The Secret Broker: Mind the gap… especially when stepping aboard Apple, Snap and co

The Secret Broker

The Secret Broker

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

When I was brokering in the UK and we were investing in USA stocks for clients, we always had to buy them in lots of 100 shares a go.

Anything under this and you would pay a much higher price and if selling, the spread could be 20% against you, as they were considered an ‘odd lot’.

One of our favourite stocks in 1982 was Minnesota Mining and Manufacturing, which had the nickname ‘Mickey Mouse Motors’ and the ticker ‘MMM’.

Two years before, the company had introduced ‘Post It’ notes to the world – one of the reasons that we were happy to have them in our clients’ balanced portfolios.

We also had the view that the USD would outperform the GBP, so a potential double win.

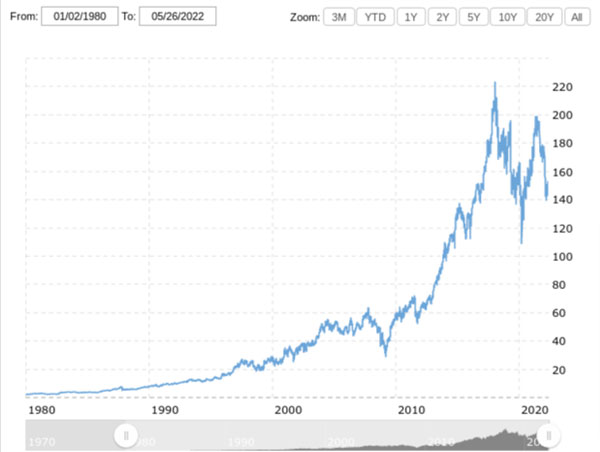

Today you would know them as 3M (having changed its name in 2002) and, like me, they still have the same ticker.

In 2002, global sales hit US$20bn and in 2013 sales hit US$30bn.

So, in those days a 100-share parcel in MMM would cost around US$22,000, whereas today it would be around US$140,000. And as their all-time high closing price reached U$258.63 on January 26, 2018, that parcel would then have been worth over US$250,000.

You see, we were value investors and we would look for companies which offered growth and at the same time, some profits.

Today they yield around 4% and have Earnings Per Share (EPS) of US$10.

In the last six months they are down 15.81% compared to say, Apple (AAPL) who are down 11.05% (EPS of US$5 yield 0.65%).

Apple’s market cap is US$2,274bn whereas 3M’s is US$89.9bn and this is where you need to be aware of the value gap – or, ‘mind the gap’ as we would say, before you step aboard.

If you have ever been on the London Underground, you will know that they announce this over the tannoy and write it on the station platform.

Talk about re affirming your investment thesis as you rode the train to work!

So the ‘value gap’ is where a share has fallen but may not actually still be cheap.

On my back of envelope calculations I would say, on paper, MMM offers better value than AAPL because MMM earns more per share on issue and they have fallen more.

It dawned on me that all the retail newbies are now able to buy fractions of shares via their apps, so the 100-share parcels must be made up of lots of small orders from retail punters.

This revelation, to me, helps me to understand why some recent stock valuations have way overshot where they should be and why some have come back to earth, with a thump.

Even though we have seen big falls recently, it does not necessarily mean that they are cheap.

If you take Snapchat (SNAP) as an example, they are down 70.6% over the last six months but still have a market cap of US$23.1bn and their EPS is -U$0.31c, so of course there is no yield.

The aptly named Snowflake (SNOW) – they offer cloud solutions- are down 65.71% over the same period, are still worth US$41.7bn and their EPS is – wait for it… -U$3.00.

No chance of a dividend there.

The past Australian pin-up USA stock Atlassian is down 56.71%. It also has an EPS of -US$3.00 a share but is still worth US$43.4b.

I could go on and on, as there are many examples of these types of falls but still high valuations.

As interest rates rise, the squeeze on the pips of all of these companies that produce losses gets more vice-like.

It was only (ironically) on the 1st April this year I wrote about coming out of a coma shouting out ‘SELL everything’.

I got the timing wrong by a month. Instead of Will Smith slaps, I would now be getting flowers, chocolates and bottles of Dom as a thank you for moving to cash.

Now, hopefully you now know where I am going.

Yes, you know:

A company that has earnings per share of US$59,500 and has actually gone up 10% over the last six months. And in which a parcel of 100 shares would set you back US$46,900,000.

The two guys behind this company have a philosophy of only buying companies that produce profits which they can take home. They aren’t interested in companies that have to keep reinvesting capital to keep their sales going.

As they put it, a company owner that sells new tractors has to take in rusty old part exchanges to make those sales. The owners’ profits are, in their eyes, just a pile of rust.

Sometimes what seems unsexy, can suddenly become very sexy, as I try to explain (in kisses) to Mrs Broker after consuming all those bottles of Dom and pointing to all the car yards as she drives me home from the station.

As she helps me out of the car and to bed, I could hear her mutter under her breath ‘Sometimes I just wish you had found the gap’.

And there I was thinking I had.

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.