This company has invented a recyclable plastic pallet, and its share price jumped 47pc today

Tech

Tech

Pallets are critical for any logistics company but like many raw materials, it has suffered from its fair share of shortages this year.

“Across the nation there is a bit of a ‘pallet gate’ going on,” he said.

“The lack of wood means not many new ones are being produced and there’s surging consumer demand.”

However Range International (ASX:RAN), a manufacturer of recycled plastic pallets is one company with a solution to the problem.

Its share price jumped 47pc today on no news but in an interview with Stockhead non-executive director Stephen Bowhill said it was a very interesting time to be in the pallet space.

“We are seeing a trend towards plastic from timber – timber isn’t sustainable and isn’t sustainably sourced,” he says.

“Plastic pallets last longer than a timber pallet – so your value over a lifetime for clients is improved and of course, recycling plastic into pallets gives way for large brands we work with such as Unilever to provide us with their plastic and process it into the pallet if they wish to do that,” he said.

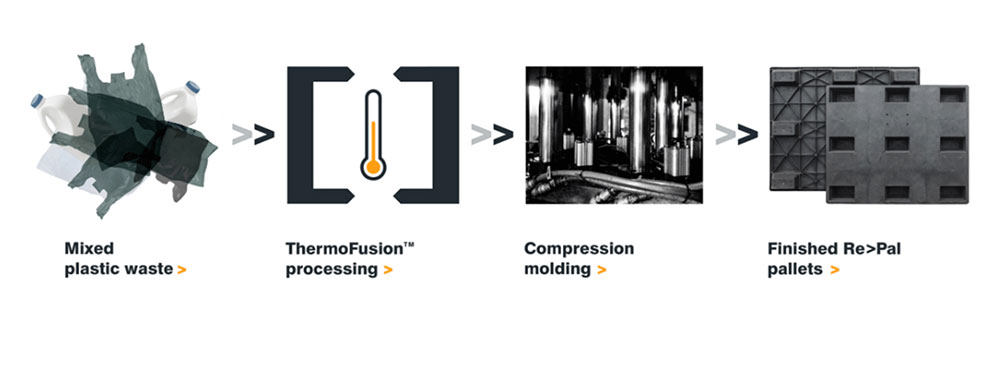

RAN’s thermo-fusion technology enables it to make plastic pallets from 100% recycled mixed waste plastic, at a price that is competitive with wood pallets.

It currently has four production lines operating in Indonesia, and sells its pallets under the brand Re>Pal.

While its revenue decreased during the September quarter due to the ongoing impact of COVID-19 across Indonesia, pallet sales for Q4 have reached more than 41,000, bringing year-to-date (YTD) sales to more than 144,000 pallets.

This is already a major improvement on the 98,867-pallets ordered in FY2020.

Despite the challenges presented by COVID-19 in Indonesia, Bowhill said this not only shows substantial progress in the increasing demand for 100% sustainable products in South East Asia but demonstrates that the transition from both wooden and virgin plastic pallets to recycled offerings is officially underway.

“We are improving volumes, getting more plastic through the factory, gaining interest from large multinationals and we are able to increase pricing because of commodity inflation, demand for the product, and the short supply of pallets,” he said.

On top of this, he said investor following was gained after the company raised $3.6 million through a fully underwritten non-renounceable entitlement offer, to establish the foundations of a breakeven operation in 2022.

RAN has also completed the design and testing of its new HDX 1100 pallets, which offers new sizes for customers.

Production is already underway with first deliveries earmarked for December with Unilver on board to test the new product in 2022.

“The current pallet range is slightly heavier per kilo but the dollar per kilo is improving,” Bowhill said.

“As opposed to say a 40-kilo pallet, the same function can be performed by the HDX which might be 30 kilos so it’s a 25% improvement on performance and therefore on gross margins.

“So, we will use less plastic to make a pallet, plus we have new sizes which opens new sale channels for us.”