Long established IOUpay builds strong foundation for sustainable growth

Tech

Tech

With 20 years’ experience IOUpay is well positioned for future growth and not perturbed by reported instability in the BNPL sector.

Malaysia-focused fintech IOUpay (ASX:IOU) says it has built its foundation on 20 years of experience securely processing high volumes of digital payment transactions as questions are asked about the viability of the BNPL sector.

In a sector once one of the strongest performing on the ASX, the current environment of lower margins caused by higher interest rates, and intensifying competition has forced a number of BNPL players to merge or shut their doors.

In a recent interview with Stockhead, IOU executive director Paul Russell says the company is an experienced fintech, having been established in 2003 and listed on the ASX in September 2014, with a well-developed strategic plan for growth in the booming cashless economies of Southeast Asia.

He said the company was targeting sustainable growth over the longer-term with profitable transactions from high quality partners, merchants and consumers, rather than top line revenue growth in the short-term.

IOU also benefits from diversity in its business lines with new products being developed for both consumers and businesses as the company pursues its goal of being one of the leading digital payments processors in Southeast Asia.

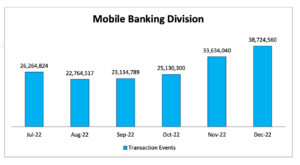

In its December 2022 Quarterly Report, IOU reported its mobile banking division achieved record transaction volumes for November and December with transaction events up 35% from the September quarter.

The result exceeded the previous record highs achieved during Q1 FY22 when pandemic-related lockdowns were shifting transaction activity to online platforms. A significant portion of this latest growth in volumes was attributed to notifications and marketing messages distributed to the mobile devices of clients’ customers.

Increased transaction activity levels during the quarter have predominantly been achieved from the existing client base.

The Company reported clients have both re-routed regular traffic from other aggregators and awarded to the company several special projects involving SMS notifications.

To leverage the increased capacity created through the infrastructure upgrade completed late 2021, there are opportunities for further growth through new client acquisition as the business seeks to capture a greater share of this market.

Source: IOUpay

Russell said the company has taken a measured approach to growth in phases, targeting the top 30% of the Malaysian population by credit quality.

“We do this through targeted customer acquisition, working with merchants and strategic partners, including payment gateways and financial institutions that have portfolios of higher credit quality customers,” Russell said.

The company has secured several strategic partnerships over the past year. Among the latest is a master merchant agreement with Simplepay Gateway, the operator of senangPay.

The agreement gives IOU access to up to 15,000 merchants on the platform who now have the option to offer their customers use of myIOU BNPL to pay for their transactions.

Among other partnerships:

“We’ve established several strategic partnerships which provide access to large communities of merchants and consumers,” Russell said.

“These partnerships are planned to be drivers for scale generating significant growth in transaction volumes.”

In September 2021, IOU announced it was acquiring a stake in Malaysian company I.Destinasi Sdn Bhd (IDSB), in a deal aimed at targeting high credit quality government workers and providing opportunities for expansion through bank relationships.

In September 2022, the company confirmed the total acquisition to be a 34% interest at completion and and announced a strategic partnership agreement with IDSB to collaborate on strategic initiatives (including new products and marketing programmes) targeting federal civil servants in Malaysia.

IDSB is a specialised finance company focusing on providing instalment-based consumer credit services to civil servants for and on behalf of Malaysian banks.

Russell said the strategic investment in IDSB enables IOU to target civil servants with proven track records servicing instalment payment plans. Moreover, there are opportunities to introduce additional bank relationships to expand the IDSB customer base, and potentially access bank customer portfolios or source capital.

Furthermore, IOU has a strong credit control strategy. IOU reports non-performing loans (NPL) of $304,630 and NPL Ratio of 0.99% as at December 31, 2022.

IOU believes the NPL and NPL Ratio remain modest, reinforcing the strong credit quality control strategy.

The company’s merchant services teams conduct ongoing re-assessment and evaluation of merchant relationship performance to ensure alignment with IOUpay brand values, anticipated transaction levels and satisfaction of return expectations.

“IOU continues to focus on building a community of quality merchants and consumers as part of its best-in-class brand positioning in Southeast Asia,” he said.

IOU has been developing innovative products to open access to new markets and diversify growth, so it’s not “just a BNPL company”.

In July 2022 the company was awarded Certification of Shariah Compliance by the independent, global Shariah advisory firm, Tawafuq Consultancy.

IOUpay Asia has also signed a merchant acquiring services agreement with Souqa Fintech Sdn Bhd, trading as PayHalal – a Shariah-compliant payment gateway, an important and necessary requirement for IOUpay’s myIOU Islamic BNPL service.

With significant Muslim populations in Malaysia and the SEA region, myIOU Islamic opens access to new communities of merchants and consumers and positions the company for territory expansion into other SEA jurisdictions with large Islamic populations.

Co-brand myIOU KA$Hplus Visa Prepaid Card and myIOU Business+ and new Bridging Loan further enable the company to substantially broaden its customer base and diversify its revenues.

“myIOU Business+ was launched at the end of 2022 and is a fully online business-to-business financing solution that allows purchasers to use myIOU to finalise supplier invoices upfront and repay over three monthly instalments,” Russell said.

“The product is targeting SMEs which account for 97% of businesses in Malaysia, generating 38% of the country’s GDP.”

While IOU has focused on securing a strong position in Malaysia, it also has a clear strategic objective to expand into additional Southeast Asia territories.

Put on hold during the early stages of the covid-19 pandemic with travel restrictions, as they have lifted the company plans to advance its expansion into other SEA territories it sees as a good fit for its offerings.

In the December 2022 Quarterly Report, IOU reported having enhanced its technology platform to accommodate cross border transactions in two foreign currencies as it prepares to reach new SEA markets.

This article was developed in collaboration with a IOUpay, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.