The Secret Broker: What could possibly go wrong?

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

Many a time, someone has approached me with a ‘no can lose’ market play, where they try and convince me (or anyone who will listen to them), that they have discovered something no one else has worked out.

Normally it would include some sort of derivative play added with their assumption that ‘something’ has a 99 per cent chance of always being consistent for a long period of time.

We would nickname them as ‘What could possibly go wrong?’ trades and sometimes we would do the complete opposite of what they were proposing we should do.

So, remember this.

If someone is telling you something about stocks and markets and they are 30 years old today, then they would have been just 10 years old when the March 2000 Dotcom Crash happened.

They would not have experienced the before, during and after bank balance highs and lows that occurred in this period and would have been obliviously playing Pokémon, when Daddy was explaining to a crying Mummy that the European holiday was off and why her new car was going back to the dealer, after Daddy’s broker’s ‘dead cert’ tips had collapsed by 90 per cent or so.

Past market events are things that you need to make yourself aware of and if you can’t find the right (older) person to explain them to you, then you need to find the right books to read. While everyone is stuck at home, my Twitter feed is full of books that people have been recommending as good reads.

My all-time stockmarket favourite book was the last one mentioned here in this list — Reminisces of a Stock Operator by Edwin Lefèvre — but there is one book which no one recommends and it is very much worth a read if you can get a copy.

It is called ‘The Book of Heroic Failures’ by Stephen Pile.

The book highlights stories from around the world, on how someone goes to achieve something but manages to come out with exactly the opposite result.

One of the best stories in this book, tells a tale of how a semi wealthy (and greedy) man goes about intending to double his wealth.

In the weeks leading up to a horse race, he secretly buys every horse running in the same race and then gives strict instructions to his jockeys in what order they are to finish in. He then places large bets in the lead up to the race and boasts to his friends about how he will be twice as rich as he is today, by the end of the week.

The race was being held in the seaside town of Brighton (a lovely track to spend a day away from London at) and in his race, just as his jockeys were coming round the final bend in their correct order, a sea mist blew in over the track and startled the horses.

This led to a bit of mayhem and the jockeys, now being unable to see each other, ended the race in complete disarray and completely the wrong order.

The result ended up bankrupting him, as he had geared up his betting with an overdraft.

The whole book contains tales like this, but being written in 1980 it does not contain Wall Street’s most heroic of all heroic failures.

In 1993, a hedge fund was formed by the crème de la crème of financial experts, who’s skills were not in trading but in quantitative financial modelling and for which a few of them had earnt Nobel Memorial prizes.

Celebrities, governments and college funds fell over themselves to have their money involved with the founders, who were considered at the time, to be the Michael Jordons and Tiger Woods of financial modelling.

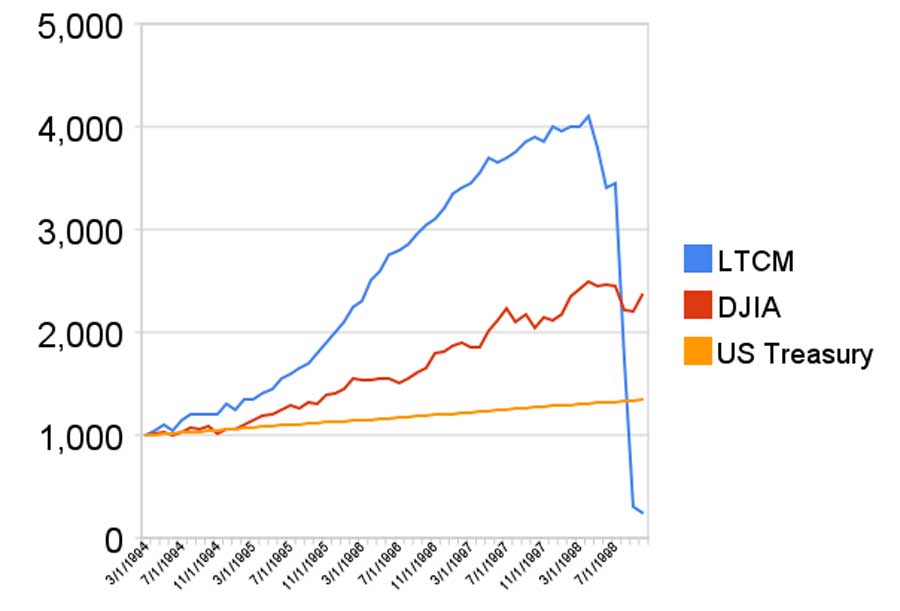

When the fund first started trading in 1994, they had over $US1bn ($1.6bn) in the bin to play with.

At the start of 1998, this play money had grown to $US4.8bn and by September 1998 it had grown to minus zero. Not only did they lose the whole lot, they had leveraged the fund by 250 times its capital.

Their leveraging on future outstanding derivatives had gone so horribly wrong, that the Federal Reserve Bank of America had to step in and rescue them, for if they had not, a 2008 style GFC grenade was about to explode and cause a global meltdown.

For all their combined financial modelling and genius of mind, they had a fundamental flaw in their modelling.

The geniuses had based all their future predictions only on the previous five years of trading data, being 1989 to 1994. If they had included 10 years’ worth of data in their financial models, they would have included the figures from the 1987 crash, which obviously would have thrown up completely different predictions.

With 16 partners and 200 staff members, they had managed to achieve the complete opposite of what the fund was set up to do and not one of them had ever thought about what could possibly go wrong!

Oh and the name of the fund – Long Term Capital Management. How heroic a name is that.

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.

READ MORE from The Secret Broker:

Forget 40 days and 40 nights. Try 30 years in the wilderness

When shareholders become divided by the ‘n’ in dividends

Where are the three Amigos when you need them?

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.