The Explorers: FYI’s Roly Hill on HPA demand, disruption, and an industry leading project

Pic:Getty

The Explorers is Stockhead’s in-depth look at the people behind some of Australia’s most innovative and courageous junior mining companies. This week, resources reporter Reuben Adams chats with managing director of FYI Resources, Roland Hill.

There’s a handful of ASX-listed high purity alumina (HPA) players intent on disrupting the status quo. This cohort of Aussie HPA upstarts use kaolin clay a feedstock, which mean super low operating costs compared to traditional producers.

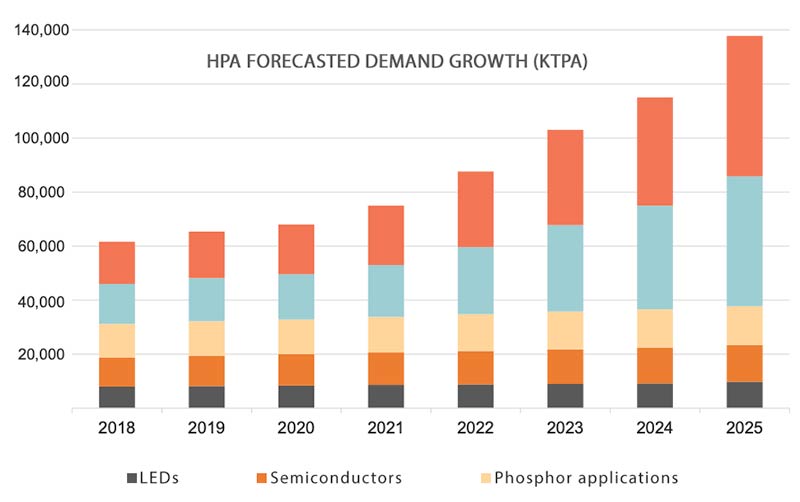

And as they move toward development, HPA demand is forecast to triple to over 120,000 tonnes by 2025 – supercharged by the EV thematic. That’s because one of HPA’s fastest growing uses is coating the separators that keep apart the cathode and anode electrodes in lithium-ion batteries.

Last year, WA-based FYI Resources (ASX:FYI) released a PFS for its 25-year Cadoux kaolin project, which, with a sale price assumption of $US24,000 per tonne, would deliver a profit margin of about $US17,500 per tonne. That’s industry-leading stuff.

Now, as part of ongoing BFS studies, the company is building a pilot plant – basically a smaller, cheaper version of the real thing — to refine its process, snare offtake partners, and support project financing.

We asked Roly Hill what makes Caudoux stand out from the pack.

Will low-cost kaolin plays disrupt traditional high cost HPA producers? If so, why hasn’t this happened before?

I think it will, but it’s only been in the last couple of years that battery applications have started to make a fundamental difference to HPA demand. Prior to that the market was small, and there was no real incentive to enter that market with a disruptive or innovative process.

But traditional suppliers will not be able to address the growth in EV markets, so kaolin derived HPA – which is cheaper to produce — will augment and then overtake that traditional supply.

There’s currently about five or six ASX-listed HPA hopefuls at various stages of development. Is there enough projected demand out there to keep you all in business?

It’s a small market today, but it’s a growing market. Independent groups are forecasting more or less the same growth trajectory — about 17 per cent per year.

Out to 2025, there’s probably enough room to support three, four maybe even five new producers at this forecast level of demand.

Your PFS mentioned a start-up capex of about $180m for an 8000 tonnes per annum project. How does this compare with your peers?

As it stands today in terms of Australian listed companies, we have the lowest projected costs — both capex and opex.

The low capex and the opex are indicative of the quality of our ore and our feedstock, and how amenable it is to our process. I think we are going to be very competitive.

What else makes FYI stand out?

Our mine, Cadoux, is about 220km north east of Perth. We have infrastructure — rail, road, power, water – all within a kilometre of our resource.

We are also going to be the only integrated project based in Western Australia.

We are planning to mine and beneficiate on site, then truck to Kwinana and refine in the Kwinana Industrial Area (KIA), alongside all the other battery element companies establishing themselves in the area.

We hope to leverage off Kwinana infrastructure. We will be the only kaolin producer to do that, and we see that as a huge advantage.

And we are extremely blessed with the quality of our project. It’s very unique geologically. The chemistry and the characteristics are excellent for this particular refining process.

I think that’s demonstrated in the quality of the product that we are achieving. We’ve proven that we can get the 4N (99.99%) as our target, as well as the higher purity 5N (99.999%) product. The market probably doesn’t realise how difficult that is to achieve.

But you achieved that 5N (which is small market, but goes for upwards of $US50,000t) reasonably easily.

That’s the thing; we ran a trial, and it came through. It really does demonstrate how efficient and how exceptional our feedstock is.

We also have a fantastic metallurgical and engineering team who have done some amazing work. We see ourselves as being extremely technically driven, which is very important.

Tell us a bit about your pilot plant and what you’re hoping to achieve.

We are going to put eight tonnes through a pilot plant in our first round of trialling. We are in construction now, which should be completed by the end of this month.

The first 2-week trial run will happen next month, and first results should be reported towards the end of June.

Is this a difficult process to get right?

On paper, the flowsheet is relatively simple. But in reality, it is quite difficult to ‘crack the nut’ in terms of getting the process optimised.

It a very different game, taking it from the lab up to production scale. What we initially considered would be quite an easy thing to do has turned out to be very technically difficult; but we have managed to get there.

We have learnt a lot, and we continue to learn. The pilot plant will be the final demonstration of all that.

The skill is in the refining, that’s for sure. I don’t know how you could attempt something as innovative as we’re doing without testing it at full scale production.

We will learn so much from the pilot plant, which all feeds back into our economic studies – costs, equipment selection, and so on.

We will still be delivering our BFS in September, but we will continue to do a lot more R&D and piloting.

This is new ground you’re treading.

Yes, it is. Each kaolin deposit will have different chemistry which will affect the processing. Each project will be completely different.

And because it is so cutting edge there really is no pre-existing HPA-from-kaolin industry experience. We are learning and building our skillset as we go. It a tremendously exciting challenge – there’s no doubt about that.

How’s discussions with potential offtake partners/end users going?

We commenced a fairly intensive program in about October or November last year, submitting trial samples to various groups.

Product marketing is crucial in a new industry like this. We’ve been speaking with a number of groups face-to-face; large industry groups who currently deal with traditional suppliers.

We’ve been received really well, and many groups are keen to follow up. The pilot plant will become critical to our product marketing strategy going forward.

What sort of feedback have you guys been getting from these meetings?

It’s been very positive, and that’s based on the quality of the product. At the end of the day we will be providing a great product.

Some of the traditional guys have certainly been interested in us. This is because firstly, we believe we can produce a cheaper, better product.

But secondly, there’s supply issues from the traditional HPA producers. We are talking to both traders and end users; both complain about difficulties they’re facing securing a good quality, constant supply of HPA.

The sense is that there is frustration building. People can’t get constant, quality supply. They can’t get the product that they want, and they know that market demand is growing at an exponential rate.

Either way, as long as the battery market continues to grow the way it is forecast to – and we are seeing that directly – the outlook is very good.

If we ran to a perfect schedule, we would be in production in about two years’ time. In that time market demand would nearly have doubled, with not much in the way of obvious new supply.

Why should investors get excited about FYI?

For me, it’s very exciting be a part of the EV revolution. We are playing an active role in this fundamental shift, a lifetime opportunity.

And at company level, I get immense satisfaction in what we are achieving at the cutting edge of a new industry. The trialling of this technology is super, super exciting for me.

Our project stands out. The characteristics of the ore, and how efficiently we can treat and process it should excite investors because it all adds up to a massive economic advantage.

It’s a product we can sell into a growing market at a big margin, and that translates into shareholder value. That’s why shareholders should be excited. I’m a very large shareholder in the company, so I’m motivated to see it work, but I’m also excited to be involved in it.

Having skin in the game should be reassuring to other investors as well.

I’ve bought every stock I own — I haven’t been issued any. It probably is a positive sign to the market, but I also think that I’m going to make a pretty decent return on my investment.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.