| MHC | Manhattan Corp Ltd | 0.002 | -33% | $5,873,960 |

| SIH | Sihayo Gold Limited | 0.001 | -33% | $12,204,256 |

| FRS | Forrestania Resources | 0.017 | -32% | $2,750,358 |

| CG1 | Carbonxt Group | 0.055 | -31% | $19,820,220 |

| NWF | Newfield Resources | 0.1 | -31% | $81,963,263 |

| MNB | Minbos Resources Ltd | 0.063 | -31% | $49,847,916 |

| CMB | Cambium Bio Limited | 0.009 | -31% | $6,894,831 |

| AVH | Avita Medical | 2.82 | -29% | $177,574,424 |

| TNY | Tinybeans Group Ltd | 0.068 | -28% | $7,918,064 |

| DTM | Dart Mining NL | 0.029 | -28% | $7,737,707 |

| ZNO | Zoono Group Ltd | 0.06 | -27% | $13,034,321 |

| EWC | Energy World Corp | 0.011 | -27% | $33,868,134 |

| CXU | Cauldron Energy Ltd | 0.037 | -26% | $48,599,361 |

| GLA | Gladiator Resources | 0.02 | -26% | $16,682,530 |

| NVX | Novonix Limited | 0.8675 | -25% | $454,648,758 |

| BBT | Bluebet Holdings Ltd | 0.225 | -25% | $47,259,991 |

| ADR | Adherium Ltd | 0.03 | -25% | $9,521,119 |

| AXP | AXP Energy Ltd | 0.0015 | -25% | $11,649,361 |

| GGE | Grand Gulf Energy | 0.006 | -25% | $12,571,482 |

| LPD | Lepidico Ltd | 0.003 | -25% | $22,914,924 |

| MRD | Mount Ridley Mines | 0.0015 | -25% | $15,569,766 |

| MRQ | MRG Metals Limited | 0.0015 | -25% | $5,050,237 |

| SKN | Skin Elements Ltd | 0.003 | -25% | $1,768,458 |

| WFL | Wellfully Limited | 0.003 | -25% | $1,478,832 |

| MX1 | Micro-X Limited | 0.094 | -25% | $49,287,935 |

| SGR | The Star Ent Grp | 0.41 | -25% | $1,204,845,968 |

| TML | Timah Resources Ltd | 0.031 | -24% | $2,751,553 |

| IMU | Imugene Limited | 0.072 | -24% | $570,945,243 |

| APX | Appen Limited | 0.635 | -24% | $143,005,048 |

| MCL | Mighty Craft Ltd | 0.013 | -24% | $5,111,850 |

| CDD | Cardno Limited | 0.245 | -23% | $9,765,166 |

| H2G | Greenhy2 Limited | 0.006 | -23% | $2,512,535 |

| FNR | Far Northern Res | 0.155 | -23% | $6,970,436 |

| IRX | Inhalerx Limited | 0.031 | -23% | $5,882,776 |

| TTT | Titomic Limited | 0.049 | -22% | $48,793,700 |

| E33 | East 33 Limited | 0.014 | -22% | $8,056,330 |

| HOR | Horseshoe Metals Ltd | 0.007 | -22% | $4,525,351 |

| IXU | Ixup Limited | 0.014 | -22% | $22,566,289 |

| ROC | Rocketboots | 0.086 | -22% | $5,985,041 |

| 14D | 1414 Degrees Limited | 0.072 | -22% | $16,909,965 |

| RFX | Redflow Limited | 0.1125 | -21% | $27,268,797 |

| ATX | Amplia Therapeutics | 0.065 | -21% | $11,501,844 |

| QFE | Quickfee Limited | 0.075 | -21% | $22,555,318 |

| 1AG | Alterra Limited | 0.004 | -20% | $3,482,763 |

| BXN | Bioxyne Ltd | 0.008 | -20% | $15,213,163 |

| CLZ | Classic Min Ltd | 0.008 | -20% | $2,790,310 |

HOW THE WEEK SHOOK OUT

Monday 15 April, 2024

US lithium stock Piedmont (ASX:PLL) received an all-important mining approval for the Carolina Lithium project in North Carolina.

“We plan to develop Carolina Lithium as one of the lowest cost, most sustainable lithium hydroxide operations in the world, and as a critical part of the American electric vehicle supply chain,” PLL boss Keith Phillips says. “The project is expected to contribute billions of dollars of economic output and several hundred jobs to Gaston County and North Carolina’s growing electrification economy.”

Adherium’s (ASX:ADR) Hailie ‘smart inhaler’ has received clearance from the US Food and Drug Administration (FDA) for use with AstraZeneca’s Airsupra and Breztri inhalation devices.

Explorer NewPeak (ASX:NPM) will buy an early stage Canadian uranium, rare earths and scandium project for $500,000 in shares.

OzAurum Resources (ASX:OZM) says drilling has started the Boca Rica lithium project in Brazil.

Neurizer’s (ASX:NRZ) shares were back on quotation after they were suspended by the ASX on 18 March. NeuRizer had been requested by the ASX to clarify a statement from their Half Year Report regarding ongoing discussions on two strategic transactions expected to generate revenue and positive cash flows.

Lithium Universe (ASX:LU7) said that the Share Purchase Plan (SPP) announced on 13 March has been closed on 10 April 2024. Applications for 23,175,000 fully paid shares to raise a total of $463,500 (before costs) were received and processed.

Talga Group (ASX:TLG) announced the completion of the front-end engineering and design (FEED) for its integrated Vittangi Anode Project located in northern Sweden. The anode production process has been configured and qualified to customer requirements, facilitating battery maker and automotive OEM offtake negotiations. Strategic agreements with project partners ABB and Rejlers are in place, and preparation for engineering and PCM tenders, along with procurement, is well advanced.

Tuesday 16 April, 2024

Explorer Dalaroo (ASX:DAL) rose after reporting a +200m long gold find at Goodbody West, part of the Lyons River project in the Gascoyne region of WA. The best of the results include 5m @ 0.85g/t Au from 9m, including 1m @ 1.83g/t Au from 9m and 1m @ 1.23g/t Au from 12m – a happy amount of gold and not far from the surface.

Hawsons Iron (ASX:HIO) revealed to the market that seven potential strategic investors had been handed a 350-page Information Memorandum, containing a comprehensive review of results from activity undertaken in line with the company’s strategic review, issued in February last year.

Western Mines Group (ASX:WMG) said assay results revealed the company is onto broad zones of nickel sulphide mineralisation – elevated Ni and S coincident with highly anomalous Cu and PGE, including a cumulative assay from one drill hole that totalled 184m at 0.27% Ni, 126ppm Co, 82ppm Cu, 18ppb Pt+Pd with S:Ni 0.9.

Locality Planning Energy (ASX:LPE) was rising on news of an unsolicited and “opportunistic” off-market takeover offer from River Capital, which the company has directed shareholders to ignore.

And Spartan Resources (ASX:SPR) announced a new high-grade discovery it’s dubbed the Pepper prospect only about a week after announcing visible gold sited 1km under Spartan’s Never Never deposit in the Murchison region of WA.

Wednesday 17 April, 2024The big mover on Wednesday was Firebrick Pharma (ASX:FRE), after it announced that its Nasodine nasal spray was being launched in the United States. The company pointed out that the spray will be marketed in the US “for ‘nasal hygiene’ without any therapeutic claims”, bypassing the need for the spray to receive FDA approval. Clever, clever.

Renascor Resources (ASX:RNU) climbed nicely on news that the Australian Government, through Export Finance Australia (EFA), has conditionally approved a $185 million loan facility from the Australian Government’s $4 billion Critical Minerals Facility to support the development of Renascor’s planned vertically integrated battery anode material manufacturing operation.

And DroneShield (ASX:DRO) was up on news that the NATO Support and Procurement Agency (NSPA) has approved the first Counter-small UAS (C-UAS) procurement framework agreement in NATO history, signed through COBBS BELUX BV, DroneShield’s in-country Belgium and Luxembourg partner for an initial three-year agreement with extension options. Plus, there’s a couple of wars on, apparently.

Thursday 18 April, 2024

Nimy Resources (ASX:NIM) reported promising intercepts coming from its Block 3 prospect, a large previously unexplored 3km magnetic anomaly. At Block 3 West, NIM pulled up elevated copper (0.20%), silver (2.2g/t) and sulphur (13%) values hosted by mafic rocks, highlighting potential for Volcanogenic Massive Sulfide (VMS) deposits – which often occur in clusters within a small area and are valuable sources of copper, zinc, lead, silver, and gold. Copper, rare-earth oxides and gallium (up to 495ppm) in ultramafic rocks (MgO to 28%) were also intersected at Block 3 East.

Burley Minerals (ASX:BUR) was continuing its good fortune from Wednesday, with investors impressed by a presentation outlining the company’s plans for maiden drilling planned at its Hamersley iron ore projects, and progress from its advanced lithium exploration in Quebec.

eLearning solutions provider Readcloud (ASX:RCL) was up after delivering its March quarterly, showing a record $5.22 million in cash receipts from customers (up 44% on the March 2023 quarter), and $1.94 million positive net cash from operations, up 52% on the March 2023 quarter.

New Age Exploration (ASX:NAE) has started the search for gold at its new Wagyu gold project in WA’s Central Pilbara, where promising intrusive and structural targets akin to the nearby ‘Hemi style’ gold deposit have been identified.

Castile Resources (ASX:CST) was up on news that its 100%-owned Rover 1 iron oxide copper gold (IOCG) project located in the historically rich copper/gold fields of the Tennant Creek region has been awarded Major Project Status (MPS) by the Northern Territory Government.

And SciDev (ASX:SDV) has delivered a positive quarterly report, showing revenue of $29.1m, up 38% on Q3 FY23 and cash receipts of $31.3 million, while cashflow from operations of $3.8 million has delivered an underlying EBITDA of $3.6 million.

Friday 19 April, 2024

Friday’s standout winner on the ASX was DY6 Metals’ (ASX:DY6) which announced that soil and rock chip sampling has returned up to 3.22% total rare earth oxides (TREO) and 0.75% niobium in the recently acquired licence EL0705 at its flagship Machinga project in Malawi.

Adisyn (ASX:AI1) was also tracking well this morning, with the defence sector IT company top of mind for many investors, thanks to the investor prezzo the company dropped on Monday.

Cyprium Metals (ASX:CYM) was rising steadily, as the copper focused company welcomes an experienced new board appointment, Scott Perry, as a non-executive director and chair of the Audit Committee.

And gold explorer Metalicity (ASX:MCT) was climbing this morning, announcing that drilling is set to commence at its Yundamindra project – the first drilling activity there in 10 years. However, Metalicity’s rise this morning was most likely due to investors being reminded that historical exploration at the site returned assays including 8m @ 56.36g/t Au from 44m, which the company announced back in 2019.

Cyprium Metals (ASX:CYM), the owner of the mothballed Nifty copper mine in WA, has secured the services of Scott Perry, a storied industry veteran with a bunch of wins under his belt. Perry – who will be CYM’s non-exec director and chair of the audit committee – has been president & CEO at TSX-NYSE listed mid-tier Centerra Gold and chair of the World Gold Council’s audit committee from 2015-2021.

Firetail Resources (ASX:FTL) says assays are now trickling in from a maiden 5000m drilling campaign at Picha’s Cumbre Coya copper target. “The confirmation of the continuation of the mineralisation over 170m with the structure open in all directions gives us huge encouragement for what we may have here,” exec chair Brett Grosvenor says. Results are pending for the third and fourth holes, which were drilled down to depths of 245m and 573m respectively.

Godolphin Resources (ASX:GRL) has acquired the remaining 49% of the Narraburra project in central west NSW from partner EX9, giving it full control of the highly prospective rare earths project following the recent maiden resource estimate of 94.9Mt at 739ppm TREO plus yttrium oxide.

Paradigm Biopharmaceuticals (ASX:PAR) has submitted key documents to the US Food and Drug Administration (FDA) for review, aiming to advance its pivotal Phase 3 clinical trial of lead drug injectable pentosan polysulfate sodium (iPPS/Zilosul) to treat osteoarthritis (OA).

And, as a result of improved performance across the Gippsland, Otway and Cooper Basin production assets, Cooper Energy’s (ASX:COE) FY24 production guidance has now been narrowed to 60.5–64.0 TJe/d. Production expenses have also been reduced and narrowed to $57–63 million. Capital expenditure meanwhile is unchanged at $240–280 million.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.