A dive into the US mortgage market could be a Credible move for this ASX fintech

Tech

Tech

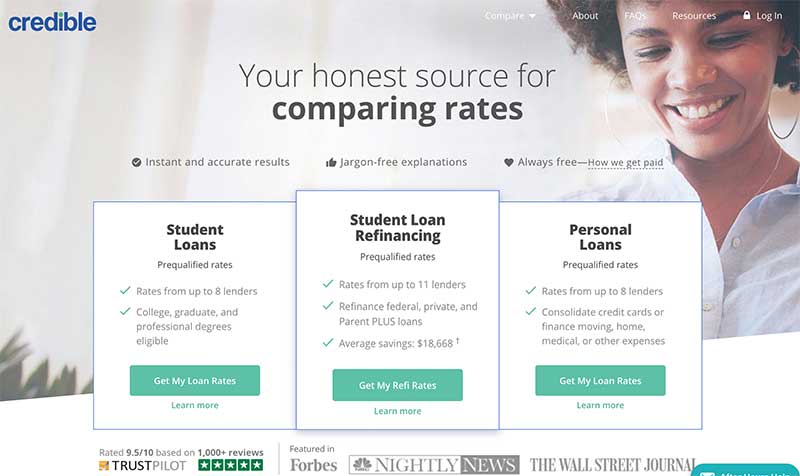

Its latest earnings may have fallen short, but student loan comparison site Credible Labs still has fans as it pushes hard to ramp up its new mortgage loan business.

Credible (ASX:CRD) — founded in San Francisco five years ago by Australian investment banker Stephen Dash — hit the ASX late last year, issuing shares at $1.21.

Of the $50 million raised through its IPO, $15 million was taken out by the company’s original backers.

The bulk of the money, some $31 million, was earmarked to spend developing its platform which targets US consumers.

Even though its existing business is centred on student loan refinancing, investors are much more interested in its ambition to move into the mortgage loan market, which is a multiple of the size of the student loan market.

Since its IPO in December, Credible Labs shares have been weak, recently trading below $1 — reflecting a lack of earnings as it spends up big to position itself for the mortgage market.

Originally due for launch in the latter part of the year, the company this week said it has decided on a pilot launch in two States – California and North Carolina – six months ahead of schedule.

A broader launch is still planned for the December quarter.

Both revenue and earnings in the June half fell short of last year, partly due to the company opting to pull back from working through some ineffective digital distribution channels, after deciding to look for better margins on the business it is writing.

Additionally, high marketing spending coupled with heavy spending on its mortgage product weighed on earnings.

Even with the heavier spending levels, cash on hand remains high, at around $50 million.

This has helped to ease concerns the company may need to come back to the market to raise fresh funds sooner rather than later.

It is unclear when Credible Labs will become profitable, with little expectation of positive earnings until sometime early next decade.

And if it is able to limit its cash-burn as it boosts cash flow, this will give investors comfort and help to take pressure off the share price.

Mortgage market 80 times bigger

Since the mortgage market is estimated to be around 80 times larger than the student loan market, quick inroads here could see the shares re-rated.

By comparison, the student loan refinancing market is estimated at around $US10 billion, which is about the same size as the student loan origination market.

Credible Labs is active in both of these market sectors.

But it is the mortgage market, with annual lending put at around $US1.6 trillion, that is the real prize.

Adjacent to this market is the mortgage refinance market, which it estimates at another $US460 billion.

Credible claims to offer a streamlined “simple, online consumer experience” which enables customers to receive personalised loan options and complete most of the loan application on a single platform, irrespective of the lender.

Getting the basic platform right in the student loans market has paved the way for it to step up and enter the much bigger home lending market as it rides the wave of millennials who are willing users of online platforms for financial services.

Helping to drive the willingness of borrowers to look at online service providers is the increased fragmentation of the lending market since the global financial crisis a decade ago.

Between 2010 and 2016, the top five bank share of the home lending market declined to 25 per cent from 60 per cent, according to figures Credible Labs has given local analysts.

This fracturing of the market, coupled with the increased willingness of borrowers to go online to search for cheaper sources for money, has opened the door for Credible.

At the same time, as more lenders have put more of their processes online to reduce costs, this has given the online lending market a further fillip, boosting the economic opportunity afforded Credible, which claims to have limited competition at present.