The Secret Broker: When shareholders become divided by the ‘n’ in dividends

Pic: d3sign / Moment via Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

There are a few more ‘first happenings’ in the market and one that caught my eye was Super Cheap Auto (ASX:SUL). Something happened that I have never seen before and it involves shareholders getting divided from their duly announced dividend payment.

On 20th February 2020, Super Cheap Auto announced the payment schedule for shareholders to receive their share of the company’s profits, via an interim half-year dividend payment.

Shareholders would be paid a fully franked dividend of 21.5c into their bank accounts on the 2nd of April 2020 and on the 28th Feb 2020 the shares would become quoted ex this dividend.

Anyone buying after this date would not be entitled to a 21.5c dividend and its franking credit.

Now, when shares are quoted ex their dividend, they are normally marked down by the grossed up dividend amount.

To calculate this amount (in this case), you combine the 21.5c dividend with its attaching 30 per cent tax credit (21.5c x 1.30 = 28c) to get the grossed up dividend figure of 28c.

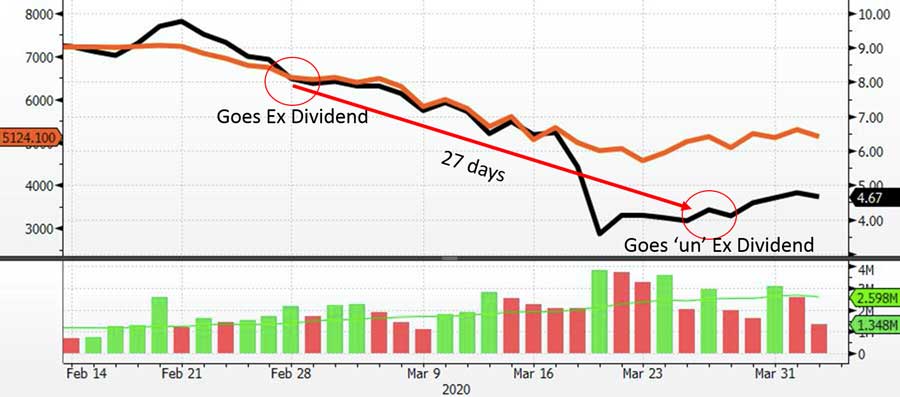

On the actual day they went ex, the shares fell 55c in total, which is 28c dividend and 27c market conditions, but then on the 26th of March 2020, the company got the virus sniffles and announced that the dividend was now being cancelled. The shares closed up 31c (28c + 3c) on the day, and this produced a cash saving of $43m to the company.

The company giveth and the company taketh!

To recap:

2/02/2020 Dividend announced: 21.5c – Great news

28/02/2020 Shares go ex: 28c gross – Come to Papa

26/03/2020 Dividend Payment Cancelled – You what?

02/04/2020 No Payment – Kick the postman

For a simple broker like me, it looks like the shares were trading for 27 days at an incorrectly adjusted price, though it appears that the ASX is not going to cancel trades or redress this problem that the company had created.

I suspect that they will just let it go to the keeper, as they are too busy relaxing capital raising rules and regulations and fighting other battles.

Talking of dividends, over in the UK, banks have been banned from paying any dividends to shareholders, holding any share buybacks until the end of the year and ordered to cut bankers’ bonuses, though most got theirs rushed through in March.

Even HSBC has been told to postpone their dividend in a ‘first happening’ event in over 74 years and this has re-opened up the debate on whether the bank should move its head office back to HK again (having moved it to the UK when China was handed back the control of HK.)

The Kiwis have just pulled the same stunt on bank dividends and the market over here is starting to speculate that Australian banks may be subjected to the same rules any time now.

Interestingly, Harvey Norman (ASX:HVN) has just gone ex dividend but I can’t see Gerry cancelling * his 12c-a-share payment, which is one advantage of being both the controller of the board and the largest shareholder.

The same will go for Dr Andrew’s FMG, as his wallet has the same passion for dividends as Gerry’s.

The only sector which may not be forced to cut dividends by order of the government are the good old gold producers.

One commentator suggested that gold companies should pay their dividends in the gold they produce to the Perth Mint, who then issue gold backed certificates to shareholders to hold or redeem.

At least that way you know your dividends are solid!

*In an extraordinary turn of events, Harvey Norman actually did cancel its dividend but only announced it would be doing so, after it had been trading all day ex dividend. The stock was down 22c of which 12c (net) was the dividend component.

Luckily, the company only traded for one day at an incorrect adjusted price, unlike Super Cheap Auto’s 27 day stint. Then, to top it all off, Gerry got a three month pay cut of 20 per cent, which all suggests to me that he must have slipped out to the bathroom when these motions were put to the board. Warren Buffet jokes about this when Berkshire Hathaway paid its only ever dividend, in 1967.

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

READ MORE from The Secret Broker:

Where are the three Amigos when you need them?

Stop the world, I want to get off!

What my gut feeling tells me this time around

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.