Who Made the Gains? Here are May’s top ASX miners and explorers

Pic: Via Getty

- Metals are booming again

- 13 resources winners with gains above 100% in May; a recent record

- 13 out of the 50 top performers last month were engaged in a project acquisition, M&A activity, or joint venture

- Small Cap Standouts: Australian Gold & Copper, Sun Silver, Falcon Metals

“Sell in May and go away,” goes the old stock market proverb.

Not this May. Mining and exploration stocks are officially back in fashion, thanks to some good old-fashioned Chinese stimulus.

“China [the world’s largest consumer of raw materials] has continued to step-up fiscal support and announced supportive/pro-growth policies, underpinning commodity demand,” says RBC Capital Markets.

“We think that the cyclical recovery underway in China should continue over the coming months as more spending comes through.”

This coupled with historically low exchange-stocks, ongoing supply disruptions and under-investment in new mine capacity should continue to support commodity prices, RBC says.

“We forecast most commodity prices to rise in 2024 (except bulks). Overall, our largest prices changes for the near term are for gold, copper, zinc, and met coal.”

RBC doesn’t mention silver, which went ballistic last month to peak at ~US$33/oz – its highest point in over a decade.

This is due to safe haven buying and the ‘we aren’t producing enough silver to meet industrial demand!’ thematic finally gaining traction with investors.

“… the most furious part of the [silver] rally may be ahead,” says Alex Kuptsikevich, FxPro senior market analyst.

“Silver could be ready to repeat the growth spurt it showed in 2010-2011.”

All up, we had 13 resources winners with gains above 100% in May, which is the best result for a long time.

Interesting stat: 13 out of the 50 top performers this month were engaged in a project acquisition, M&A activity, or joint venture with a major miner.

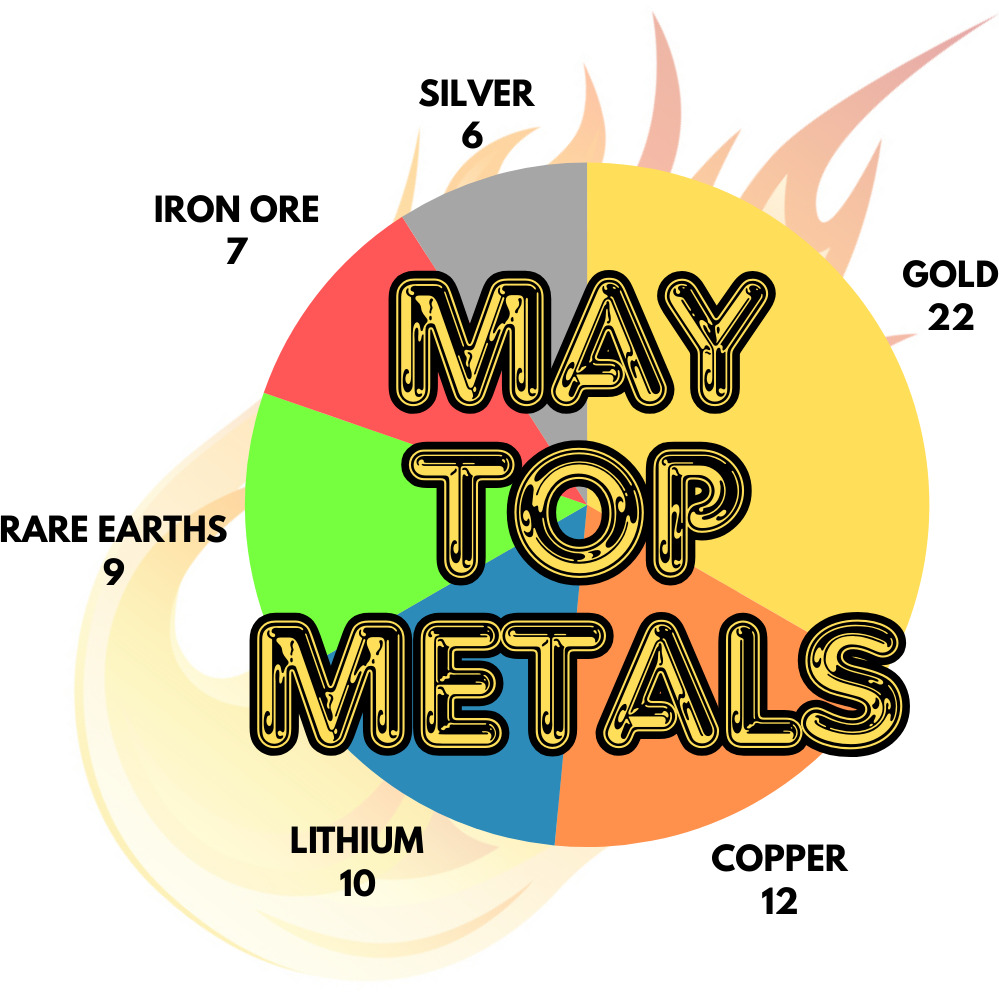

Most popular commodities for May:

Here are the top 50 ASX resources stocks for the month of May >>>

Scroll or swipe to reveal table. Click headings to sort.

| Security | Description | Last | %Mth | MktCap | COMMODITY FOCUS |

|---|---|---|---|---|---|

| AGC | AGC Ltd | 0.465 | 447% | $103,333,333 | GOLD, SILVER, COPPER |

| KP2 | Kore Potash PLC | 0.038 | 245% | $25,014,051 | POTASH |

| DY6 | DY6 Metals | 0.12 | 173% | $4,849,300 | RARE EARTHS, NIOBIUM |

| ERW | Errawarra Resources | 0.115 | 161% | $11,030,877 | LITHIUM, GRAPHITE, GOLD |

| FRS | Forrestania Resources | 0.046 | 156% | $7,442,144 | IRON ORE, GOLD |

| ICL | Iceni Gold | 0.066 | 154% | $18,002,229 | GOLD |

| FAL | Falcon Metals | 0.32 | 137% | $56,640,000 | MINERAL SANDS, GOLD |

| BUR | Burley Minerals | 0.14 | 115% | $21,051,932 | IRON ORE, LITHIUM |

| CRS | Caprice Resources | 0.036 | 112% | $10,053,912 | NIOBIUM, RARE EARTHS |

| RC1 | Redcastle Resources | 0.025 | 108% | $8,207,104 | GOLD |

| M4M | Macro Metals Limited | 0.035 | 106% | $125,946,867 | IRON ORE |

| SER | Strategic Energy | 0.02 | 100% | $11,959,939 | COPPER, GOLD, NICKEL |

| CBH | Coolabah Metals | 0.077 | 83% | $9,271,283 | FLUORITE |

| EMU | EMU NL | 0.032 | 78% | $2,159,775 | COPPER |

| ILT | Iltani Resources Lim | 0.335 | 72% | $11,393,519 | SILVER, INDIUM, COPPER, ZINC, TIN |

| SVY | Stavely Minerals Ltd | 0.047 | 68% | $17,951,184 | COPPER, GOLD |

| ENT | Enterprise Metals | 0.005 | 67% | $4,423,605 | HEAVY MINERALS, RARE EARTHS, TITANIUM |

| IND | Industrial Minerals | 0.25 | 67% | $16,846,200 | QUARTZ, SILICA SAND |

| PEC | Perpetual Resources | 0.015 | 67% | $9,600,441 | RARE EARTHS, LITHIUM |

| EQN | Equinox Resources | 0.355 | 65% | $43,842,501 | RARE EARTHS, IRON ORE |

| BM8 | Battery Age Minerals | 0.165 | 65% | $15,348,983 | LITHIUM, ZINC, GERMANIUM |

| BMR | Ballymore Resources | 0.205 | 64% | $36,229,770 | GOLD |

| CCZ | Castillo Copper Ltd | 0.008 | 60% | $10,396,043 | COPPER |

| MDX | Mindax Limited | 0.053 | 56% | $108,585,540 | IRON ORE, GOLD |

| RR1 | Reach Resources Ltd | 0.014 | 56% | $12,242,039 | RARE EARTHS, NIOBIUM, LITHIUM |

| GIB | Gibb River Diamonds | 0.048 | 55% | $10,152,453 | GOLD, DIAMONDS |

| KOB | Koba Resources | 0.15 | 55% | $23,784,242 | URANIUM |

| AQD | Ausquest Limited | 0.017 | 55% | $14,027,537 | IRON ORE, COPPER, GOLD |

| TOR | Torque Met | 0.2 | 54% | $36,645,760 | GOLD, LITHIUM |

| SUM | Summit Minerals | 0.23 | 53% | $10,961,139 | NIOBIUM, RARE EARTHS |

| GBE | Globe Metals & Mining | 0.058 | 53% | $39,200,320 | NIOBIUM |

| OZZ | OZZ Resources | 0.05 | 52% | $4,626,506 | GOLD |

| AOA | Ausmon Resorces | 0.003 | 50% | $3,176,998 | RARE EARTHS, COBALT, LEAD ZINC, SILVER, COPPER |

| IEC | Intra Energy Corp | 0.003 | 50% | $5,072,345 | GOLD, LITHIUM |

| MRQ | MRG Metals Limited | 0.0015 | 50% | $3,787,678 | HEAVY MINERALS, LITHIUM, PHOSPHATE |

| LGM | Legacy Minerals | 0.25 | 47% | $26,363,749 | COPPER, GOLD |

| HRZ | Horizon | 0.047 | 47% | $32,946,233 | GOLD |

| KTA | Krakatoa Resources | 0.016 | 45% | $7,553,716 | NIOBIUM, RARE EARTHS |

| GSR | Greenstone Resources | 0.013 | 44% | $17,852,345 | GOLD |

| MGT | Magnetite Mines | 0.39 | 44% | $38,389,465 | IRON ORE |

| CHW | Chilwaminerals | 0.57 | 44% | $26,148,751 | HEAVY MINERALS |

| A8G | Australasian Metals | 0.092 | 44% | $4,795,085 | QUARTZ, LITHIUM |

| KCC | Kincora Copper | 0.056 | 44% | $11,478,291 | COPPER, GOLD |

| T88 | Taitonresources | 0.1 | 43% | $5,377,454 | MOLYBDENUM, QUARTZ |

| MMC | Mitremining | 0.705 | 42% | $78,950,931 | SILVER, GOLD |

| KRM | Kingsrose Mining Ltd | 0.052 | 41% | $39,131,379 | NICKEL, COPPER, COBALT |

| POL | Polymetals Resources | 0.4 | 40% | $65,904,266 | SILVER, ZINC |

| VUL | Vulcan Energy | 4.74 | 40% | $817,346,788 | LITHIUM |

| AQX | Alice Queen Ltd | 0.007 | 40% | $4,836,930 | COPPER, GOLD |

| SS1 | Sun Silver | 0.54 | 170% | $38,000,000 | SILVER, GOLD |

Small Cap Standouts

AUSTRALIAN GOLD & COPPER (ASX:AGC) +447%

Timing its run perfectly with silver’s meteoric rise was NSW explorer AGC, which announced a slew of rich hits from its Achilles gold-silver discovery including a highlight 5m grading 16.9g/t gold, 1,473g/t silver, and 15% lead+zinc.

That’s super high grade.

It is the culmination of a few years of boring exploration legwork for AGC, starting in 2021 when it drilled into several large zones of anomalous lead, zinc and copper around Achilles.

“Achilles is producing some exceptional grades in the drill bit,” AGC MD Glen Diemar said.

“The first six holes have produced grades including combined lead and zinc to 38%, gold to 45g/t and silver above 3,000g/t.

“This silver result is so high grade the laboratory is sending the sample to Canada for further analysis, which is a rare occurrence.

“We are extremely happy with how Achilles is taking shape. With drilling now spread across more than half a kilometre of strike we are excited to see how big this can get.”

Enjoy the nearology glow last month was Strategic Energy Resources (ASX:SER), which has a target confusingly named ‘Achilles 1’ 8km away from AGC’s discovery.

SUN SILVER (ASX:SS1) +170%

The pickings for quality silver exposure on the ASX are fairly slim.

Bringing some shine to the ASX last month was Sun Silver (ASX:SS1), which closed its IPO early after raising the maximum $13m in mere days before going +170% in its first month on the bourse.

The focus is Maverick Springs, an advanced, high grade 292Moz silver-equivalent resource at 72.4g/t (175.7Moz silver, 1.37Moz gold) in the tier 1 jurisdiction of Nevada.

It is just off the southeast end of the Carlin Trend belt of monster gold-silver deposits, and a proverbial stone’s throw from Kinross’ 3.7Moz Bald Mountain gold mine.

Maverick Springs’ large, continuous body of silver-gold mineralisation is 2.4km long, up to 1.2km wide, and between 30-110m thick. The deposit starts about 130m below surface.

SS1 reckons there’s more where this came from, with the current mineralisation model covering less than 25% of the property area.

IPO funds will be used for infill drilling (to increase resource confidence), resource expansion, mining studies, and downstream opportunities.

READ: Silver’s Perfect Storm

FALCON METALS (ASX:FAL) +137%

The Chalice Mining (ASX:CHN) spinout has been plugging away at the Pyramid Hill gold project in Victoria, CHN’s No 1 focus before it hit the motherlode at Julimar.

But FAL, notably chaired by Mark Bennett, discoverer of the Nova nickel deposit, scored an unexpected rerate last month when it stumbled upon a large, shallow, and high grade heavy minerals sands deposit.

A shallow drilling at the Farrelly prospect hit thick, high grade minerals sands — including zircon, ilmenite, rutile, and potential rare-earth element bearing monazite and xenotime — over a 1.2km by 600m area.

It remains open in several directions, the company says.

“While it is early days in our understanding of Farrelly, with more drilling and test work required, it is shaping up to become a significant mineral sands deposit, in proximity to other major deposits, but at far higher grades,” MD Tim Markwell says.

“Importantly, we have not yet defined the limits of the high-grade zone and drilling to test this is expected to recommence in the summer once harvesting is completed, in parallel with our gold exploration at Pyramid Hill.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.