You might be interested in

Tech

ASX Tech March Winners: Sector up 55% YTD as Aussie retail investors still love 'Magnificent 7'

Tech

ASX-listed BluGlass possesses potentially one of the most critical, enabling technologies on the planet

Tech

Tech

A moonshot by definition is a long shot, a giant leap, a lofty goal – and there’s a few tech companies on the ASX in that category.

Namely because tech players typically have to do a lot of R&D and it could take years – maybe even decades – before they’ve got a product ready for market.

But there are some definite hot shots in the pile who’re ready to launch.

Here’s a look at some of the ASX’s longest tech residents (we capped it at 10 years+) with products pending, what those products promise and just how close they are to commercialisation.

Listed: December 2004

The Israeli directional sound MEMs chip maker has been persevering with its difficult-to-produce speaker for about 14 years.

The company have been trying to develop a new kind of digital speaker that can deliver ‘boom-box’ sound from a mobile phone.

In December the company announced a comprehensive fabrication agreement with Eagle Mountain (Shanghai) Intelligent Technology – a semiconductor company focused on mass commercialisation of devices and systems rooted in Micro Electrical Mechanical Systems (MEMS).

EM is guaranteeing AKP long-term resilient supply of tens of millions of digital loudspeaker chips per year, and was aiming to mass produce the company’s products from the first quarter of 2022.

But there’s been supply chain issues which have impacted milestones around chip packaging and demonstration systems, and the current focus is on “transitioning from development wafers, chips and systems to demonstration and production products,” AKP says.

Apparently, there’s a headphone demo in the works, and in the meantime the company is planning a $10m cap raise.

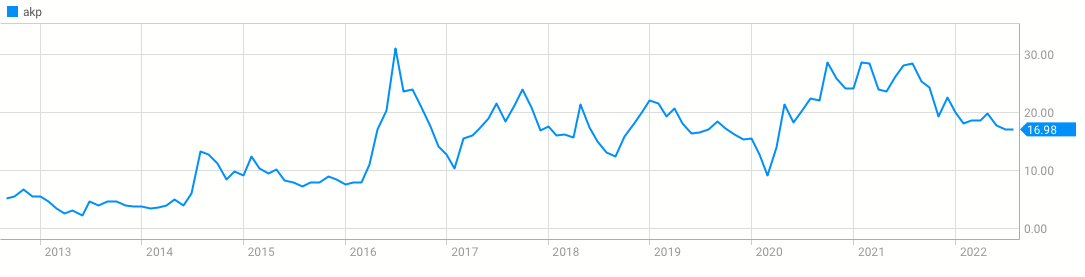

Despite the time it’s taken to get to this point, the company’s share price has been on the rise for the last five years.

Listed: November 2011

The ASX’s hottest, (largely) pre-revenue AI chip manufacturer has a market cap of $1.83 billion – yes billion . That’s higher than plenty of established, profitable ASX stocks.

The pitch is that the company has an AI chip that mimics the neural networks of the human brain, which tbh does sound pretty cool.

It’s basically an ultra-low power, AI neural processor that is capable of continuous learning, so it can think with ultra-low power consumption because it eliminates the power usage caused by interaction and communication between separate elements.

And this avoids dependency on network connections to powerful remote computer infrastructures.

Last year, BrainChip completed functionality and performance testing of Akida, which achieved performance and lower power consumption results.

Luke Winchester at Merewether Capital isn’t convinced, noting that “if the tech is genuine head-and-shoulders best in class, you get bought out.”

It’s still unclear when this AI chip will be ready for market, however the company did announce a few commercial partnerships in the June quarter with strategic technology (Arm, SiFive & Prophesee) and AI software leaders (Edge Impulse & NVISO), which it said demonstrates “pre-integration and interoperability”.

Listed: December 2010

This semiconductor player specialises in non-volatile memory technology, with the focus on an interface switching ReRAM for next generation gigabyte storage in mobile and cloud.

But they’ve hit a few hurdles recently.

Last year an etch residue problem resulted in the partial failure of the Second Platform Lot (basically the second batch of wafers processed together) and in trying to fix this they’ve inadvertently caused another issue with the Third Platform Lot.

“Testing of the memory cells used in the imec megabit memory array showed unexpected problems with scaling the memory cell to small dimensions suitable for Storage Class Memory potential applications,” the company said.

“These results suggest that the memory stack etch mask modification and further optimisation of the etch process utilising this new mask appears to have created another problem, while having resolved the root cause of the electrical shorting of the memory devices in the Second Platform Lot.”

Got that?

Until this issue is resolved, the company believes there’ll be long-term delay in achieving its strategic goal of commercialising the technology.

To conserve existing cash reserves, MD Ken Hurley will leave the company effective immediately – since he was engaged for the specific purpose of leading the commercialisation effort – and will reengage when 4DS is ready to start commercialisation.

Listed: August 2007

Last year Archer divested its mineral tenements and turned its full focus on to its quantum computing division, developing the 12CQ quantum computing chip – a world-first qubit processor technology that would allow for mobile quantum computing powered devices.

How long this could take to commercialise is the big question, but last month the company did announce that its chip is compatible with existing industrial foundry processes – a pretty big deal because you don’t need custom (i.e. expensive) fabrication.

“The results of the advanced simulations provides Archer with an initial avenue to designing qubit devices in a form suitable for scalable processing, and importantly, using existing chip production equipment found in many industrial semiconductor manufacturing foundries,” CEO Dr Mohammad Choucair said.

“Archer intends to use this modelling to determine which commercial semiconductor manufacturers to engage with regarding future fabrication.”

Listed: December 2010

Another player in the semiconductor space is Weebit, the inventor of ReRAM, faster and lower-power memory chip functions which could be used for the neuromorphic computing which drives AI.

ReRAM, unlike DRAM, is non-volatile meaning that it remembers the contents of its memory even when power is removed.

And Weebit is zeroing in on the ultimate prize of commercialisation.

The company has already completed a technology transfer to US giant semiconductor fab Skywater, and taped-out demo chips to the fab.

“These integrated chips allow potential customers to evaluate the functionality of our embedded technology, using it to analyse our ReRAM with the goal of integrating it within their new product designs,” CEO Coby Hanoch said.

“Technology qualification with SkyWater will commence once we get the wafers back from the fab towards the end of 2022.

“This will be the final technical step before customers can commence volume production.”

Listed: July 1986

This company might just take the cake for the longest listed tech player targeting commercialisation.

But at least it’s very nearly, almost ready to take its graphene-based additives and coatings products to market.

In June, Sparc announced that it was preparing to commercially manufacture its products – with detailed discussions progressing with global coatings companies.

“Comprehensive test data, undertaken to ISO standards, has now been shared under Confidentiality/Non-Disclosure Agreements and Material Transfer Agreements,” MD Mike Bartels said.

“Sparc has been able to demonstrate its know-how in addressing industry acknowledged challenges in the production of homogenous graphene dispersion having developed a proprietary manufacturing process for the commercial manufacture of graphene based additive products.

“Sparc is now poised to undertake the manufacture of graphene based additives on a commercial scale supporting coatings companies generating significant revenue from products targeting anti-corrosive end uses.”

Not to be pigeon-holed, the company also has a hydrogen arm, seeking to deliver a process aimed at producing commercially viable green hydrogen directly from water and sunlight via thermo-photocatalysis with green hydrogen technology developed by the University of Adelaide (UoA) and Flinders University.

Commercialisation of that one could be a while away though.

Listed: May 1998

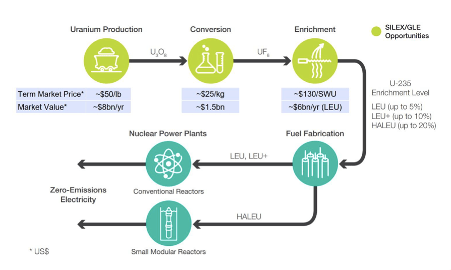

This semiconductor player (spot the theme emerging?) is eyeing commercialisation of its laser technology for uranium enrichment, thanks to the recent US Inflation Reduction Act which includes a US$700 million funding package to support the High Assay Low Enriched Uranium (HALEU) availability program to be conducted over the next four years by the US Department of Energy (DOE).

HALEU is the fuel required by many of the emerging advanced Small Modular Reactors (SMRs) – the next-generation of nuclear power technology.

The company was also a recent top pick for Perennial’s Sam Berridge.

“All of a sudden, there’s a big rush on and the Department of Energy has thrown some money at this and thrown their weight and support behind this to develop in situ uranium enrichment in the US, and certainly that speaks to Silex and their intellectual property,” he said.

Global Laser Enrichment (GLE), the exclusive licensee of the SILEX laser technology for uranium enrichment, will explore opportunities to be a potential participant in the HALEU Availability Program.

“As the US Government ramps up initiatives to domesticate its nuclear fuel supply chain and lessen its dependence on nuclear fuel imports, particularly from Russia, we expect GLE may have increasing opportunities to commercialise the SILEX technology,” Silex MD Michael Goldsworthy said.

Listed: September 2006

In April the company picked up a semiconductor fab in Silicon Valley for a cheap $2.5 million, and in June shipped its first fully packaged laser diode prototypes to its initial customer.

The 405nm and 420nm alpha products will be integrated and tested by the customer within their new product design and development cycles.

For context, an alpha product is an advanced prototype still in the design phase and the company says it’s a valuable tool to collect customer feedback in real-world applications.

“We are working with several customers wanting to trial alpha laser diodes for innovative new applications, including medical devices, sensing, quantum computing, and automotive products,” BLG president Jim Haden said.

“The fact that we have customers anxious to receive our alpha products, ahead of our full product launch is indicative of the significant unmet demand within the 405nm and 420nm wavelengths, and a testament of our improved performance.”

BLG is currently building laser diode chips at 405, 420 and 450 nanometres, with plans to launch six or seven products this year.