The Secret Broker: The sweet, the sour and the bland aspects of trading in ‘Black Gold’ futures

Pic: d3sign / Moment via Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

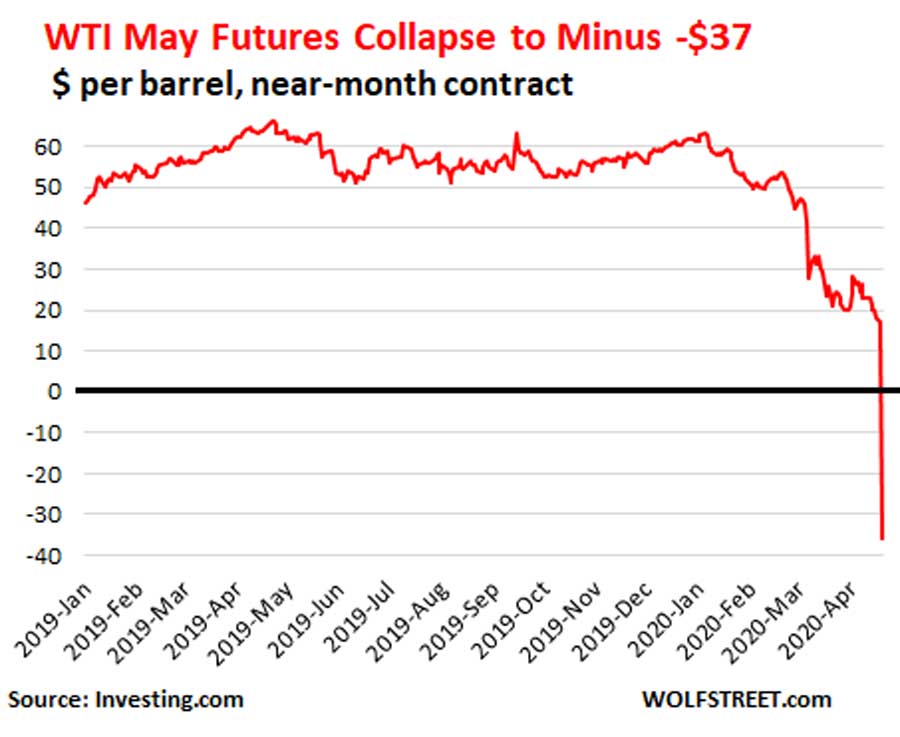

I woke up one morning this week to the headline news, that the price of oil had fallen past the zero on the ticker tape and fallen to MINUS $37 a barrel.

My first reaction was imagining me filling up the V8 to the brim and walking up to the servo counter, saying the words ‘number 8’ and being handed a $20 note.

These thoughts conjured up the same feeling of euphoria that one gets, when buying the weeks’ worth of groceries and being asked if you want any cash out.

That feeling of pushing the trolley to the car with one hand and holding a metre long receipt with $200 cash in the other, gives an endorphin induced brain high, even though deep down you know that this reaction will get squashed when the AMEX statement arrives.

Unfortunately for all us petrol heads, the headlines contained a large dose of click bait. They made out that storage problems had made the real oil price crash, when in fact, it was the price of a futures contract that had actually gone rogue, two days before its expiry date.

The headlines did seem strange to me as all the futures contracts I have ever traded, have all settled in cash and not in their actual underlying physical product.

Can you imagine a trader sitting in his office and being told that his delivery of pork belly was here and is there a larger fridge than the one in the canteen?

I don’t think so.

Now, the official title of the contract that caused petrol heads around the world to get excited, was the ‘West Texas Intermediate Light Sweet Crude Oil Futures Contract’ or WTI as we all now know it and this is traded on The Intercontinental Exchange which is shortened down to ‘ICE’, in trading terminology.

One WTI is worth (in cash) the equivalent of 1,000 barrels of oil, which by my calculation is about 3,700 litres and to give you a feel for size, one of those fuel delivery trucks you see around town can hold 40,000 litres — or about 10 WTI contracts — when fully loaded.

The advantage of dealing oil futures on ICE (the trading platform, not the drug), is that they also allow you to trade other global oil based future contracts and only require one settlement account and one margin account.

These contracts are electronically traded around the world, as well as being able to trade the aptly named ‘West Texas Intermediate Light Sweet Crude Oil Futures Contract’, you can also trade the UK’s ‘Brent Oil’ as well as the ‘Middle East Sour Crude Oil Futures Contract’.

3-in-One, if you pardon the pun.

Their trading menu gives you something sweet, something sour and judging by the UK’s culinary input, something bland, to feast on live between Singapore, London and New York time zones.

How culinary words slipped into naming different types of oil, I don’t really know, other than that Jamie Oliver’s marketing team may have been called in at some point when the exchange was looking at trading Olive Oil futures and they didn’t want any mix ups.

Incidentally, that rogue contract actually settled at $US10.01 after rising 127 per cent on the day before it expired and then another 38 per cent on expiry. The biggest previous move before these two moves was 18 per cent on December 22, 2008.

On a side note, one of those delivery trucks carrying around some traders 10 WTI contracts can, on a hot day, finish the day with 10 per cent more fuel in it than when it left the depot. This is because fuel expands in heat.

So my tip, much to the annoyance of Mrs Broker and the family, is to always fill up at around 5am in the morning, as the cold air will have the opposite effect on the underground tanks and this gives you an extra 10 per cent in the tank.

Now, there is a tip no other broker would ever give you!

P.S. I use this tip to still justify to the family why I still occasionally drive around 1970s style in my gas guzzling V8 or as the family rudely say behind my back, off he goes in his midlife crisis.

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

READ MORE from The Secret Broker:

What could possibly go wrong?

Forget 40 days and 40 nights. Try 30 years in the wilderness

When shareholders become divided by the ‘n’ in dividends

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.