A tale of two BNPLs: Zip records $1 billion loss; Prospa bottom line up 2,274%

Tech

Tech

Zip Co’s (ASX:ZIP) announcement today that it has lost $1.1 billion for the full year demonstrated the steep challenges facing buy now pay later (BNPL) companies.

The sector is facing several headwinds, including a planned ‘crackdown’ by the government, increasing competition, and rising credit losses as interest rates increase.

Zip recorded bad debts for the year of $276 million, which is eating into its cash margins.

But its billion dollar loss in FY22 was mainly driven by $821 million of non-cash impairments and write downs, which do not impact its cash position.

During the year, Zip made conscious decisions to minimise cash burn by closing down Zip Singapore and Zip UK, and undertaking measures to reduce staff costs.

It’s also decided to terminate the proposed acquisition of fellow ASX-lister Sezzle, while winding down non-core products including Zip Business Trade, Trade Plus and Pocketbook – as it looks to focus on core businesses.

The $821m impairments announced today reflect this strategic review, writing down the value of goodwill and intangibles attributable to its US, UK, Spotii and Twisto CGUs businesses.

Spotii is a BNPL platform operating in the Middle East which Zip acquired in October last year, while Twisto is a payment app for the European markets which was also acquired in November.

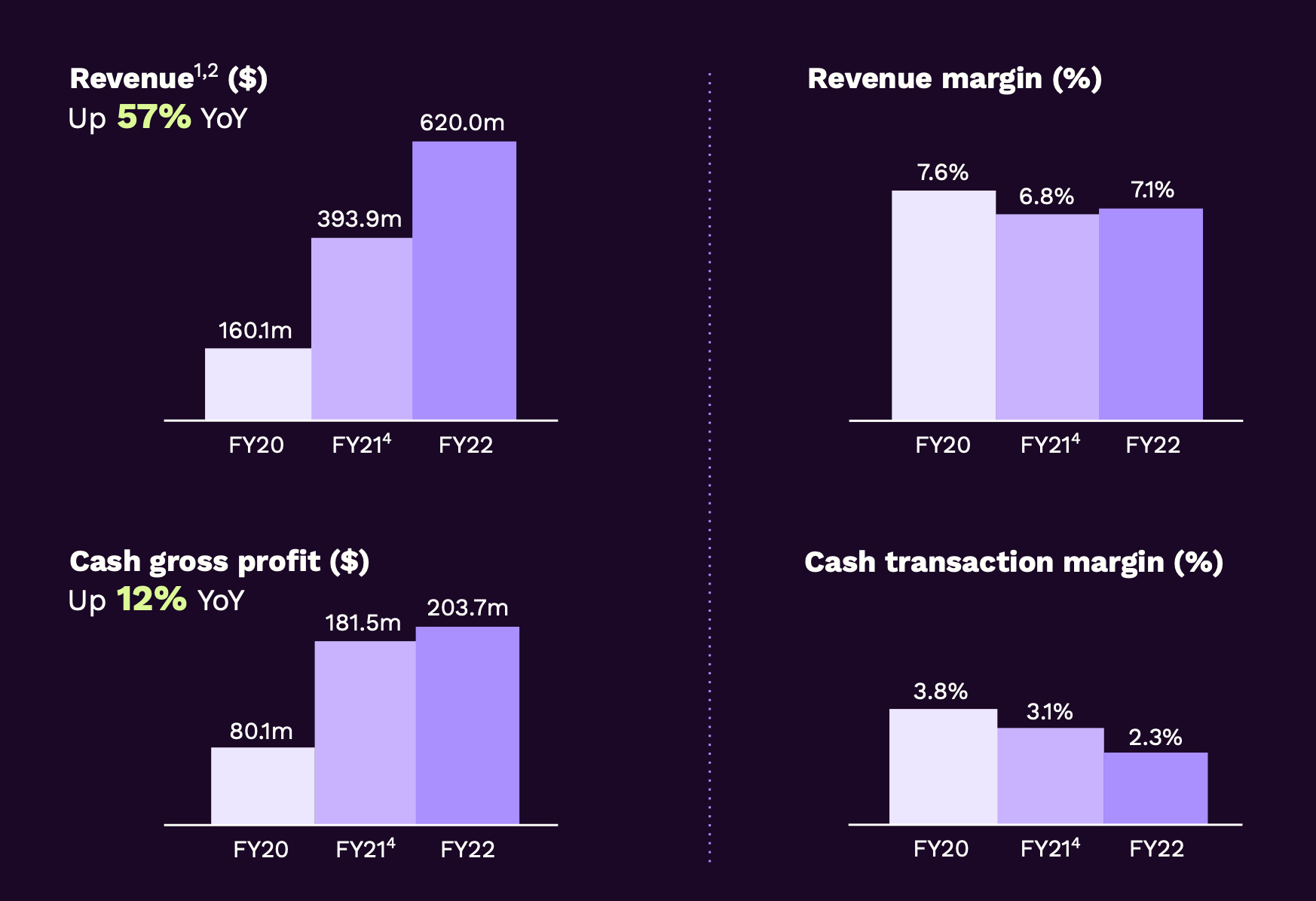

Despite the bottom line loss, Zip’s top line metrics actually look quite impressive.

The company recorded a record group revenue for the year of $620m, which is a 57% increase YoY.

It also recorded record transaction volume (TTV) of $8.7b, also up 51% YoY, while transaction numbers reached a record of 74.3m, up 80% YoY.

Its merchant numbers continue to climb, and it now has over 90,000 merchants worldwide using the Zip platform.

During the year, Zip gained notable new clients such as Best Buy, Bed, Bath and Beyond, and in Australia, entered into new agreements with Qantas.

And its ever-faithful shareholder cohort kind of liked what it saw, sending its share price up some 2.5% this morning.

The company has made a number of initiatives to manage its rising credit losses in order to meet its medium target range of 2.5% – 3%.

This includes tightening its decisioning rules and cut off scores, meaning that it will be harder now for non-credit worthy customers to sign on with the platform.

Zip has also sought ways to improve and optimise its approach to repayments and collections.

These efforts have resulted in improvements and Zip now expects credit losses to trends towards ~2% of TTV through FY23.

Zip has also taken measures to keep its margins in Australia by passing on some of its cost increases, allowing it to keep revenue margins at 8.3% in Q4.

“While FY22 has been a year of change and consolidation, our mission and values remain constant,” said Zip co-founder and CEO, Larry Diamond.

“In times of heightened inflation and cost of living pressures, BNPL has become even more of an important budgeting tool for everyday consumers.

“That is why we have never felt more passionate about giving people the knowledge, access and the ability to control their financial lives so they can live every day with confidence.”

Meanwhile, fintech lender Prospa (ASX:PGL) has delivered a record breaking performance for FY22.

Loan originations for the full year reached $732.8 million, up 52% on pcp – a record for the company.

In the month of June alone, Prospa achieved its highest ever month of $104.6 million in originations.

Total revenue increased by 51% for the period to $178.3 million, and its bottom line EBITDA was $12.1 million, a 2,274% (roughly 23x) increase from the prior year.

Prospa put these strong results down to its new technology platform, which the company said has created substantial opportunities across all products including the launch of the New Zealand Line of Credit.

The company is running a stable credit quality loan book with strong margins of almost 30%, driven interestingly by lower funding costs.

Prospa has managed to lower funding costs by 0.9% during the year as a result of diversifying into its first public asset-backed securitisation (ABS) of $200 million.

Looking ahead in FY23, the company said it wants to release new features in the All-In-One Business Account such as BillPay, overdrafts, foreign exchange, and invoicing.

Over time, these enhancements are expected to increase retention and improve its customer lifetime value.

“It has been an incredible year, with the team investing a tremendous amount of time and effort to deliver these results. It’s a great way to celebrate Prospa’s 10-year anniversary,” commented co-founder and CEO, Greg Moshal.

“Prospa is well positioned to deliver another set of strong results.

“We will keep the market informed about our range of new products to drive greater engagement with customers, and offer increased lifetime value, while remaining well ahead of the curve amongst our competitors.”

And here’s how the BNPL stocks have performed.

| Code | Name | Price | % 1-Year Change | % 6-Months change | % 1-Month Change | Market Cap |

|---|---|---|---|---|---|---|

| CI1 | Credit Intelligence | 0.095 | -65% | -63% | -17% | $7,613,016.90 |

| IOU | Ioupay Limited | 0.073 | -74% | -58% | -24% | $42,104,916.94 |

| SQ2 | Block | 104.77 | 0% | -10% | -3% | $3,890,846,879.76 |

| OPY | Openpay Group | 0.205 | -86% | -42% | -16% | $44,062,951.68 |

| ZIP | ZIP Co Ltd.. | 0.995 | -86% | -52% | 13% | $667,344,032.83 |

| SPT | Splitit | 0.2 | -59% | 21% | -9% | $96,640,481.11 |

| NOV | Novatti Group Ltd | 0.205 | -59% | -9% | -5% | $67,059,504.20 |

| LFS | Latitude Group | 1.465 | -38% | -26% | -10% | $1,516,153,845.48 |

| PYR | Payright Limited | 0.11 | -74% | -27% | 22% | $8,603,563.87 |

| DOU | Douugh Limited | 0.025 | -73% | -38% | -24% | $14,871,356.98 |

| FFG | Fatfish Group | 0.027 | -56% | -46% | -4% | $27,975,506.68 |

| SZL | Sezzle Inc. | 0.705 | -89% | -55% | 135% | $144,812,852.91 |

| LBY | Laybuy Group | 0.08 | -85% | -13% | 74% | $20,218,485.33 |

| HUM | Humm Group | 0.545 | -44% | -35% | 15% | $274,873,916.49 |