Tech-focused capital fund Bailador in strong position for H2 FY24

Tech

Tech

Special Report: At the halfway point of FY24, tech-centric capital fund Bailador Technology Investments is in a robust position, with its private company investments well-positioned for growth.

Bailador Technology Investments (ASX:BTI) has reported its post-tax net tangible assets (NTA) per share, plus net dividends paid, increased 9.8% in H1 FY24.

Co-founder and managing partner Paul Wilson says the increase was made up of a gain in the value of the post-tax portfolio – investment gains less expenses – of 15c/sh adjusted for the payment of 3.2c/sh fully-franked dividend.

“Our private company investments continue to be well-positioned,” he says.

Wilson says, in line with its dividend policy, BTI paid its final FY2023 fully franked dividend of 3.2 cents/share to shareholders in September 2023, which delivered an annualised dividend yield of 7.3% when grossed-up for franking credits

The company’s policy is to pay 4% per annum of NTA pre-tax, including 2% of June NTA and 2% of December NTA. However, historically the actual dividend yield paid to shareholders has consistently been higher than this.

Wilson says the interim dividend implied by December’s pre-tax NTA based on unaudited numbers is 3.5c/sh (fully franked), which remains subject to discretion of the board. This implies an annualised grossed-up yield of 7.2% based on Bailador’s shareprice of $1.295 at the time of publication.

In July 2023, BTI completed the cash realisation of InstantScripts receiving $51.6 million in cash with final adjustments processed in November.

The realisation followed InstantScripts acquisition by Wesfarmers (ASX:WES) subsidiary Australian Pharmaceutical Industries Pty Ltd (API) in a deal worth ~$135 million.

Wilson says the realisation was at a value 25% higher than its previous carrying value and generated a cash IRR of 60.9% on its investment.

BTI initially committed $5.5 million to InstantScripts with additional $24.7 million in subsequent investments, reflecting their conviction in the company’s potential.

InstantScripts provides online prescription services, telehealth consultations, blood test arrangements and issuance of medical certificates.

Since its inception in 2018 by Dr Asher Freilich and Maxim Shklyar, the platform has served more than 600,000 customers and conducted more than 1 million consultations.

“We were pleased to continue our track record of realising our investments for cash at a value above our previous carrying value,” he says.

During H1 FY24, BTI made two follow-on investments in private portfolio companies.

In December, BTI invested $900,000 in company RC TopCo, which was formed in June 2023 following the merger of worldwide tours and activities operators Rezdy (Australia & Pacific), Checkfront (Americas) and Regiondo (Europe).

BTI had been an investor in Rezdy and opted to take shares in the new merged company.

“We now own a significant share of a large worldwide tours and activities software business,” Wilson says.

He says the team at RC TopCo have been busy in H1 FY24 adjusting cost bases, focusing product development, and aligning sales and marketing strategies.

“We continue to hold board representation on RC TopCo and are pleased with progress,” he says.

Also in December, BTI invested $1.57 million in a convertible note with Access Telehealth.

Wilson says pricing of the note is tied to the pricing of a future transaction and does not impact the value for which BTI currently hold Access Telehealth.

“However, as of December it had been 12 months since the last third-party transaction in Access Telehealth,” he says.

“Consistent with our valuation policy we reviewed the valuation and following a year of strong performance and pleased to write Access Telehealth up by 28%.”

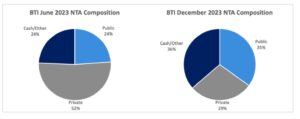

Wilson says the BTI portfolio is currently evenly weighted between private investments, public investments,and cash.

“We’re pleased with the positioning of the portfolio companies and their prospects,” he says.

Wilson says the cash realisation of InstantScripts and ~76% increase in the SiteMinder (ASX:SDR) share price in H1 FY24 are the primary drivers of the weighting shift since June 2023.

“We expect to see a substantial amount of cash move into private investments (both new and follow-on investments) throughout CY24.”

Source: BTI

Wilson says SDR’s growth guidance is unchanged and continues to target organic revenue growth of 30% in the medium term.

BTI was an early investor in SDR, which has become the world’s leading SaaS businesses for connecting hotels to digital distribution channels.

“The company also continues to expect to be underlying EBITDA profitable and underlying FCF positive for H2FY24.”

Wilson says its other public investment Straker (ASX:STR) continues to work on R&D to capture new channel opportunities associated with AI.

STR is leading player in the AI language services and technology industry and launched a share buyback program in December 2023 to purchase up to 5% of the issued capital.

BTI has not sold any shares into the buyback.

Along with RC TopCo and Access Telehealth BTI’s other private investments include end-to-end volunteer management software solution Rosterfy, which joined the portfolio in April 2023.

“Everything we have seen since gives us confidence we have made a good investment,” Wilson says.

“The company continues to grow strongly while investing in sales and marketing in the US and the UK, adding senior talent in Australia and developing world-leading product.”

Wilson says its investment in Nosto arises from BTI’s sale some years back of Stackla into the larger digital marketing services business Nosto.

“Nosto continues to focus on enhancing its product offering including introducing generative AI features and functionality into their Commerce Experience Platform,” he says.

BTI is also an investor in Mosh, which digitally delivers high quality and easy-to-access hair loss, weight management and sexual health care for men.

“In August, Mosh bought The Healthy Mummy to accelerate its growth in female healthcare as well,” Wilson says.

This article was developed in collaboration with Bailador Technology Investments, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.