Who Made the Gains? Here are October’s top ASX miners and explorers

Pic: Henrik Sorensen, DigitalVision/ Via Getty Images

Thirteen resources companies made gains of 100% or more in August, which now seems like an aberration in a fairly weak H2 for metals stocks, sans lithium.

Just two explorers made gains of 100% or more in October, which is on par with September (1), June (1), and July (3).

Of course, one of these October winners, WA1 Resources (ASX:WA1), comfortably 10-bagged (gained +900%) over five glorious sessions.

Which puts it in rarefied air.

Over the course of 2022 no other resources stock has been able to 10-bag in any given month, according to our dubious research.

The next best for 2022 was Tempest Minerals (ASX:TEM) which leapt 639% back in March for much the same reason: a potential discovery.

In fact, you have to go all the way back to August 2021 to find a resources 10-bagger in Kuniko (ASX:KNI).

Amazing effort.

(Read our in-depth analysis of October’s best and worst performing metals here.)

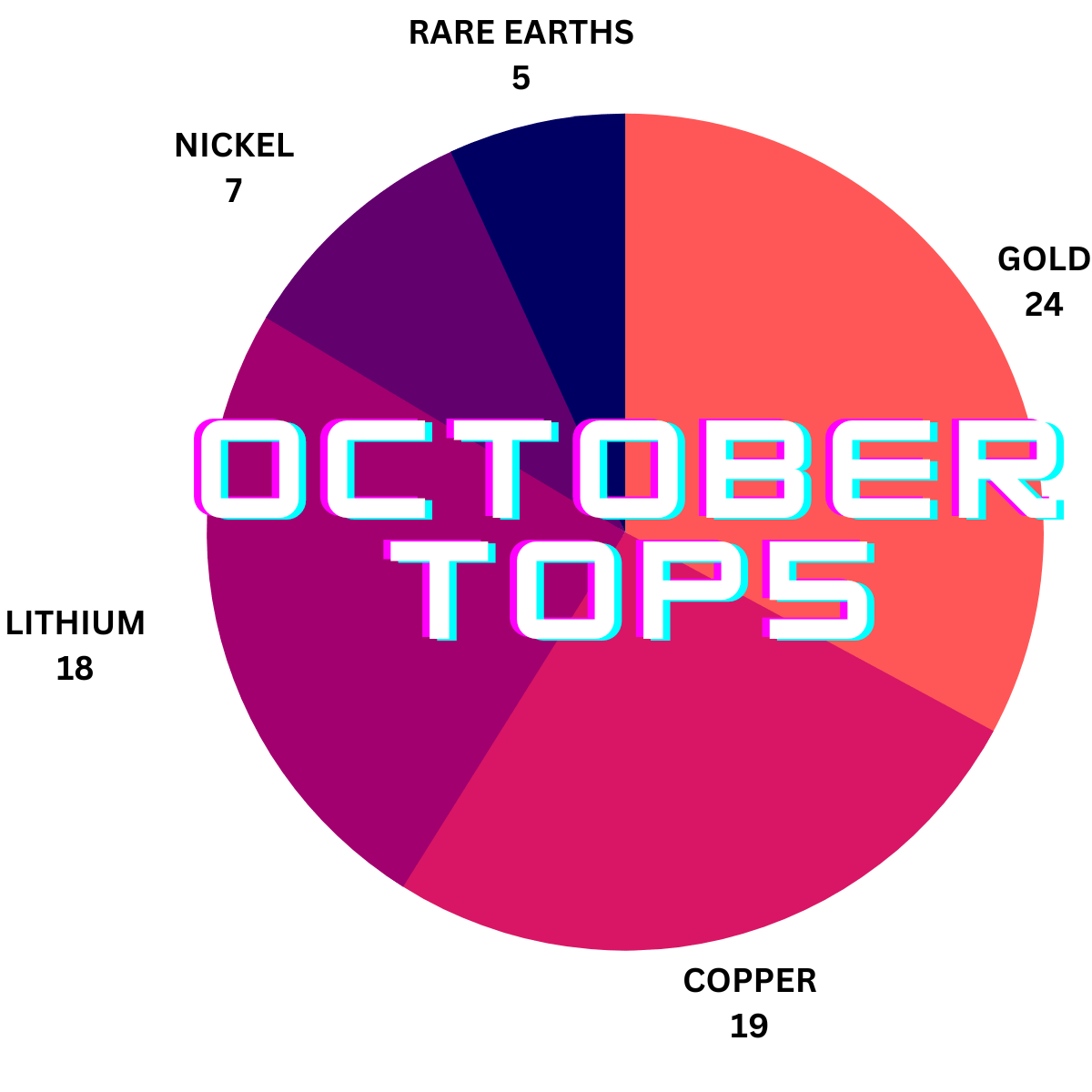

Here’s a breakdown of the five most popular commodities for October:

Here are the top 50 ASX resources stocks for the month of October >>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

| CODE | COMPANY | PRICE | % MONTH [OCT01-NOV01] | MARKET CAP | COMMODITY FOCUS |

|---|---|---|---|---|---|

| WA1 | WA1 Resources | 1.99 | 1184% | $36,003,409 | niobium, rare earths, copper, gold |

| SGQ | St George Mining | 0.077 | 117% | $49,701,264 | nickel, lithium |

| CY5 | Cygnus Gold | 0.48 | 78% | $72,109,898 | lithium |

| AZS | Azure Minerals | 0.295 | 74% | $69,915,537 | nickel, copper, cobalt, lithium |

| PBL | Parabellum Resources | 0.45 | 70% | $24,625,125 | rare earths |

| KOB | Koba Resources | 0.21 | 68% | $11,050,000 | cobalt, copper, lithium |

| A1G | African Gold | 0.097 | 63% | $12,794,339 | gold |

| CNR | Cannon Resources | 0.435 | 61% | $33,505,389 | nickel |

| TIE | Tietto Minerals | 0.7 | 61% | $755,669,243 | gold |

| LEL | Lithium Energy | 1.125 | 60% | $66,766,500 | lithium |

| DCN | Dacian Gold | 0.14 | 54% | $170,352,131 | gold |

| C29 | C29Metals | 0.22 | 52% | $6,887,620 | lithium, copper, gold |

| GSN | Great Southern | 0.05 | 52% | $29,004,521 | gold, nickel |

| GBZ | GBM Resources | 0.057 | 50% | $29,157,122 | gold |

| RFR | Rafaella Resources | 0.045 | 50% | $15,821,652 | nickel, copper, PGE, tin, tungsten |

| HMG | Hamelin Gold | 0.17 | 48% | $15,950,000 | gold |

| RB6 | Rubix Resources | 0.155 | 48% | $4,057,500 | copper, zinc, lead |

| DNK | Danakali | 0.38 | 46% | $139,967,051 | potash |

| ENR | Encounter Resources | 0.175 | 46% | $52,668,867 | copper, gold, rare earths |

| QXR | Qx Resources | 0.065 | 44% | $53,793,602 | lithium, gold |

| NWM | Norwest Minerals | 0.052 | 44% | $9,550,618 | copper, gold, lithium, rare earths |

| E25 | Element 25 | 1.075 | 42% | $161,978,991 | manganese |

| MRL | Mayur Resources | 0.155 | 41% | $39,997,348 | industrial products, vanadium, mineral sands |

| AKN | Auking Mining | 0.12 | 40% | $13,609,753 | uranium, copper, gold |

| AS2 | Askari Metals | 0.43 | 39% | $21,215,822 | lithium, copper, gold, silver |

| HMX | Hammer Metals | 0.069 | 38% | $52,483,792 | copper, gold |

| WR1 | Winsome Resources | 0.52 | 37% | $62,828,007 | lithium |

| SXG | Southern Cross Gold | 0.375 | 36% | $22,725,904 | gold, antimony, silver, copper |

| QPM | Queensland Pacific | 0.17 | 36% | $285,493,958 | nickel, cobalt |

| BRB | Breaker Resources | 0.285 | 36% | $91,235,460 | gold |

| OBM | Ora Banda Mining | 0.081 | 35% | $104,541,977 | gold |

| BUR | Burley Minerals | 0.185 | 32% | $6,692,995 | iron ore, nickel, copper, cobalt, PGE |

| EUR | European Lithium | 0.1 | 30% | $131,425,765 | lithium |

| GLN | Galan Lithium | 1.55 | 30% | $462,946,219 | lithium |

| POL | Polymetals Resources | 0.2 | 29% | $8,030,625 | gold |

| BEM | Blackearth Minerals | 0.105 | 28% | $27,495,903 | graphite |

| QML | Qmines | 0.185 | 28% | $15,590,577 | copper, gold |

| SFX | Sheffield Res | 0.51 | 28% | $175,026,715 | mineral sands |

| MI6 | Minerals260 | 0.33 | 27% | $72,600,000 | copper, gold, nickel, PGE |

| CBE | Cobre | 0.165 | 27% | $32,593,510 | copper |

| ARN | Aldoro Resources | 0.285 | 27% | $33,176,195 | lithium, rubidium |

| CZL | Consolidated Zinc | 0.024 | 26% | $11,573,036 | lithium, zinc, lead, silver |

| ALY | Alchemy Resources | 0.034 | 26% | $38,711,516 | gold, lithium |

| NVA | Nova Minerals | 0.81 | 26% | $127,644,586 | gold |

| C6C | Copper Mountain | 2.17 | 25% | $34,874,624 | copper |

| AAJ | Aruma Resources | 0.07 | 25% | $10,987,305 | gold, lithium, rubidium |

| CLE | Cyclone Metals | 0.0025 | 25% | $12,233,474 | lithium, iron ore, copper, rare earths |

| KFE | Kogi Iron | 0.005 | 25% | $6,528,311 | iron ore |

| RNX | Renegade Exploration | 0.0075 | 25% | $6,241,786 | copper, gold |

| GT1 | Greentechnology | 0.94 | 25% | $178,340,397 | lithium |

October Top ASX Resources Stocks

WA1 RESOURCES (ASX:WA1)

On a Wednesday October 26 the share price of $3m market cap explorer WA1 jumped a barely believable 420%.

Why the rocket? WA1 hit thick, high-grade niobium in its first hole in a remote, lightly explored, but highly mineralised region on the WA/NT border.

Niobium is mainly used to make steel better, but also has growing uses in lithium-ion batteries, intelligent glass, solar panels, 5G tech, and nuclear energy.

Ferroniobium metal (65% Nb) currently sells for ~US$45,000/t.

WA1’s only drillhole into the P2 target at the West Arunta project in WA – and only the second in the region — pulled up 54m at 0.62% niobium, 0.18% rare earths and 3.85% phosphorus from 162m.

The 216m-long hole ended in 2m at 1.22% Nb2O5, 0.22% TREO, and 5.73% P2O5.

Furthermore, because WA1 was hunting for deep IOCGs (iron oxide copper gold deposits) they didn’t assay the top +70m of the hole.

Managing director Paul Savich told Stockhead the highest-grade stuff in a lot of rare earths deposits is in the weathered material at the top.

Punters poured into the stock, and kept pouring. WA1 is now worth almost $60m.

Special mention goes to neighbouring explorers Encounter Resources (ASX:ENR) and Norwest Minerals (ASX:NWM), up 46% and 44% respectively for the month.

WA1, ENR, NWM share price charts

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.