With the rise of ChatGPT and AI sentiment flying, where does BrainChip fit in?

Tech

Tech

Artificial Intelligence (AI) is all the rage right now, with the rise of ChatGPT sending stocks – mainly on the NASDAQ, we’ll admit – into the spotlight.

There actually aren’t too many on the ASX in the space (think Straker (ASX:STG), Icetana (ASX:ICE) and Appen (ASX:APX)) but the one we want to focus on today is BrainChip (ASX:BRN).

The company has developed an ultra-low power, AI neural processor that is capable of continuous learning – which allows customers to create ultra-low power chips and systems with the ability to incrementally learn on-chip without the need to retrain in the cloud.

Essentially this means it can think with ultra-low power consumption because it eliminates the power usage caused by interaction and communication between separate elements and avoids dependency on network connections to powerful remote computer infrastructures.

And reducing processing costs could mean big bucks in the AI space.

“Whoever the winner is in this space, it’s going to be incredibly lucrative,” Merewether Capital founder and MD Luke Winchester said.

“You can see the hype around AI with ChatGPT, anyone who can bring down the processing costs that will come from increased processing from AI, there’ll be billions and billions of dollars to be made.”

But market darling BrainChip isn’t exactly riding the wave.

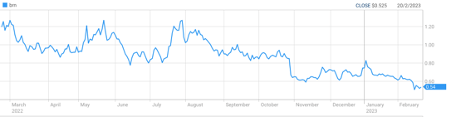

The company was trading around $1.75 per share with a market cap of $2.537 billion when Stockhead last spoke to Winchester back in January 2022.

Now the share price is around $0.54, and the market cap has dropped below $1 billion to $927 million.

The company recently taped out the AKD1500 reference design on GlobalFoundries’ 22nm fully depleted silicon-on-insulator (FD-SOI) technology – which is basically like a trial chip for fabricators to quality.

Even so, Winchester says he stands by his previous statement that he doesn’t have the conviction that BRN can be in the “1% that make it” to production scale, profits, and re-ratings.

“It’s not one I’ve followed too closely, it’s a very interesting stock and very popular with retail investors, but when I look at the development, they’ve got a bit of revenue coming in which is nice, but there hasn’t been that huge scale up.

“When they did get that first test chip into production, I think the hope was that you’d really see it take off.

“Last quarter there was US$1.2 million in receipts and they’re still burning through a decent chunk of cash and there’s a fair chance they’ll have to raise capital again, so from that sort of top-level view, my view hasn’t changed a great deal.”

The company is also competing with some of the biggest names in the industry – the likes of Nvidia, Taiwan Semiconductor, Intel – even Google and Apple who’re doing their own chips these days. And all of them are spending billions in R&D.

“I haven’t done a great deal of work into their tech compared to others but one of the challenges they face is they’re up against peers that have 1,000x better distribution to customers,” Winchester said.

“Nvidia, Intel, Taiwan Semiconductor, if they release a new chip similar to BrainChip, they’ve already got a customer book of thousands and thousands of customers whereas BrainChip is trying to do it from scratch.”

“Even when BrainChip was at its peak, the cost it would have been to one of those larger players would have been a pittance out of their budget,” Winchester said.

“These guys are just so large that they could have bought BrainChip at the peak if the technology was one that was genuinely going to change that industry and be that technological breakthrough.”

“One of those big guys could afford to make that acquisition 10 times over.”

He did however note that the company makes a more appealing takeover target if someone has looked at BrainChip in the past and couldn’t justify the price tag – which has now been cut in half and then some.

“But I don’t think the price is the biggest factor for anyone who would look to acquire BrainChip; if the tech was promising on that front, then you’d have your eye focused on the potential,” he said.

Winchester says you need a bit of an iron stomach to invest in tech, because the market is essentially divided clearly between profitable and unprofitable businesses.

“If you’re someone who is a little bit risk averse, for sure keep looking at those profitable tech names, they generate profits, cash and obviously you have to make an assessment on valuation but at the end of the day those companies are pretty safe,” he said.

“For those people who are willing to take a bit more of a risk, certainly people who’ve invested in the likes of BrainChip, the key to investing in unprofitable tech is that you’ve got to make a really good assessment of their underlying technology, and if I can’t focus on revenues and profits right now to value the business, what can I focus on?

“For BrainChip it might be winning new trial customers to their trial chips or for other tech companies it might be increasing their ARR to eventually scale up into profit – but you have to do the work around the actual product itself because you don’t have the profits and the cash to fall back on and to value as an earnings stream.”

Winchester points out that, in the short term, stock price is moved mostly by themes and narratives, and that over the last six to eight weeks that AI theme has been going gangbusters.

“BrainChip hasn’t moved on that theme which sort of makes me think that that hype and narrative around it has maybe started to wane,” he said.

“So, maybe moving forward it won’t be triggered as much by that sort of stuff and may be by the actual numbers that they report which are still I think well below the current fundamentals.

“They’ve got to really get that revenue growth going in the next few quarters to start justifying the valuation.

“I won’t tell people to buy, hold or sell, it’s up to them, but I’d be focused very much on the numbers over the next couple of quarters rather than the hype or the future of what AI could be – because BRN is clearly not reacting to that at the minute when it’s probably the best environment for that in a very long time.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.