Palladium supply is drying up. These Aussie stocks could open the floodgates

Pic: Getty

Platinum group metals (PGMs) — platinum, palladium, rhodium, iridium, ruthenium and osmium — are highly valued for their wide range of industrial, medical, and electronic applications.

The big money is in palladium, which is currently worth ~$2,400/oz.

That’s more than gold (~$US1870/oz) and a lot more than platinum (~$1,130/oz).

80 per cent of palladium goes into ‘autocatalysts’ in car exhausts to reduce polluting emissions. There’s also future demand from the nascent hydrogen sector.

Metals Focus predicts palladium prices will hit all times highs above $US2,750/oz in 2021.

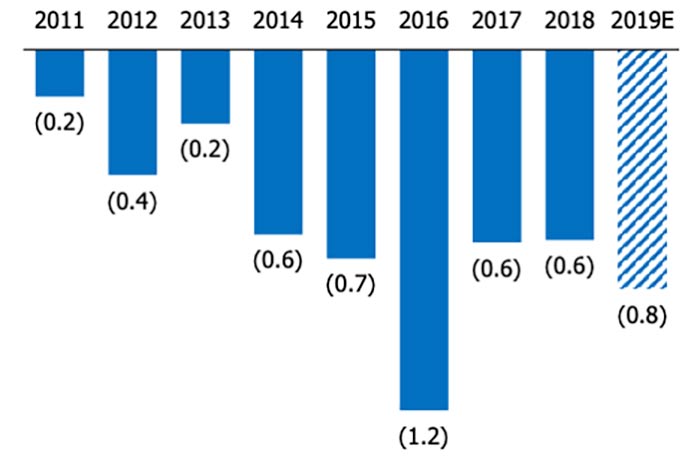

Why? Nine straight years of ever-enlarging deficits.

The gap between mine supply and consumption in 2020 alone was about 1 million ounces of palladium.

Most mines are concentrated in the Bushveld Igneous Complex in South Africa which also makes supply “uniquely vulnerable” to severe supply disruptions, Metal Focus says.

“The lack of geographical diversity in PGM mine supply and for platinum and rhodium in particular, is largely a function of geological constraints,” it says.

2020 was the second time in six years that disruption to South African supply created a major, global supply challenge.

The dual impact of COVID-19 and the unexpected shutdown of a large processing plant resulted in platinum and rhodium output falling by around 21 per cent year-on-year, with palladium declining ~ 13 per cent.

That’s why palladium has been holding up strongly in the high $US2,400s at a time when other precious metals, like gold, have come under some price pressure:

While mine supply is expected to rebound this year — returning to near 2019 levels as disruption normalises — there is limited upside for new mine supply, Metals Focus says.

And so the palladium deficit remains.

Why aren’t more palladium projects developed?

Most PGE deposits are platinum dominant, with palladium credits.

The mines in the Bushveld are about 60% platinum – 30% palladium – 10% the rest. And because the platinum price has decreased significantly over the past decade, less production is coming online.

World class palladium dominated PGE deposits are extremely hard to find.

That’s what makes Chalice Mining’s (ASX:CHN) Julimar deposit in WA – which the company calls “Australia’s first major palladium discovery” — so special.

In March 2020, the very first hole at the Julimar project hit 19m at 8.4g/t palladium, 2.6 per cent nickel and 1 per cent copper.

The discovery sparked a 2,700 per cent gain in the Chalice share price, from 17c to $4.76 currently:

CHN share price chart

Six rigs are turning right now as Chalice aims for a maiden resource in mid-2021.

Numerous explorers are in the neighbourhood actively hunting for a palladium payday of their own.

They include Cassini/ Caspin Resources, DevEx Resources (ASX:DEV), Liontown Resources (ASX:LTR), Mandrake Resources (ASX:MAN), Anson Resources (ASX:ASN), Australian Vanadium (ASX:AVL), Lachlan Star (ASX:LSA) and Lithium Australia (ASX:LIT) … just to name a few.

DEV, LTR, MAN, ASN, AVL, LSA and LIT share price charts

The other palladium-rich explorer on the ASX is Impact Minerals (ASX:IPT), which is focused on the ‘uniquely difficult’ Broken Hill project in NSW.

Previous explorers hit extremely high grades at Broken Hill, but they could never find the motherlode.

Drilling at Platinum Spring for example, has pulled up thin bonanza grade intercepts like 0.6m at 11.5g/t platinum, 25.6g/t palladium plus high grade gold silver, copper and nickel.

Where’s it coming from? Impact reckon they have it figured out.

“There have been various attempts over the decades to explore one of the prospects in particular which has returned very high grades, but no one could put it all together,” Impact managing director Dr Mike Jones says.

“We are the first to get a grip on the geology and geometry of the system.

Another prospect – Little Broken Hill Trend — is a large, layered intrusion which had never been explored before, he says.

“We drilled 40 holes into the bottom contact. Every single drillhole has come in with anomalous to reasonable grade PGEs,” he says.

“These aren’t economic grades, but there’s quite clearly millions of ounces of PGEs in the base of this intrusion.

“Now we need to find out where it has been concentrated.”

Impact is dialling in on the large, high grade ‘feeder zone’, Dr Jones says.

“There is so much smoke here. Finding it is a matter of time,” he says.

“We have demonstrated that the system is fertile enough, pregnant enough to have carried enough material to form a big deposit.”

IPT share price chart

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.