The West Arunta: A tale of one mighty explorer and its followers

WA1 were first movers in WA's West Arunta region. Pic via Getty Images

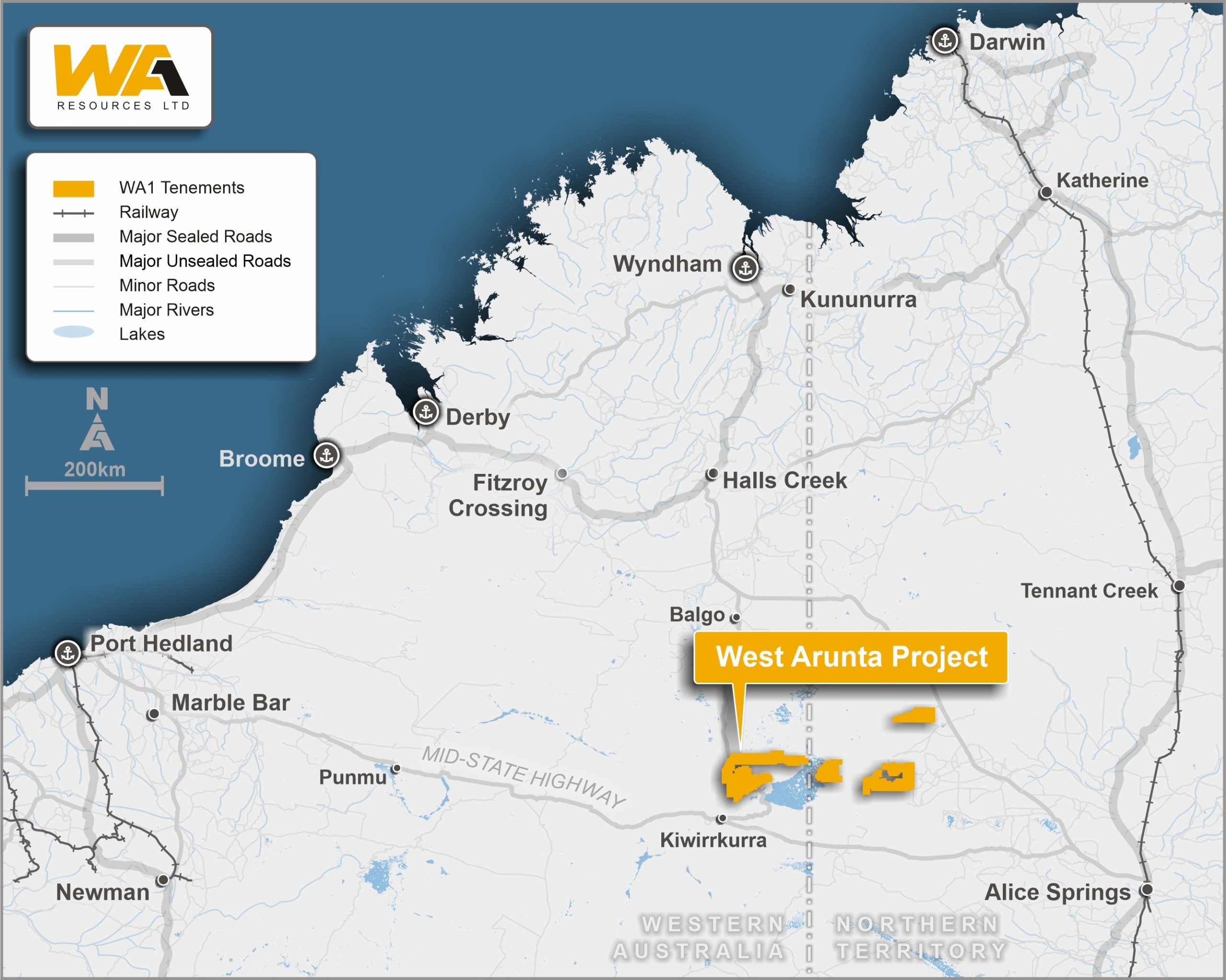

In remote east-central WA, right on the border of the NT, a niobium-rare earth monster has emerged from the under the spinifex country of the Gibson Desert, into the minds of investors all over the country.

Before the surprise discovery in 2022, the West Arunta region was considered one of the least studied and least understood areas of the state by the Department of Mines, Industry Regulation and Safety (DMIRS).

It was a region touted by geologists as ‘something special’ due to its lightly explored and highly mineralised nature but one where, given its sheer remoteness, few have been able to spend much time and effort in.

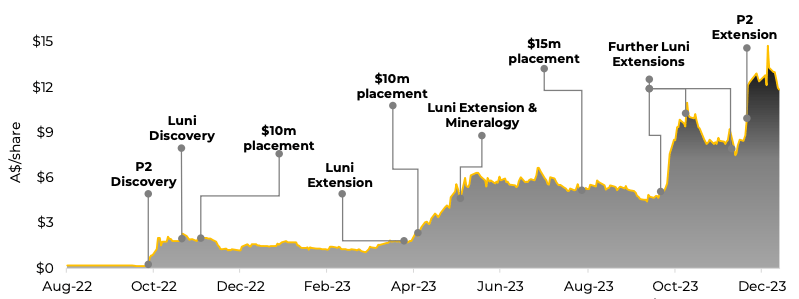

Historically, only two drill holes had been drilled in the West Arunta before WA1 Resources (ASX:WA1) drilled seven in July 2022, the results of which uncovered 54m at 0.62% niobium, 0.18% rare earths and 3.85% phosphorus from 162m, sending shares in the company sky high (surging some 420%).

In what was a bad year for IPOs, WA1 reached the top of the ASX debutante list for 2022 with share in the company rising some 843% after its spinout of private project generator Tali Resources.

Thanks to its 2022 drilling campaign, the region is seeing heightened exploration activity with more than ~$60m invested in exploration expenditure in the district by a number of ASX companies.

With its two-year anniversary coming up this week, we take a deep dive into WA1’s success in the region and track some of those that have followed in their lead hoping to make similar findings.

Cheers to two years and the first big raising of ’24

For many junior explorers, the two-year anniversary comes around just as IPO funds start to run dry. But WA1 breaks that mould, holding $18.7m in cash at the end of December 2023, and having raised $40m for a placement to investors in mid-January.

According to WA1 managing director Paul Savich, the completion of the placement left the company in its strongest financial position to date, with a steady flow of results expected to be reported in the current quarter from the 2023 drill campaign.

The placement price of $10 per share, a 5.5% discount to the 30-day VWAP, also attracted new, highly regarded institutional investors in Australia, Europe and North America, boosting WA1’s total cash balance to a hefty $58.7m.

How did WA1 get to this point?

As first movers in the region, the company’s 2022 drill program followed several years of targeting and testing of large gravity anomalies for their potential to host significant iron oxide-copper-gold deposits.

But as mining geologists and company directors will tell you, there’s no recipe when it comes to exploration; in fact it’s rare to find what you’re looking for straight off the bat and the aim of the game changes depending on the minerals you uncover.

It was almost seven years, a series of reconnaissance airborne geophysics, ground geophysical surveys, surface sampling and some $600,000 later, before the company began its first program of deep drilling, eventually stumbling upon what they call a ‘once in a generation niobium discovery’.

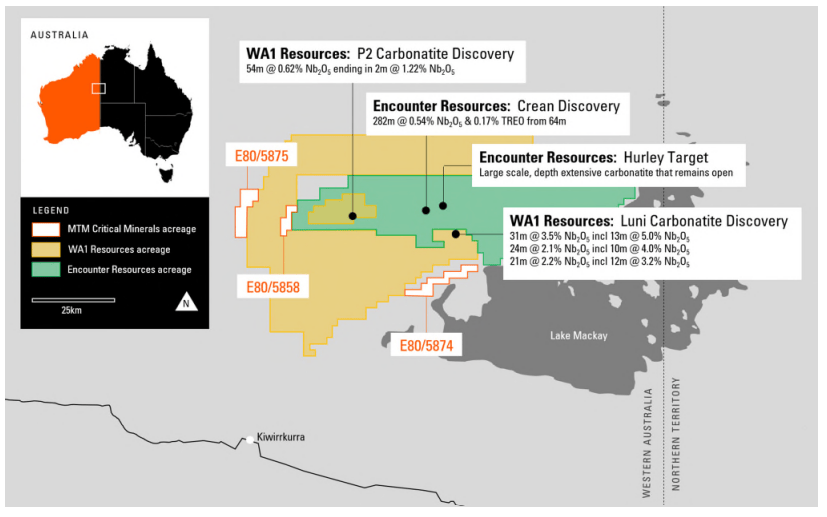

Now, the company has two mineralised carbonatites – P2 and Luni – containing elevated levels of niobium and rare earth elements, and capped off 2023 with 30,000m of drilling its 6,400km2 tenement package.

Funds from the recent $40m raising will be used to carry out exploration and resource drilling, along with the estimation of an initial resource for Luni in the June quarter and metallurgical test work, as well as project development planning.

Let’s take a step back

Before WA1 burst onto the scene, mining majors like Western Mining Corporation (WMC) and BHP Group (ASX:BHP) spent time in the West Arunta looking for diamonds during the ’80s and gold in the ’90s.

But according to Lycaon Resources (ASX:LYN) managing director Tom Langley, the owner of the Stanmore project about 90km to the north of WA1’s ground, both companies were merely scratching the surface.

“The drilling BHP did at Lycaon’s project in the ’80s only went to a maximum depth of 12m over the magnetic bullseye anomaly, which goes to show just how cursory in nature their exploration efforts were,” he says in an interview with Stockhead.

“Proterozoic age rocks are known to host significant quantities of copper, nickel, gold and critical minerals throughout the world, so it’s been a natural progression to have a look in Australia’s backyard at these important geological provinces for the next major discoveries.”

The Stanmore project sits within a major regional gravity anomaly that, according to Langley, has a local gravity low and magnetic high boasting a very similar geological setting as WA1.

“Although we don’t yet know what the rock types are underneath the ~6-12m of sand cover, the targets we have defined to drill look to have the hallmarks of an intrusion of some form, hopefully a carbonatite or IOCG type intrusion.”

Who else is around?

Another important player in the area is Encounter Resources (ASX:ENR) whose Aileron critical minerals project surrounds WA1’s tenements.

The company drilled its first drill hole at the project back in 2020 when it was in a joint venture with Newcrest Mining and has been advancing it ever since with gravity, magnetics, and radiometric surveys collecting the datasets needed to take it forward.

In its first reconnaissance drilling at the Emily target on the western side of the Aileron project, ENR intersected mineralisation within a primary carbonatite at depth and associated shallow, enriched niobium-REE mineralisation in two adjacent holes.

Additional heritage surveys are planned for early in 2024 to facilitate detailed aircore/RC drilling at Emily, Green and Joyce with much of the eastern part of the +100km wide project still under-explored.

Immediately adjacent to tenements held by WA1 and ENR is MTM Critical Metals (ASX:MTM).

MTM entered into binding agreements to acquire Flash Metals, the owner of three exploration licences prospective for niobium and REEs in the West Arunta, in December 2023.

As newcomers to the region, MTM managing director Lachlan Reynolds says the company hopes to piggyback on the experience of both WA1 and ENR.

“The remoteness means you need to be well set up in terms of what gear you’ve got and how you look after your teams when they are out there and WA1 especially are moving into a more advanced phase now,” he says.

“There’s no question, just operating out there is expensive compared to other areas, and we’re relying on the fact that the regional geophysics will show similarities in the geology between the areas.”

For a company like MTM, Reynolds says WA1’s success will have knock-on effects from an investor interest perspective but also in terms of opening up that region for further exploration.

“Once one company is able to – hypothetically – advance to a mining operation, then it is generally a lot easier to get there for others,” he says.

“It means that the logistics are more straightforward, it also often means there will be an airstrip and services which can be utilised by other parties, so the success of our neighbours is pretty important to us.”

The big Kahunas and other minnows

The resurgence in the area kicked back into shape in 2014 when Agrimin (ASX:AMN) went out in search of potash at Lake Mackay and started to establish relationships, opening the region up for business with the signing of their mining agreement in 2017.

For Savich, that was a good enough sign for WA1 to get into the area.

Not too long after, major miner Rio Tinto (ASX:RIO) locked up West Arunta’s southern belt as part of its venture with Tali Resources (a private exploration company incorporated in 2018) over the exploration of five copper-gold tenements.

CGN Resources (ASX:CGR) listed on the ASX in October 2023 following a $10m oversubscribed IPO with the Webb project under its wing, which includes the Tantor prospect – an anomaly similar in size to Prominent Hill.

The West Arunta explorer capped off 2023 with the completion of a heritage survey to establish access routes and clear the sites for ground-based geophysics programs and deeper drilling in 2024.

Rincon Resources (ASX:RCR) are exploring the West Arunta across three exploration licences comprising the Pokali target, where RC drilling will kick off later this month.

West Arunta stocks share prices today:

At Stockhead we tell it like it is. While Lycaon Resources and MTM Resources are Stockhead advertisers, they did not sponsor this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.