Wiluna targets full gold production by the end of FY22

Mining

Mining

Wiluna Mining progresses its staged development of the Wiluna Gold Mining Operation over the September quarter, investing $41.9 million with construction on the new flotation circuit to produce gold in concentrate 90% complete.

The company says stage 1 is on track to be commissioned in December, targeting a full production run rate of 120,000 ounces per annum (ozpa) by the end of FY2022.

Underground development is also ahead of schedule, with more than 95,000 tonnes stockpiled and ready to progress.

A total of 1,910 metres of sulphide underground development and rehabilitation has been completed for access to the initial stoping blocks in sulphide ore completed during the quarter.

363 metres of underground development at Golden Age (the total for FY 2021 was 1,758) was also completed.

The company also continued developing the Wiltails project, which has an ore reserve of 31.6 Mt at 0.6 g/t for 579,000 oz in three historic tailing dams and four open pits.

Dry tailings will be excavated from the dams and hauled by truck to the Wiltails plant before being feed into the feed hopper.

Commissioning is anticipated for Q3 FY 2022 following obtaining environmental approvals.

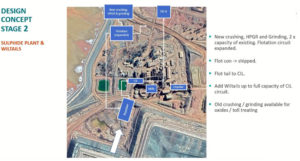

The final size and shape of the Stage 2 development at the Wiluna Mining Operation will depend on the conclusions from the feasibility study currently taking place.

The study includes significant resource and reserve drilling which is aiming to add an additional 500,000 oz to the current underground ore reserve of 661,000 oz at 4.74 g/t.

Both the feasibility study and the updated ore reserves are expected to be published at the end of Q3 FY 2022.

The estimated ASIC/ounce for stage 1 is US$1,150-$1,200/ounce – and while this data is not yet confirmed for stage 2 – the company expects improvements in ASIC to result from increased grade and reduction in development cost per tonne mined.

The Wiluna Mining Operation has significant exploration and discovery potential within its 1,600km2 tenement area, with thick high-grade intervals at shallow levels defined in the last 18 months, that are close to previously mined zones with available access for rapid low-cost development.

The company completed 13 RC test bores for 577m drilled during the quarter, and 67 diamond core holes for 14,784 metres for the upcoming mineral resource and ore reserve estimates.

Strong results from Happy Jack and East Lode include:

Ore drive development on sulphide mineralisation is underway ahead of stoping in the December quarter.

Drilling is ongoing with 3 rigs now focused on resource infill, resource extension and grade control programs at the Bulletin and Happy Jack ore bodies.

Net cash inflow from operations (before corporate and treasury) for the September quarter was $11 million, which the company said exceeded expectations.

Operations cash flow for the quarter derived from WMC gold production of 8,332oz (with 9,435oz of gold sold at an average price of A$2,514/oz) and additional toll treating of 38,106 tonnes third party ore.

The current free milling stockpiles are approximately 400,000 tonnes and another, larger, toll treating campaign is planned in November which the company expects to contribute to December quarter cashflow.

Wiluna also paid its Mercuria Tranche 1 debt in full on 29 July, and at 30 September had gold hedging contracts in place with Mercuria of 159,000 oz at US$1,820/oz (or ~A$2,526/oz), with a positive mark-to-market position of $10.5 million.

The company is also planning to dual list on the London Stock Exchange in FY 2022.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.