The Secret Broker: ‘Excuse me but does IPO mean I’ll Profit Overnight and if so, where’s my allocation?’

The Secret Broker

The Secret Broker

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

Please read the following statement from an Indian broker talking about IPOs:

‘…… increases of stocks of new companies in shares like the Back Bay Reclamation (face value Rs. 5,000) touched Rs. 50,000 and those of the Bank of Bombay (face value Rs.500) touched Rs. 2,850.’

This statement actually comes from them explaining how a speculation bubble was built up leading to the Indian Stock Market crash of 1865. It continues:

‘……..after banks loaned money to speculators further fuelling the bull run and wealthy merchants like Premchand Roychand dispensed advice that led to ordinary people placing their bets on shares.’

Ah. Many a time the phone would ring from a newbie client wanting to get an allocation of shares in a company that we were floating off. And between 1980 and 2020, I have seen a few, ridden the highs and lows and witnessed fully grown men fight over allocations in the office.

New clients wanting allocations had not yet learnt the system and how it works. Unless they were a super duper client, their allocation of shares would be almost non-existent on the good ones. On the bad ones, obviously, it was ‘how many would you like?’

The best IPO pop I’ve ever allocated myself shares in was a 20c mining stock. The year was 1987 (pre-crash) and for 20c you were issued with one share and one ‘five-year – 20c’ option. The stock came on at A$1.00 and the options came on at 80c, making my 20c become A$1.80.

They went straight out the door and after the ‘87 crash they disappeared forever.

Going back to the extract from the Land of Spices and even spicier floats, it continued:

‘…….Shares of the Backbay reclamation fell by 96% to under Rs. 2,000 and shares of Bank of Bombay, which had touched Rs 2,850 at the peak of the market, slumped to just Rs 87 in the aftermath of the bubble bursting…….’

So, that’s in 1865 and how much has changed since then? Er, nothing really.

The only difference is that the prospectus that accompanies the application form has blown out from 1 page to about 500 pages.

This blowout is because of the public outcries that occur after the bubble has burst and the finger pointing starts to happen.

Now we have class actions and the like, which now seem to occur almost everyday. You only need the Chairman to sneeze and fart at the same time in an AGM and the lawyers will be at the doors, even before the meeting is declared closed, forms in hand, signing up shareholders ‘who may have suffered’ from this occurrence.

If you work on company prospectuses pre-IPO, then you may want to look away. What I am about to suggest may end your career.

If a prospectus just stated on the front page ‘that by applying for shares via the attached form, you acknowledge that you could lose 100% of your investment’ then this would save about 1m trees and 499 pages per prospectus.

All this paperwork that ASIC requires and all the fees charged, mean nothing if it’s a dud company but happens to be in the right fashionable sector and then eventually have their Emperor’s clothes exposed.

I’m just waiting for AfterPay and ZIP’s logos to appear on the application forms, as that will mean ringing the bell on IPOs for a year or two.

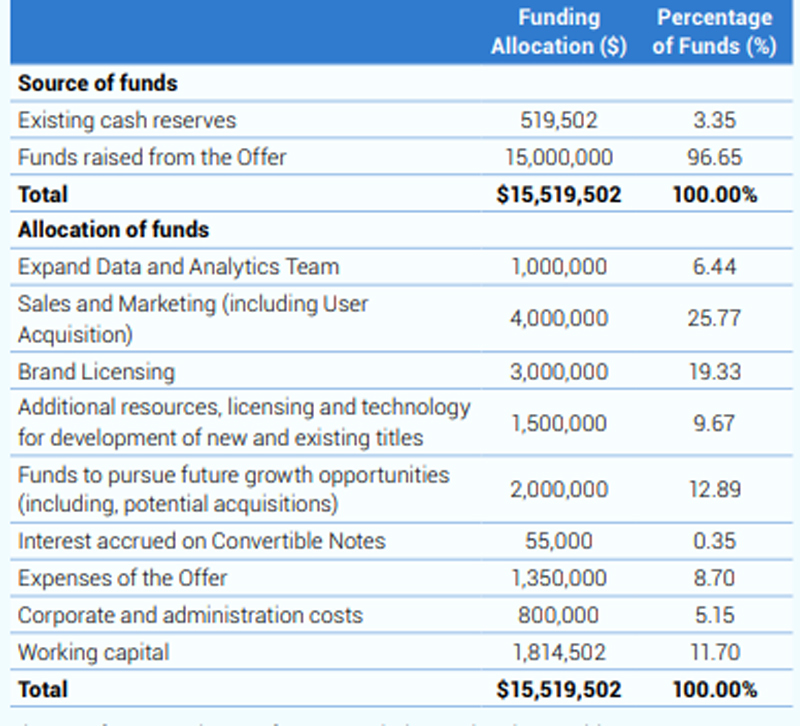

Now, I just looked at something that listed on Thursday and the cost of raising A$15m was stated as A$1.35m and the prospectus was 150 pages long. At the 20c issue price, the whole company was valued at A$73m. This is a screenshot of how the A$15m will be used:

So, while teams of accountants, lawyers and advisors would have worked for thousands of hours to produce the prospectus and earn their fees, this screenshot tells me that they must have worked on this bit of information for about two minutes.

If someone would have shown this to me during the prospectus due diligence period, I would have told them to go away and come back and make it at least look like you have used a spreadsheet.

Under the allocation of the A$15m funds raised there are nine entries. Only one – working capital – shows an exact amount and that’s down to the last A$2, whilst the other eight entries all end in three zeros. They have taken the back of the envelope figures and then used the old ‘working capital’ trick and tickled that figure around to balance everything out.

God help any Merchant Bank that produced a prospectus with a spelling mistake. That same zeros-hating partner would get straight on the phone to their Senior Partner and give him a hairdryer blasting.

Sometimes, it’s the little things that matter and that is what he explained to me, so I always stick to his rules. But…

The shares in this example rose 33% on their opening, so the directors have nothing to worry about. And if you are wondering how the Indian IPO market is going, Burger King India just floated and rose 125% on their opening, so the bull market in IPOs keeps trucking along.

If you are wondering about the name of the stock that went from a 20c package to a $1.80 package, I think it was Salamander Mining or something like that.

If anyone can remember it, please ping me with an email.

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.