You might be interested in

Tech

Xref says people-focused data is key to building a corporate memory

Tech

When employees exit stage right, too many companies are missing a huge opportunity for their return: Xref

Tech

Tech

A reference-checking system used by Westpac and Qantas has added a new “tone of voice” feature that can tell if someone gives a half-hearted answer when talking about a job candidate.

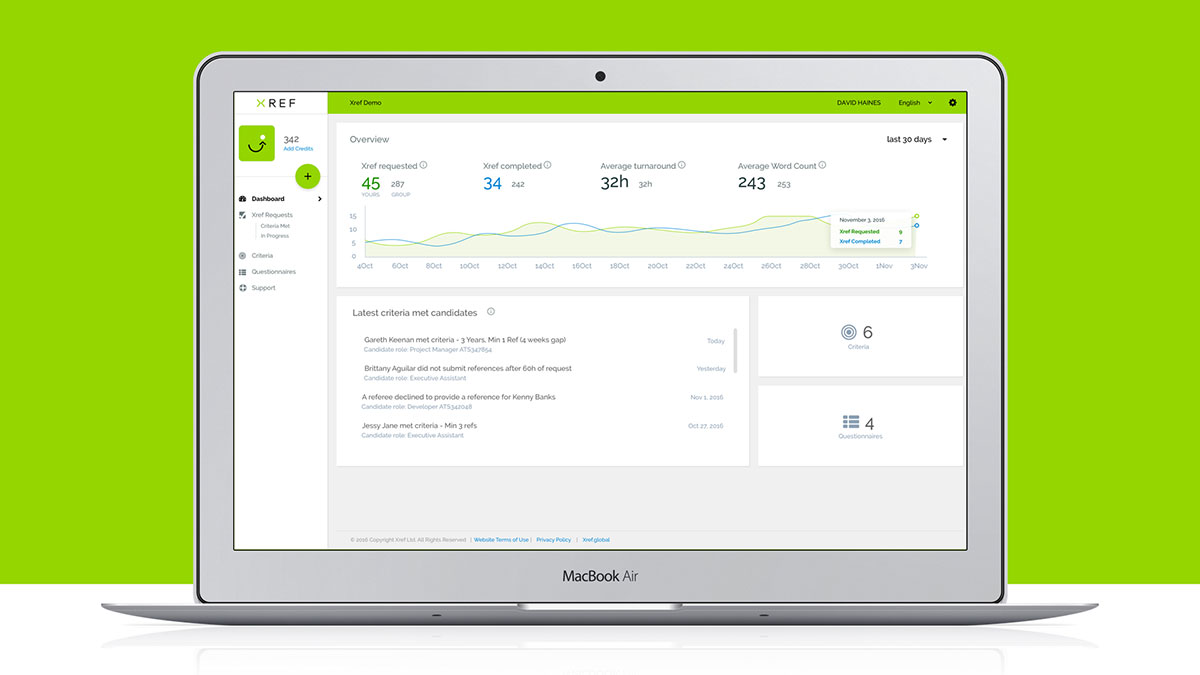

Xref (ASX:XF1) was founded by recruitment industry veteran Lee-Martin Seymour and Tim Griffiths, a technologist, to remove the biggest “pain point” in the hiring process — collecting reference checks and making sure they’re valid.

“That pain point surfaced when I was with Hays and one of my consultants decided to fake references for one of the candidates they were placing,” Mr Seymour told Stockhead.

“On that fateful day, the client rang me and said ‘can you show me the references you did for that particular candidate, because they’ve been done for fraud’. I pulled them out from the filing cabinet and asked the consultant how they’d come about.

“He said ‘we have a client, we had a candidate, the candidate wanted the job and the only thing standing between us and a $20,000 fee was the references, so I faked them’.

“The consultant left the building that day, by the window.”

The solution the pair came up with was to shift the onus of collecting references from employers to job candidates, and move the process online.

Using the Xref platform, a potential employee can login and add each of their referees, who then receive an SMS or email asking them to provide a reference online. The referees can decline, or decide to complete a series of “smart questions” consisting of drop-down menus, smart buttons and free text.

One of the benefits of the process is that referees’ answers can be compared to each other, as well as an average.

“We won’t just show that candidate in isolation, we’ll show them in relation to all the other times that question has been taken,” Mr Seymour said.

Xref was quickly adopted by Westpac, followed by other big names including Qantas, the NBN and Chelsea Football Club.

“We’ve put on an enterprise client every day of the financial year, and we’ve never lost a client in six years,” said Mr Seymour.

However, there was one thing that employers still missed.

‘The fake sounds the best’

“Their first objection to automating the process was that ‘I want to hear the tone of voice on the phone, because I want to hear those changes in their voice’,” Mr Seymour said of the industry feedback.

“Our standard rebuttal to that, is that the referee that is fake sounds the best. You know, you ring ‘John’ and he’s sitting next to his mate in the pub. He’s a fake reference, but he sounds great on the phone.”

To prevent that sort of reference going into Xref, the company developed an anti-fraud algorithm that looks for suspicious digital similarities, such as a candidate and a reference both logging on from the same internet connection.

“It picks up anomalies in the process and flags to the employer that this doesn’t look right, and you need to check how their referee gave feedback,” Mr Seymour said.

The other new feature is called Sentiment Engine, which is designed to measure the “tone of voice” in responses by analysing phrases and searching for specific indicators.

“Our sentiment algorithm will pull apart each question and do things like spot double negatives. It will pull everything apart and it will rate questions under an aggregate at the top of the report as negative, neutral or positive,” said Mr Seymour.

“To make sure it keeps learning we actually send samples of these ratings out via what’s called Mechanical Turk to actual human beings around the world who answer the questions and get paid per click.

“They look at the question, and how our algorithm has rated it, and they can recalibrate it if they wish.”

Xref listed on the ASX in February last year through a reverse takeover of King Solomon’s Mines. Its shares have traded between 33c and 76c over the past 12 months.

The company spent $1.8 million in the June quarter, leaving $4.11 million in cash, and in August raised another $7.5 million through a share placement to institutional and sophisticated investors. It expects to spend $2.97 million in the current quarter.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.