Will Bougainville’s resources remain a curse, or become a cure?

Mining

Mining

Thirty-one years after the the fabulously rich gold mine Panguna sparked a decade-long war on the small Pacific island of Bougainville erupted, the islanders are going to the polls to decide on independence.

The referendum, running for two weeks from November 23, is widely expected to prefer independence over greater autonomy from Papua New Guinea (PNG).

What is unknown is the future of the very issue that kicked off the conflict: resources.

Bougainville’s land is full of minerals, but the circling “mining sharks” which include the Australian company which last owned Panguna, the post-referendum political unknowns, and the competing interests among the islanders add up to a heady mix of uncertainty.

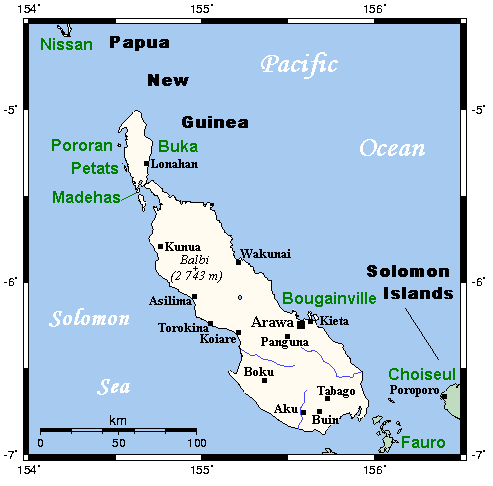

Gold was discovered in Bougainville’s central hinterland in the 1960s by Bougainville Copper, a subsidiary of Rio Tinto (ASX:RIO) which now calls itself BCL (ASX:BOC).

What ensued was a masterclass in how not to run a mining operation in a foreign country.

Panguna was established in 1972 and was the world’s largest open cut mine — 150,000 tonnes of rock waste and tailings were removed a day.

It is still one of the world’s richest. In the 17 years to 1988, Rio extracted a total of 3 million tonnes of copper, along with associated silver and gold. Today it’s estimated to still hold 5.3 million tonnes of copper and 19.3 million ounces of gold, worth about $US58 billion ($85 billion).

From the early 1960s onwards Bougainvilleans came into conflict with Rio’s tactics for dealing with landowners, and these tensions were left to simmer.

Further, while the mine later provided about 45 per cent of PNG’s export income, little of that money ended up in Bougainville; the local people were told they did not have any rights to the minerals beneath the surface.

To make matters worse, pollution from the mine’s tailings and overburden were causing worsening environmental problems, and rapid urban development coupled with rising numbers of migrants brought to work at the mine were blamed for increasing rates of crime and violence.

By 1988 patience with the status quo had been stretched thin, and the spark that lit the fire was the rape, murder and mutilation of a popular nurse at a local hospital.

The 1988-1998 war is still the Pacific’s most violent conflict, causing the deaths of 15,000 to 20,000 people.

The ensuing peace deal in 2001 between the Bougainville Revolutionary Army (BRA) and PNG mandated a referendum by June 2020 over autonomy or independence from PNG.

Two decades of delays were cut short in May this year when PNG Prime Minister Peter O’Neill quit, opening the way for a referendum date to be set. It’s taking place between November 23 and December 7, 2019.

Veteran Bougainville watcher and journalist Ben Bohane says the “vote will almost certainly be overwhelmingly for independence, probably 80 per cent-plus”.

Australian National University fellow James Batley, who is in Bougainville as a referendum observer, says the vote won’t lead to an outcome immediately because both sides are required to discuss the result and come to an agreement, and PNG must ratify the result.

“The point is that the PNG government having to ratify it is not just an add on. It’s [part of] the peace agreement as it was negotiated in 2001,” he told Stockhead.

Be it greater autonomy or independence, Bougainville will need money to finance its first steps. Bohane says Bougainvilleans are pragmatic that a resources sector is likely to be necessary to underwrite the economy.

Over 90 per cent of the Autonomous Bougainville government’s (ABG) budget of $125m comes from PNG and foreign aid.

Promises from PNG may not be worth much either: in September new Prime Minister James Marape promised the island 1 billion kina ($433m) for development over 10 years — but he had also just asked Australia for $130m to fill gaps in the PNG budget.

If gold is to pay for Bougainville’s future, here is no shortage of offers.

The ABG gave Kalia (ASX:KLH) two exploration licences for the north of the island in 2017 and promises landowners 25 per cent of any projects from those licences.

It is backed by Australian polo baron Peter Yunghanns and former defence minister David Johnstone. Kalia did not respond to requests for comment.

But Panguna is the promised land for mining companies.

BCL had its licence over Panguna revoked in January 2018 when the ABG put a moratorium on mining at the site.

BCL company secretary Mark Hitchcock told Stockhead by phone from his PNG office the outcome of an appeal for a judicial review into the decision in the PNG Supreme Court was still pending, and in the interim they are doing community works to “remain relevant and active”.

“We’ve always had good relationships with landowners. We work closely with the recognised land agents who have the mineral rights in Panguna,” he says.

They say it’ll cost about $US5.2 billion and five years to reopen the mine.

Toronto and ASX-listed RTG Mining (ASX:RTG) also wants a piece of Panguna.

RTG claims it has the backing of the Special Mining Lease Osikaiyang Landowners Association (“SMLOLA”), but the ABG rejected a development plan put forward by the pair in March that costed the reopening of the mine at $US2 billion. RTG did not respond to requests for comment.

Also in the mix is Caballus Mining, a new venture backed by Perth businessman Jeffrey McGlinn.

Caballus encouraged the government earlier this year to try to change the 2015 Mining Act to give it the exclusive rights over 40 per cent of all mining projects, if they could find $US6 billion to reopen Panguna.

These changes were rejected by the government’s legislative committee after fears from Bougainvilleans that their hard-fought for land rights were being swept away.

Andrew ‘Twiggy’ Forrest, founder of iron ore miner Fortescue (ASX:FMG), is also said to be interested.

Finally, there is China.

A 60 Minutes report last week revealed a $US1 billion offer from China to rebuild infrastructure across the island, in exchange for mining rights.

It’s an offer that has not been matched by PNG, Australia, or any of the companies wanting to mine Bougainville, and is attractive to Bougainvilleans looking for an integrated nation-building plan.

But in terms of handling these offers, Bougainville’s resource sector is still in-utero: it has the 2015 Mining Act which is reputed as having some of the strongest landowner rights protections in the world, but no bureaucratic or infrastructure capacity to support an industry.

Furthermore, negotiations with PNG after the referendum could take years, after which Bougainville might be open to talks about its resources.

“It sounds very tempting for people to say we’ll have an economy based on mining. I think there’s virtually no prospect of any serious investment in the near future,” ANU’s Batley says.

Bohane said in an analysis for the Lowy Institute in October that reopening Panguna “would involve revisiting the same issues that triggered the conflict in 1988” and offered 2025 as a date for when the mine — all things going perfectly — could be restarted.

“It’s a very sensitive issue and that’s why there is concern about all these different miners and mining sharks circling the resource sector at a time when they’re trying to find unity,” Bohane told Stockhead.

Bougainvilleans also want a resources sector set up the right way, now they’re in control.

“I think they’re hesitant to embrace any big overseas miners at the moment. They want to get their independence first, they want to get that in the bag.”

Companies need to obtain their social licence and do their “cultural homework”, which includes understanding how land ownership works — Bougainville is a matrilineal society so women are key stakeholders — and in BCL’s case it needs to take responsibility.

“BCL still hasn’t done a proper reconciliation ceremony. That mine started a war there. And quite a few people have commented if BCL want to come back why haven’t they done a reconciliation ceremony according to local custom,” Bohane says.

So far the island collectively has managed to avoid jumping at short-term promises of cash and infrastructure, but this is unlikely to be a speedy process for Bougainville or the bidders.