Resources Top 5: Who said WA nickel was dead? Not us, no.

Pic: Philip Gostelow/Bloomberg via Getty Images

- Alliance Nickel gives hope to down sector with Samsung supply deal

- Aldoro uses the magic word … niobium

- Real actual lithium ion batteries made with Sarytogan’s graphite

ALLIANCE NICKEL (ASX:AXN)

Australia’s battered and bruised nickel sector was stung by yet another mine closure last night as Kordamentha, administrators of the collapsed Mallee Resources, threw the Avebury mine near Zeehan in Tasmania into care and maintenance.

“As a number of other Australian miners have recently experienced, without a structural change in the market to properly value low carbon, battery-grade nickel, local mine operations will continue to be disadvantaged compared to their competitors,” receiver Scott Langdon said.

“It is disappointing that despite interest from global participants, current market conditions have presented challenges to finding the right path for a sale at this point in time. These external factors left us with no other choice than transitioning to a Care and Maintenance program for Avebury.”

Having shut in 2011 due to arsenic issues, the mine was open for less than two years before a halving of nickel prices bit.

But it’s not all doom and gloom, with some local developers still seeing demand from carmakers keen on nickel supply from the West to feed their long term EV ambitions.

Much of that investment looks to be coming from technology rich Japan and South Korea, two of the strongest competitors to China in the battery supply chain. And they have shown a key interest in backing undeveloped nickel laterite projects in Western Australia.

Japanese conglomerates are behind a renewed attempt to prepare Ardea Resources’ (ASX:ARL) Kalgoorlie Nickel Project for development.

Meanwhile, today’s big early mover Alliance Nickel has surged to a 63% gain in early trade after announcing a non-binding term sheet for nickel and cobalt sulphate supply with Korea’s Samsung SDI for its NiWest nickel-cobalt project.

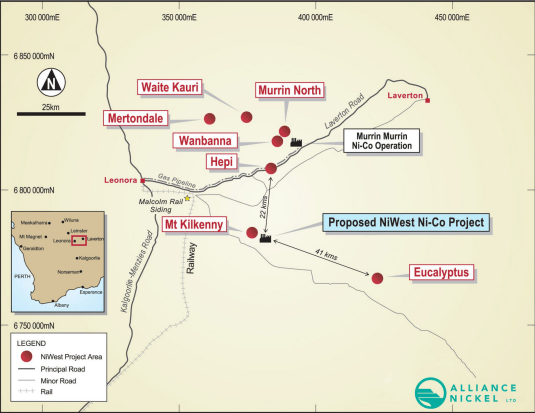

NiWest is one of the largest undeveloped nickel deposits in WA, located 30km from the Murrin Murrin laterite mine operated by Glencore.

It’s the second major partnership inked by Alliance, after it brought US-European auto giant Stellantis on board last year as an offtaker and major 11.5% shareholder in a $15m placement.

“We are delighted to introduce Samsung SDI as a new potential long term strategic partner in the NiWest Project, particularly given the current challenging market conditions facing the critical minerals sector,” Alliance MD Paul Kopejtka said.

“The term sheet is further validation of the credentials of the NiWest Project, its strategic significance to Tier-one automakers and battery manufacturers and the importance of the supply of specialty materials that comply with the US Inflation Reduction Act.

“Samsung SDI has an existing business relationship with our strategic partner and cornerstone investor, Stellantis N.V. and we look forward to building a strong partnership as we move towards first production from NiWest.”

A DFS is due in mid-2024, with a PFS in 2022 NiWest expecting the project will produce 19,200t of nickel and 1400t of cobalt a year for 15 years, or 100,000tpa of nickel and cobalt sulphate.

However, prices have come down significantly since July 2022 due to a flood of material (including class 1 battery grade nickel) from Indonesia, something which has prompted the Australian Government to call for Western carmakers to offer a so-called ‘green premium’ to secure Inflation Reduction Act compliant supply out of Australia.

The lowest price case for the NiWest PFS came in at US$9/lb nickel and US$28.50/lb cobalt with a 10% sulphate premium. Prices are currently US$7.24/lb for LME nickel metal and US$13.24/lb for cobalt.

Alliance Nickel (ASX:AXN) share price today

ALDORO RESOURCES (ASX:ARN)

Aldoro Resources stoked some excitement from punters around its Kameelburg project in Namibia very late last year on rock chips grading between 5-9% niobium pentoxide.

That is the very commodity that has turned WA1 Resources (ASX:WA1) into a market darling and the West Arunta region on WA’s border with the NT into a hotbed of exploration activity.

Niobium is a critical mineral used largely as a steel alloy which makes metals resistant to wear and heat. It’s a small market, but one largely supplied by a single player — Brazil’s CBMM.

There’s a premium therefore on new discoveries, with buyers no doubt keen to see some competitive tension to break the virtual monopoly.

This fine morn Aldoro rose more than 34% after telling shareholders that on the southwest margin of the ‘giant’ Kameelburg carbonatite it had traced intermittent intrusive dyke bearing pyrochlore (a niobium containing mineral) over 200m and at widths of up to 1m.

And that is unlikely the limit, with sedimentary colluvium obscuring the extent of the dyke system which looks to dip to the northeast.

Seven rock chip samples have been taken with results pending. They will obviously be closely watched.

Aldoro is talking to drill contractors about starting a 2000m diamond drill program at Kameelburg and has engages a new country manager in geologist Andreas Palfi to oversee its mapping and sampling program.

ARN wants to target high grade rare earth element dykes on the southeast margin of the carbonatite plug as well as niobium rich dykes on and off the intrusion.

Meanwhile, results are still pending for met test work on rare earths and niobium rock chips.

Aldoro Resources (ASX:ARN) share price today

SARYTOGAN GRAPHITE (ASX:SGA)

Kazakh graphite developer Sarytogan has claimed a major fillip in its bid to join the EV supply chain, with the first lithium ion batteries made from uncoated spherical purified graphite produced by the junior.

And the company claims testing of the six coin-cell batteries demonstrates its anodes have consistently superior capacity compared to many synthetic graphite anodes used in electric vehicles at the moment.

Coated spherical purified graphite testing is expected to commissioned imminently, and the company says that will likely improve performance. Tests will continue on the USPG cells over the next three months to see how they stack up over a longer timeframe.

The company said all six cells were measured as “having remarkably repeatable and consistent results” with “no significant degradation in performance was observed after nine rounds of 10-hour charge and discharge cycles.”

“We are delighted with the achievement of this major and revolutionary technical milestone that demonstrates Sarytogan Graphite to be highly suitable for use in lithium-ion batteries,” SGA managing director Sean Gregory said.

“Sarytogan Graphite is proving itself to be a unique combination of high performance and lower costs due to its exceptionally high-grade microcrystalline nature.

“Investors can look forward to the well-advanced Pre-Feasibility Study quantifying the anticipated financial returns associated with the long list of superlatives that the Sarytogan Graphite deposit commands.”

SGA says its product is unique given the micro-crystalline structure of the Sarytogan graphite deposit, which eludes classification in line with standard product categories like vein, flake and amorphous.

The project contains a resource of 229Mt at 28.9% total graphitic carbon, with mineralisation successfully upgraded to 99.87% purity with chemical purification and 99.998% purity with thermal purification. A PFS is due in the third quarter of this year.

Sarytogan Graphite (ASX:SGA) share price today

CADOUX (ASX:CCM)

(Up on no news)

Just an FYI, Cadoux is the former FYI Resources, but it’s certainly clear to see why they may have undergone a rebrand.

CCM is down almost 64% over the past year, largely because of Alcoa’s decision to ditch its involvement in the company’s proposed Kwinana high purity alumina plant in February 2023, less than a month after selecting a site for a demo plant ahead of a final investment decision.

That came despite Alcoa and FYI entering a binding term sheet in 2021 that would have seen them spend US$57m to design and build a 1000tpa demo plant and as much as US$200m on a full scale 8000tpa facility with the US based alumina producer to sole fund the first US$194m.

HPA is a crystallised white powder consisting of almost entirely pure aluminium oxide; its purity measured by how many 9s sit past the decimal point after 99.

Highly stable, scratch and corrosion resistant, it’s an important component in LED diodes, synthetic sapphire and lithium ion batteries, where it coats the ceramic cathode separator sheets which catalyses the movement of ions from cathode to anode.

Cadoux is up over 20% today with little news to report.

The $24 million capper’s last whimper came in the form of its December quarter report, when it said it was completing activities towards the completion of a feasibility study on its Minhub rare earths project in Darwin and an FID on the HPA project.

Cadoux had $7.8 million in the bank at December 31 and was formally awarded a $3m WA Government grant from its Investment Attraction Fund during the December quarter along with a $1.2m R&D rebate.

Also during the quarter it confirmed a site for its proposed demonstration plant in Kwinana.

Cadoux Ltd (ASX:CMM) share price today

KULA GOLD (ASX:KGD)

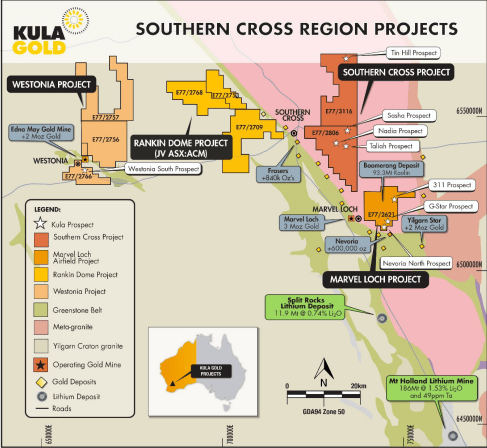

$3m minnow Kula Gold is up more than 20% after announcing it had put its finger on two new gold prospects at the Marvel Loch project near Southern Cross, one of WA’s pre-eminent gold fields.

They include the new Stingray gold and lithium prospect and Boomerang gold prospect, the latter identified in drilling for kaolin three years ago in a hit of 1m at 2.6g/t from 54m.

Crucially they are all close to existing infrastructure, located to the north of the 600,000oz Nevoria gold mine and 3Moz Marvel Loch mine.

“The Company is excited to be exploring the historically rich Southern Cross Goldfield region which has produced over 15Moz of gold, at an average of 3-5g/t,” said KGD MD Ric Dawson.

“Following recent geochemical sampling results the Company is focussing on the Boomerang and Stingray Gold Prospects with follow up at the Nevoria North, G-Star and 311 Prospects.

“A very large magnetic circular feature had provided the Kula team with a concept for an initial UFF soil programme which provided a surprise gold anomaly at the now named Stingray Gold Prospect.

“A gold intercept from drilling at the Boomerang Kaolin Deposit in 2021 reported, 1m at 2.6g/t gold from 54m and recent geophysics work shows it is located near a strong dislocation feature in the magnetics.”

Kula Gold (ASX:KGD) share price today

At Stockhead we tell it like it is. While Kula Gold was a Stockhead advertiser at the time of writing, it did not sponsor this article.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.