Who made the gains? Here are October’s top 50 small cap miners and explorers

Pic: Getty/ Burn After reading (2008), Focus Features

Most metals ended higher in October on the back of trade war resolution hopes (that hoary chestnut) and social unrest across Chile, a globally significant copper and lithium producer.

And the two that fell marginally – iron ore and nickel – are still up about 60 per cent since the start of the year.

>>Scroll to the end for October’s Top 50 small caps

Until it stumbled in early November, gold was continuing its leisurely stroll toward $US2000/oz ($2900); up about 3 per cent for the month and 18 per cent year to date.

Benchmark’s lithium price index fell another 1.8 per cent but these price reductions are slowing down, with “tightening margins suggesting the market could be bottoming out”. It’s about time.

‘Dr Copper’ crawled off the mat, recording a much needed 3.5 per cent boost to $US5795/t for the month.

Despite copper having a mostly forgettable year – down marginally since January 1 – punters can’t get enough of the red metal. Probably because analysts keep talking about that emerging supply gap.

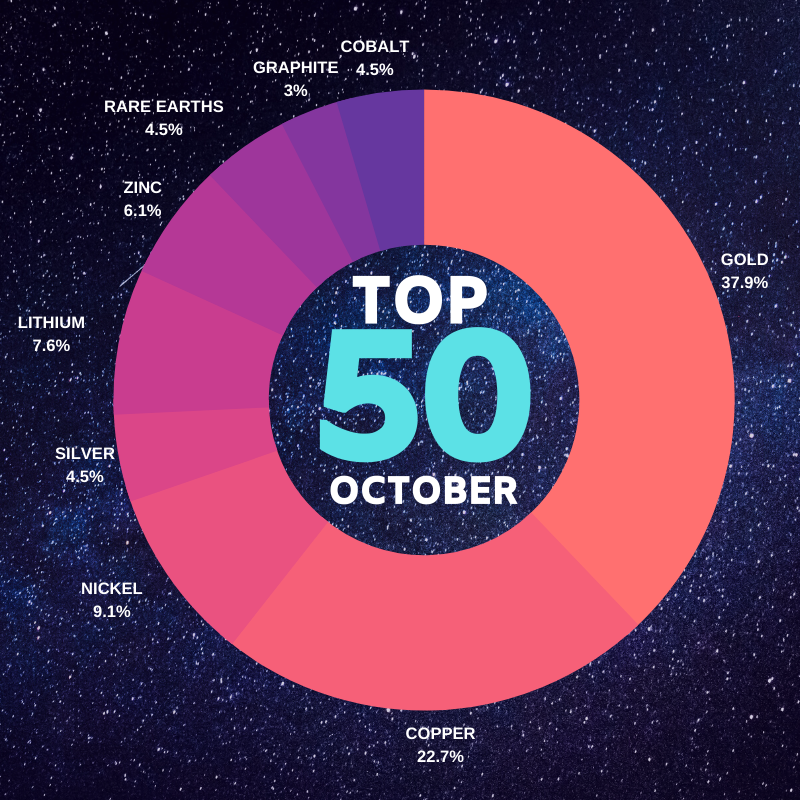

Check this out:

The percentage of copper-focused plays in our top 50 has increased from 13.5 per cent in August, to 19.7 per cent in September, to 22.7 per cent in October.

Gold retained dominant market share, while rare earths explorers moved strongly into the rankings.

TOP STOCKS: OCTOBER HIGHLIGHTS

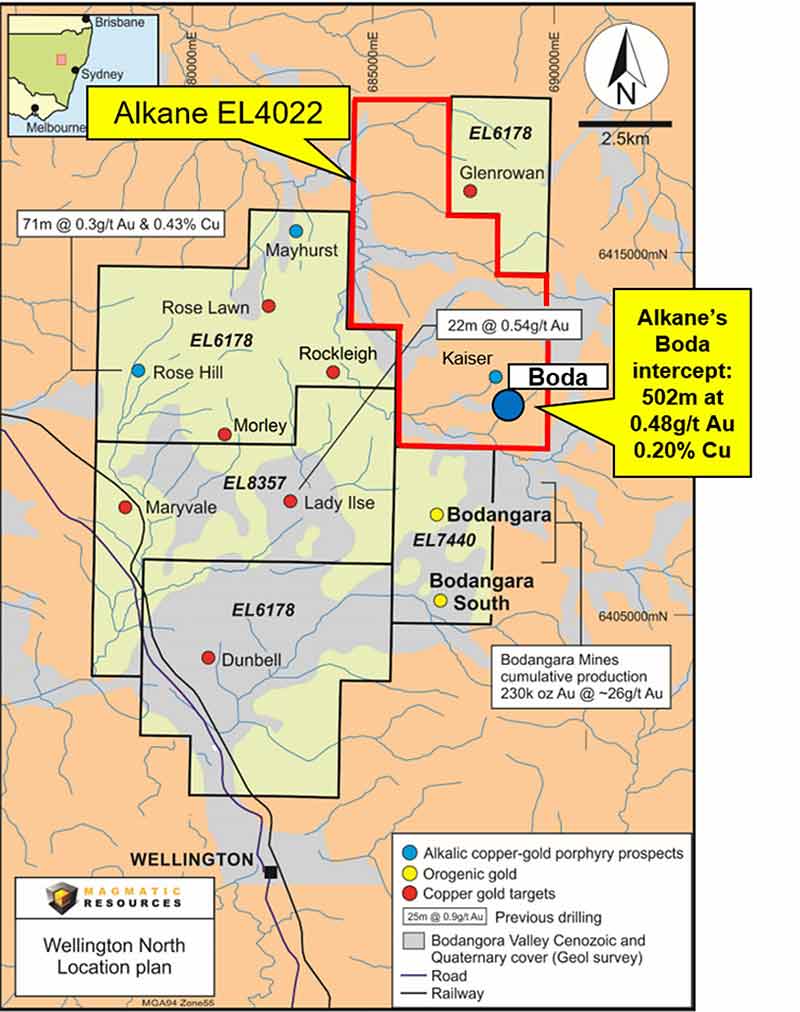

Magmatic Resources (ASX:MAG) +194%

Market Cap: ~$20m

In early September, ~$5m market cap Magmatic was finalising a WA gold project acquisition and, simultaneously, the demerger of its East Lachlan copper-gold assets in NSW.

Evidently Magmatic wasn’t too fond of this initial plan because when NSW neighbour Alkane Resources (ASX:ALK) hit the big one at Boda it performed a hasty U-turn.

We mean ‘neighbour’ quite literally:

Now — following a $2.2m cap raise and the appointment of experienced mining exec David Flanaghan to the board — Magmatic has dumped the WA acquisition and officially refocused on copper-gold in the East Lachlan. Game on.

Northern Cobalt (ASX:N27) +94%

Market Cap: ~$5m

Northern Cobalt is no longer a cobalt explorer. In October, the micro-cap signed a binding agreement to acquire up to 80 per cent of an Alaskan gold project called Goodpaster.

Goodpaster surrounds Northern Star Resources’ (ASX:NST) high-grade Pogo mine, which has produced 4 million ounces of gold over the past 13 years.

We see a name change on the horizon — something like Northern Gold, or Northern Gold Star.

Krakatoa (ASX:KTA) +72%

Market Cap: $7m

Another Alkane nearology play. In late September Krakatoa — which had recently acquired a rare earths project but was for all intents and purposes a shell company — announced the acquisition of the Belgravia project.

Belgravia is nestled between Newcrest Mining’s (ASX:NCM) Cadia Valley mine and Alkane Resources in the Lachlan Fold Belt.

It’s a trendy neighbourhood.

Tietto Minerals (ASX:TIE) +64%

Market Cap: ~$100m

Calling a stock which is up 420 per cent over the past year ‘a sleeper’ is probably absurd, but that’s the feeling you get from Tietto. Like it’s just waking up.

These guys love to drill, which means strong news flow for investors.

In February, Tietto told Stockhead it was aiming to double the 700,000oz Abujar project resource in Cote D’Ivoire, West Africa, in an April resource update.

It exceeded that goal, significantly. Abujar is currently 1.7 million ounces and growing fast.

Since then, over 20,000m of additional diamond drilling has been completed using the company’s three, wholly owned rigs.

This drilling blitz will feed into an updated mineral resource estimate for the AG deposit, due this quarter. And yeah — a fresh 50km diamond drilling campaign also kicked off earlier in October.

Stavely Minerals (ASX:SVY) +55%

Market Cap: ~$285m

A current market darling. It was our #1 mover in September after making a huge copper discovery at its namesake Victorian project.

The market’s verdict? $40m market cap Stavely leapt ~330 per cent to $1 per share in September.

The investor love continued to flow in October — despite some insisting the stock was due a correction — and Stavely currently has a market cap of about $285m.

FYI Resources (ASX:FYI) +54%

Market Cap: ~$15m

Roly was, believe it or not, changing a car tyre at 5pm during this interview.

READ: FYI’s Roly Hill on HPA demand, disruption, and an industry leading project

How’s that for dedication.

In October, this WA-based high purity alumina front runner took its pilot processing plant (a smaller version of the real thing) for a week-long test drive.

It was successful, marking the next crucial step in the development of the Cadoux HPA project.

Here’s the top 50 mining small caps for the month of October>>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | NAME | % RETURN | PRICE 1 OCT | PRICE 31 OCT | MARKET CAP |

|---|---|---|---|---|---|

| MAG | MAGMATIC RESOURCES | 194 | 0.051 | 0.150 | 20.41M |

| AEV | AVENIRA | 133 | 0.006 | 0.014 | 6.17M |

| VIC | VICTORY MINES | 100 | 0.001 | 0.002 | 4.14M |

| MRD | MOUNT RIDLEY | 100 | 0.001 | 0.002 | 5.37M |

| ACS | ACCENT RESOURCES | 100 | 0.003 | 0.006 | 1.09M |

| N27 | NORTHERN COBALT | 94 | 0.033 | 0.064 | 4.86M |

| KTA | KRAKATOA RESOURCES | 72 | 0.025 | 0.043 | 7.10M |

| OVL | ORO VERDE | 67 | 0.006 | 0.010 | 20.03M |

| TIE | TIETTO MINERALS | 64 | 0.220 | 0.360 | 98.11M |

| AQC | AUSTRALIAN PACIFIC COAL | 59 | 0.110 | 0.175 | 8.83M |

| SVY | STAVELY MINERALS | 55 | 0.860 | 1.330 | 284.35M |

| FYI | FYI RESOURCES | 54 | 0.046 | 0.071 | 15.11M |

| NES | NELSON RESOURCES | 50 | 0.060 | 0.090 | 4.10M |

| NCZ | NEW CENTURY RESOURCES | 50 | 0.250 | 0.375 | 238.98M |

| CML | CHASE MINING | 50 | 0.020 | 0.030 | 6.21M |

| AVW | AVIRA RESOURCES | 50 | 0.002 | 0.003 | 3.00M |

| ARO | ASTRO RESOURCES | 50 | 0.002 | 0.003 | 3.82M |

| GSN | GREAT SOUTHERN MINING | 48 | 0.050 | 0.074 | 24.55M |

| HOR | HORSESHOES METALS | 45 | 0.011 | 0.016 | 3.11M |

| NME | NEX METALS | 45 | 0.011 | 0.016 | 3.08M |

| FMS | FLINDERS MINES | 42 | 0.053 | 0.075 | 261.39M |

| PGI | PANTERRA GOLD | 38 | 0.026 | 0.036 | 7.59M |

| EHX | EHR RESOURCES | 38 | 0.026 | 0.036 | 4.56M |

| NML | NAVARRE MINERALS | 36 | 0.088 | 0.120 | 57.39M |

| OKJ | OAKAJEE | 36 | 0.042 | 0.057 | 5.21M |

| JRL | JINDALEE RESOURCES | 34 | 0.220 | 0.295 | 11.36M |

| COY | COPPERMOLY | 33 | 0.006 | 0.008 | 17.02M |

| GBE | GLOBE METALS AND MINING | 31 | 0.016 | 0.021 | 9.78M |

| KGD | KULA GOLD | 30 | 0.020 | 0.026 | 1.53M |

| BLK | BLACKHAM RESOURCES | 30 | 0.010 | 0.013 | 61.31M |

| GBR | GREAT BOULDER RESOURCES | 30 | 0.050 | 0.065 | 8.67M |

| ENR | ENCOUNTER RESOURES | 30 | 0.135 | 0.175 | 49.14M |

| TKM | TREK METALS | 29 | 0.024 | 0.031 | 1.70M |

| RDS | REDSTONE RESOURCES | 29 | 0.007 | 0.009 | 4.27M |

| INR | IONEER | 27 | 0.200 | 0.255 | 376.76M |

| OKU | OKLO RESOURCES | 27 | 0.110 | 0.140 | 57.79M |

| LCD | LATITUDE CONSOLIDATED | 27 | 0.015 | 0.019 | 5.23M |

| GMN | GOLD MOUNTAIN | 24 | 0.058 | 0.072 | 43.91M |

| PLL | PIEDMONT LITHIUM | 22 | 0.094 | 0.115 | 93.77M |

| VML | VITAL METALS | 22 | 0.009 | 0.011 | 23.57M |

| BRB | BREAKER RESOURCES | 22 | 0.275 | 0.335 | 69.77M |

| TLG | TALGA RESOURCES | 21 | 0.425 | 0.515 | 114.41M |

| RWD | REWARD MINERALS | 20 | 0.083 | 0.100 | 16.26M |

| AZI | ALTA ZINC | 20 | 0.005 | 0.006 | 10.98M |

| RIE | RIEDEL RESOURCES | 20 | 0.010 | 0.012 | 5.02M |

| PWN | PARKWAY MINERALS | 20 | 0.005 | 0.006 | 7.32M |

| MRZ | MONT ROYAL RESOURCES | 19 | 0.215 | 0.255 | 9.61M |

| MRC | MINERAL COMMODITIES | 18 | 0.190 | 0.225 | 94.77M |

| NXM | NEXUS MINERALS | 18 | 0.044 | 0.052 | 6.15M |

| AZM | AZUMAH RESOURCES | 18 | 0.028 | 0.033 | 32.29M |

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.