How to make sense of the Property Capital Stack

Tech

Tech

Did you know that, just like with startup investing, real estate investing has different investment layers with different risks and returns?

While real estate is a natural go-to for many new investors wanting to maximise returns and reduce risks, there are many ways to break into property investing.

And because every real estate investment is unique, it’s important to understand how real estate investing can look depending on how you invest, when you enter the market and the deal type you invest in.

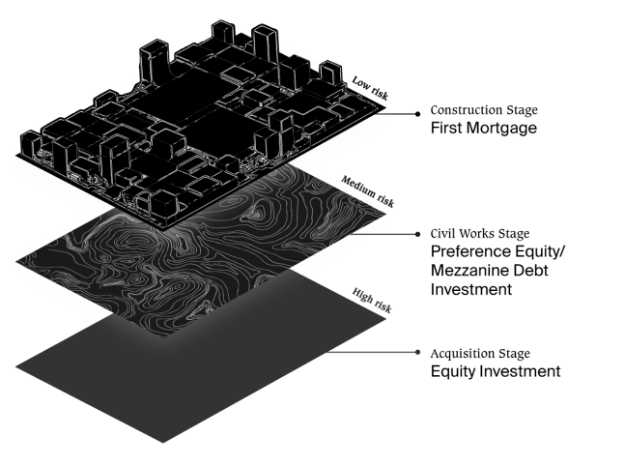

In commercial property development such as what we do here at VentureCrowd, deals are broken down into 3 primary layers, each with different investment types, returns and risks attached to them – and those different investment levels are referred to as the property capital stack.

Once you get your head around the capital stack, it’s a lot easier to evaluate and manage real estate investment risks and projected returns. Not sure where to begin? Fret not, because here’s how it all breaks down.

The property capital stack describes the capital investment layers for financing, developing and operating a commercial real estate investment.

The capital stack defines who has the rights (and in what order) to the income and profits the property generates throughout the hold period and upon sale.

Importantly, it also defines who has rights to the actual asset in case of a default on the loan that’s not secured.

When investing in real estate through an online marketplace, platform or other means, getting clear on the capital structure of any given development and the associated risks and rewards helps you diversify your portfolio in an optimal way.

Essentially, the stack’s structure and your place within it as an investor will determine how and when you will get paid and whether you have the ability to take control of the underlying property.

In a nutshell, your position within the stack shows your exposure level and also the level of your expected return.

The real estate capital stack is structured into three main components:

At the bottom of the capital stack we have equity.

Common equity holders have the highest risk in the stack as they’re in first and paid last. Common equity holders require the highest return to compensate for such risk and have the potential to enjoy very high rewards.

Unlike debt investors, equity investors target a Return on Equity (RoE) which typically translates into higher returns than the other two investment levels.

However, this level carries more risk. For example, common equity holders aren’t guaranteed to receive periodic payments or even their principal back and their investments are generally illiquid. At VentureCrowd, equity projects tend to target a Return On Equity between 30-40%.

Preference Equity/Mezzanine Debt is the next position in the capital stack. It is a fixed income security that offers passive recurring income for investors.

This level forms the middle of the stack. Mezzanine debt is not secured by the property but by a pledge of the ownership interest.

Because mezzanine debt is repaid after First Mortgage Fund (FMF) debt, it carries a slightly higher risk profile but is considered less risky than a common equity investment because the site value is higher after DA approvals and acquisition.

As such, investors can expect to earn higher returns than they would gain with FMF. At VentureCrowd, we tend to offer between 12 to 15% returns on our preference level investments.

In VentureCrowd property deals, First Mortgage Fund is another debt-based or fixed income security that pays regular passive income to investors.

It sits at the top of the real estate capital stack, and is home to the highest priority debt, meaning in the event of a default, FMF investments are backed by a registered mortgage and are paid out first.

If a property performs well and generates cash flows sufficient to pay periodic debt service payments, then debt holders will get their full periodic payment before any other capital contributors.

Because of this, First Mortgage Debt is considered to have lower risk. Traditionally first mortgage investments can range from 6 to 9%.

In our case, because of our focus on high-growth areas like South East Queensland, our first mortgage fund often allows for a 12% target return.

The property capital stack is important for two main reasons. From a property developer’s perspective, the way the capital stack is structured will influence a deal’s overall profitability. From the investor’s perspective, understanding the capital stack can help them to determine where and when to invest.

hose seeking “safer” investments at lower yields can choose to invest in low-leverage debt, while those investors chasing higher returns may want to invest in common equity.

Understanding how a property developer distributes cash flow in each layer of the property capital stack will better position you to understand whether the intended return is worth the risk you take on.

In commercial real estate, if you are less tolerant of risk as an investor, then FMF debt is generally the most secure position in the capital stack.

Note that while risk decreases as you move up the capital stack, so does the potential return. There is no “good” or “bad” position within the stack, as long as you are aware of the potential return compared to the risk.

You also have the opportunity to invest in projects at each level to diversify your portfolio. Our Cannon Hill project, for instance, provides the opportunity for an equity (high return, first in, last out) stake. Our Carrara project is a level 2 investment and our Glenvale project is now at the FMF stage.

In reviewing crowdfunded real estate investments, an important part of due diligence is to understand the terms of the investment, including where you, as the investor, will sit in the capital stack. It’s also important to factor in the current investment environment.

During a bear market such as we’ve experienced in 2022, where there’s high inflation, investors tend to gravitate towards fixed-income securities to take advantage of subsequent higher interest rates, so that’s something to bear in mind (pun intended).

However, when you consider regional growth, it’s worth looking at projects at each layer of the property capital stack to optimise your overall returns.

Here at VentureCrowd, we raise capital for property development projects across the different stages of the property capital stack. Some projects will involve all capital stack investment layers and some will only have one or two. It really depends on the project.

If you’re interested in property investment, the Queensland property market is a great place to start. Driven by affordability, lifestyle and work flexibility, regional property prices have on average climbed 15.2% (versus 9.4% in capital cities) over the past 12 months.

Current property development projects we have on offer include:

Whichever level of the property capital stack you’re comfortable with, our aim here at VentureCrowd is to empower you to back what you believe in and access impactful property investments that allow you to diversify your portfolio.

Further information can be found on the VentureCrowd website. Any queries regarding VentureCrowd should be directed to VentureCrowd and not to Stockhead.

This article was developed in collaboration with VentureCrowd, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions. Any documents linked or referred to in this article were not selected, modified or otherwise controlled by Stockhead. Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in the documents linked or referred to in this article