ASX Tech Stocks: Pentagon finds illegal Chinese alloy in fighter jets, Sparc teams up with QUT to develop battery materials

Pic: gece33/ E+ via Getty Images.

- Pentagon halts F-35 fighter jet deliveries containing illegal Chinese alloy

- Sparc Technologies teams up with QUT to develop sustainable battery materials

- Vection Technologies reckons FY23 full year revenue will be around $24-26 million

The Pentagon delayed deliveries of new F-35 aircraft last week after Lockheed Martin determined that all 825 of the fighters delivered so far contain a part of a Chinese cobalt and samarium alloy that’s illegal under US law and Pentagon regulations.

It turns out an alloy used in magnets contained in the F-35’s turbomachine pumps came from China, and while Lockheed Martin builds the overall aircraft, the turbomachine is produced by Honeywell.

Apparently, the magnet has no visibility or access to any sensitive program information, but still, bit awkward.

“We have confirmed that the magnet does not transmit information or harm the integrity of the aircraft and there are no performance, quality, safety or security risks associated with this issue and flight operations for the F-35 in-service fleet will continue as normal,” F-35 Joint Program Office (JPO) spokesperson Russell Goemaere told POLITICO.

“Defense contractors voluntarily shared information with Defense Contract Management Agency (DCMA) and the JPO once the issue was discovered and they have found an alternative source for the alloy that will be used in future turbomachines.”

Who’s got tech news out today?

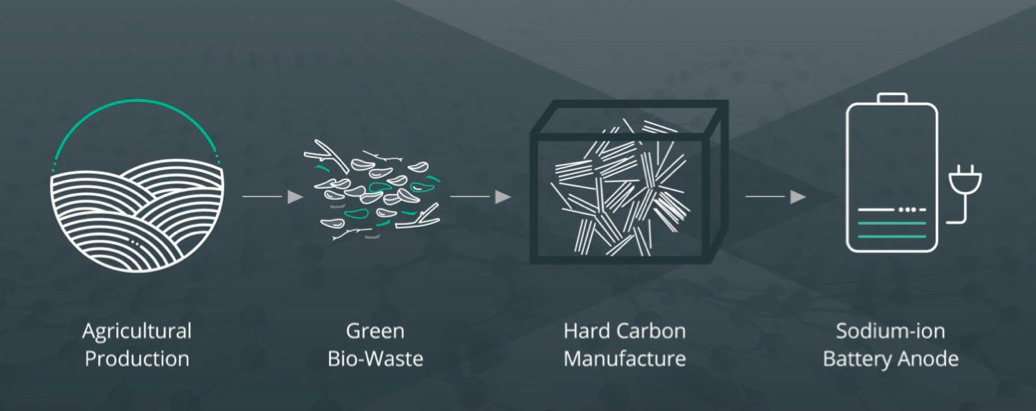

Sparc has signed a strategic partnership agreement with the Queensland University of Technology (QUT) to develop sustainable battery materials.

“Sparc is excited to join with QUT in a Strategic Partnership, commencing with a project in the battery anode space with the development of a novel process for the production of hard carbon,” MD Mike Bartels said.

“Using readily available, sustainable bio-waste material will provide Sparc with a strong environmental value proposition when compared with conventional sources of hard carbon. “We will be targeting the production of materials for the high growth market of Sodium ion batteries which is displaying significant promise as an alternative to Lithium-ion batteries.

“In addition to enhanced safety for industrial scale energy storage, of great significance is the fact that the materials used in Sodium ion batteries are accessible and not challenged in supply as is the case with Lithium-ion batteries.”

Wood Mackenzie expects Sodium ion batteries to take some of LFP’s share in passenger EVs and energy storage, reaching 20GWh by 2030 in its base-case scenario.

Along with signing the Strategic Partnership Agreement, Sparc has commenced a project with QUT that will develop a novel process for the production of hard carbon using low cost sustainably sourced green bio-waste targeting the Sodium ion battery industry.

“The Sustainable Hard Carbon Anode project compliments existing knowledge and skills Sparc has developed through its graphene expertise and the extension of this into renewable energy technologies is a natural fit with Sparc’s photocatalytic green hydrogen project,” Bartels said.

VECTION TECHNOLOGIES (ASX:VR1)

The virtual reality and metaverse player expects full year total revenue for the 2023 fiscal year to be in the range of $24 million to $26 million.

The company’s INTEGRATEDXR immersive solutions from virtual reality and augmented reality to mixed reality, delivered a 440% revenue growth acceleration during fiscal 2022, to over $18 million.

And the company has high hopes for FY23.

“During the first half of fiscal 2023 the company expects to continue investing in its INTEGRATEDXR R&D activities, global expansion and partnerships creation to deliver incremental growth during the second half of the fiscal year,” MD Gianmarco Biagi said.

“Furthermore, management is picking up pace towards foundational agreements and M&A objectives, which are expected to significantly improve the current revenue guidance objectives.”

SYNERTEC CORPORATION (ASX:SOP)

Synertec has raised $5 million through the issue of 31.25 million shares at a price of $0.16 per share.

Around $4 million of the funds will be used to provide balance sheet support for the execution of the Ccompany’s growth strategy – including commercialisation of its large near-term ESG-focused technology, Powerhouse.

“With the development of our Powerhouse technology progressing rapidly and a number of upcoming milestones, we are well positioned to commercialise our technologies and potentially generate material value for our shareholders,” chair Dennis Lin said.

The company has been signed to support engine development work for Anduril Industries, a US-based defence products company, to determine an engine upgrade pathway for one of Anduril’s uncrewed aircraft system (UAS) programs.

Subject to Anduril’s approval of the engine upgrade pathway, Orbital UAV expects to be contracted and complete this development work in the second half of FY23.

At this time both Anduril and Orbital UAV will evaluate the potential production responsibilities and volume requirements of the engine.

“Having successfully demonstrated Orbital UAV’s superior heavy fuel engine capability to the Anduril team, this contract is a continuation of the collaborative approach the companies have adopted – working on concepts, products and technical solutions in the evolving uncrewed domain,” CED and MD Todd Alder said.

“As we continue to build our relationship with the Anduril teams in the USA and their Asia Pacific subsidiary, Orbital UAV has an opportunity to participate in and influence programs that will be at the forefront of future global UAS operations.”

The initial contract does not affect Orbital UAV’s FY23 revenue forecast of $20-$25M.

SPN, VR1, SOP and OEC share prices today:

At Stockhead we tell it like it is. While Orbital Corporation is a Stockhead advertiser, they did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.