ActivePort can double in 12 months on conversion of global telco pipeline: Bridge Street

Tech

Tech

Sydney-based Bridge Street Capital says ActivePort could double in value over the next 12 months if the networking and cloud software specialist successfully executes on its cracking pipeline of large telco clients.

The highly innovative global software provider ActivePort (ASX:ATV) is significantly undervalued, according to Sydney-based capital advisory firm Bridge Street Capital.

In a note to clients, Bridge Street’s senior analyst Daniel Seeney has put a “buy” recommendation on ATV, with a 12-month fair value of 33c which is more than double the current share price of 15c.

Central to his thesis is ATV’s pipeline of potential deals with big telcos which if converted successfully, could earn ATV a flood of revenue over the short-term.

During an analyst call, ActivePort’s management noted most of the firm’s currently engaged telcos are the major, dominant players in their respective global markets, the majority of which are the size of Telstra and some much larger.

Additionally, management revealed, “many of the deals we’re working on are valued at millions per annum in software license revenue, with several wishing to pay up front for multi-year deals”.

With those large telcos in the pipeline, Seeney believes the addressable market for ActivePort’s software is huge and expects the company to begin showing its full potential during this half.

“If a few of those large telcos could translate into commercial customers, that should make a big difference for the company’s cash flows,” Seeney told Stockhead.

The market for cloud IT services and global networking is vast and rapidly growing, and with its growth comes increasing complexity.

Companies around the world struggle to deal with a convoluted array of different vendors and intricate software architecture – and that’s ActivePort’s bread and butter.

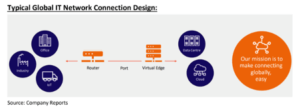

ATV provides a solution by facilitating data connections between company premises (such as offices, factories, and remote workplaces), known as the “edge” of enterprise IT networks, to essential cloud computing services.

ActivePort’s SD-WAN 2.0 and orchestration software lets customers manage all their cloud hosting and networking technology end-to-end, from one single screen. Using ActivePort’s unique software, customers can create network connections, deliver cloud services, and manage their data at a local, national, or global scale.

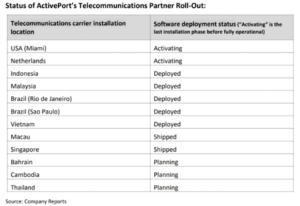

The company’s sales strategy has been to forge partnerships with global network service providers and telecommunications carriers around the world, laying the foundation for potential software sales agreements.

Currently, 20 network service providers and 10 major telcos have signed up and are now promoting ActivePort’s software to their customers across 11 countries.

Competing in this global market for cloud and networking services requires a global vision, hand-in-hand with a critical mass of connected global technological infrastructure.

Bridge Street believes ATV is ideally positioned in this rapidly growing market – and it boasts the right management team to navigate the opportunity.

“Achieving scale quickly is an important determinant of success, and we believe ATV’s management team is highly experienced, capable and aligned, which is a critical element of any investment consideration in small companies,” Seeney said in the report.

As a relatively young company, ActivePort has been growing rapidly.

The company delivered $4.3m of revenue in the latest December quarter, which was a massive 74% jump on the September quarter.

During the last three months, the company has also established a strong pipeline of telco-channel partners, straddling a mix of APAC and global telecommunications companies.

As such, its software has already gained significant traction with local and international telecommunications customers.

With the amount of sales activity underway and deals close to being concluded, Bridge Street expects ATV’s software license revenue growth to accelerate throughout the second half.

“They’ve put themselves in front of those big telcos, and if they can sign contracts with them, those software sales are in essence pure margin,” Seeney said.

“The key operational focus in the near-term is securing those signed contracts, followed by driving deployments, and commencing active engagement with the sales teams of channel partners to drive software license revenue realisation.”

Given ATV’s early stage, high-growth strategy, Bridge Street has adopted the EV/Sales multiple methodology as its primary valuation framework.

The analyst has applied a multiple of 3x on ATV’s managed services revenue, and 5x on its software/port revenue to come up with the 33c valuation.

Additionally, Seeney says the company is in a sound financial position after the recent IPO which raised $12m, and that should support the strategic growth plans for the next 2 years.

On the risk side, Seeney has drawn investors’ attention to key risks facing every young tech company – looking carefully at factors such as the availability of funding, competition, technological change and data security.

Whilst not in direct competition, ActivePort’s potential growth has previously been compared with Megaport’s successful growth story, whose share price has grown 6x in the last five years.

“It certainly has the potential today (to become like Megaport), but I think that remains to be seen over the next half, because it revolves in the short term around getting the contract with those large telco customers,” Seeney said.

This article was developed in collaboration with ActivePort, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.