Digital payments in Australia are still off-limits, but pick-and-shovel ASX fintechs are thriving

Tech

Tech

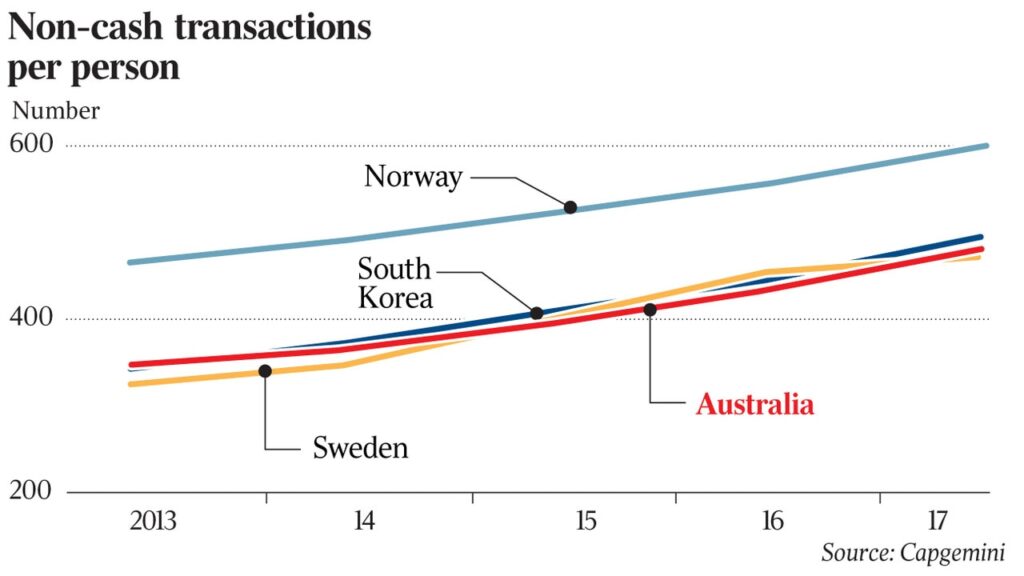

Physical cash is dying a slow death with the gradual mass adoption of electronic payments.

Smartphone devices have practically shifted what was once a tedious task to an instantaneous end-to-end process.

Not only are digital payments quick, they are also becoming more secure, accessible and convenient relative to cash-based payments.

As a result, the trend toward digital payments has been exploding around the world.

On the ASX, B2B (business-to-business) digital payment companies like Novatti (ASX:NOV) have been reporting stellar growth.

In the last quarter, Novatti increased its sales revenue by 60% to $9.3 million after experiencing a 13x growth in its gross transaction value (GTV) from a year earlier.

While the B2B side is growing, the consumer side is harder to crack because apart from banks, only Wise and PayPal have digital payments licences in Australia.

In December last year, the Federal government released a consultation paper in a first attempt to reform the nation’s consumer digital payments regime.

To understand the local payments market, we first need to understand the participants in the space.

In Australia, the digital payments universe is a multi-faceted complex universe – comprising payment rails at the core, and layers of infrastructure supporting it.

This infrastructure is made up of banks, institutions, processors, gateways, cards, and the new breed of fintechs.

Chris Jewell, the CEO of Zepto, sees the rails at the core as two distinct galaxies within the universe.

“You’ve got MasterCard, Visa, Amex on the ‘Cards’ side, and you’ve got the New Payments Platform (NPP) and Direct Entry (BECS) under the Reserve Bank on the ‘Bank Accounts’ side,” Jewell told Stockhead.

“They’re distinct in the sense that they’re regulated separately, and have use case applications that don’t compete and can exist in very different worlds.”

Jewell believes this separation creates silos that enable some of the smaller fintechs like Zepto to avoid competition with the bigger ones.

“We’re not all competing for the same payment experiences. A customer that’s relevant to a smaller player is not relevant, quite often, to a bigger player,” he said.

Zepto’s account-to-account (A2A) payments technology for example, is only relevant to large flow, large scale enterprise customers that have significant, complex payment flows.

“As an infrastructure player we see that clearly. We can’t be everything to everyone,” Jewell said.

Jewell believes that for smaller fintechs providing digital infrastructure like Zepto, the opportunity is virtually limitless as adoption continues to grow.

Smaller players almost always have the advantage of speed, focus and, very likely, the advantage of being built for the digital economy.

“Smaller fintech companies can often differentiate themselves by focusing on a specific niche or market segment, such as account-to-account payments in Zepto’s case.

“We have dived right into the infrastructure space, and pushed ahead with gaining direct access to the underlying payments infrastructure alongside the banks, rather than through the banks,” said Jewell.

Meanwhile, those banks are doing as much as they can in the digital payment environment right now.

“They want to continue to be relevant to the extent that they can be when it comes to payments,” Jewell added.

“But the reality is they’re governed by APRA, they’re governed by the non-payments regulator, they’re really beholden to deposits and lending.”

In that context, Jewell says he’s seeing more cross-pollination and collaboration between banks and fintechs.

“We’re seeing some banks investing in fintechs, others are partnering with them, or simply contracting with them to roll out new payment experiences and services.

“We believe fintechs like Zepto are better-positioned to create or contribute to those optimal payment environments at scale more quickly than the banks.”

Change’s technology offers Banking as a Service (BaaS) solutions to businesses and financial institutions, providing infrastructure and tools for building customisable payment solutions.

Last year, the company signed an exclusive six-year direct issuing partnership deal with Mastercard in Australia and New Zealand, enabling Change to issue prepaid and debit cards under the Mastercard logo.

Earlier, Change had launched its payments platform, Vertexon. Vertexon is a Payments as a Service (PaaS) offering, which provides quick-to-market card and payments solutions to banks and fintechs around the world.

Novatti provides businesses with everything they need to pay and be paid.

The focus of Novatti’s technology is on mobility – the ability for businesses to make or receive payments using any device, anywhere.

The technology covers the complete payments value chain, from issuing payment cards to banking services.

Following the granting of restricted banking licence by APRA, Novatti launched the International Bank of Australia with a 91% stake.

Novatti says its business has shifted from an investment and development phase, to scaling to drive increased margin.

Key focus in FY23 include delivering positive cashflow and rapidly scaling new growth engines and acquisitions.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.