The Explorers: S2 Resources’ Mark Bennett on the secret recipe to finding big deposits

Pic: Tyler Stableford / Stone via Getty Images

The Explorers is Stockhead’s in-depth look at the people behind some of Australia’s most innovative and courageous junior mining companies. This week, resources reporter Reuben Adams chats with managing director of S2 Resources, Mark Bennett.

In 2012, micro cap explorer Sirius Resources made an entirely new type of nickel discovery in the Fraser Range of Western Australia.

Sirius had barely any cash left when it found the globally significant Nova deposit, sending an otherwise dour market into a frenzy.

Within two months the Sirius share price was up 4000 per cent, from 5c to over $2.50. And when it was finally acquired by major miner Independence Group (ASX:IGO) in 2015, the former penny stock was valued at $4.38 per share, or $1.8 billion.

But this wasn’t the first big find for Mark Bennett, or his team.

This guy had already discovered the Thunderbox gold mine in 1999 – WA’s best discovery in decade — and the nearby Waterloo nickel mine in 2002.

We asked Bennett, who now helms Sirius spinout S2 Resources (ASX:S2R), where his next tier 1 discovery is going to come from.

Why did you and the Sirius team start all over with S2?

“Fund managers ask me ‘why did you carry on after Sirius?’ Most of [the team] have worked together in three or four different companies, and it’s because we love it.

“Exploration is such high-risk stuff, and if you’re only it for a quick financial win you will get sick of it pretty quickly. You have to be stupid enough and passionate enough to give yourself the best chance of hitting the jackpot.

“It didn’t take much to motivate us to start over because we hadn’t finished with Sirius. That ended a bit sooner than we expected it.

“As part of that deal with IGO, we demerged S2 so we could carry on with the other projects we had up our sleeve. Nova was just the first in our grand plans.

“IGO wanted Nova so badly that we were able to dictate pretty good terms.

“One of those terms, apart from demerging S2 with the Polar Bear project and our Scandinavian assets, was to start off life with $20 million in the bank.

“Now, rather than unnecessarily issue stock and dilute shareholders we try and monetise assets that we think aren’t going to be company makers.

“We had a 250,000oz resource at Polar Bear, but that’s not what our shareholders are in S2 for, so we sold it to Westgold for $9 million.

“This means we can deploy cash where we think the big wins will be, without perpetually going ‘cap in hand’ back to the market.

“We don’t want to be small subsistence miner; we’re batting for the home run.”

Did you feel there was a weight of expectation to replicate Sirius’ success at S2?

“After you have found a number of big deposits people start to think you have some sort of secret recipe.

“After Sirius, there is an expectation that we can just pull another Nova out of the proverbial. It may look like an overnight success, but there’s a lot of hard yards involved.

“S2 started its life as with all its old Sirius shareholders. In one sense that’s great, because they were already happy and they understand what we do.

“But it also means they are in it for another ‘company maker’ rather than something more modest.

“So our strategy is to chase big ones. That means going into under explored areas we believe are prospective, but aren’t necessarily regarded as such by everyone else.”

What project is your key focus right now?

“We were attracted to Finland, in particular Lapland, which is a few hundred kilometres north of the Arctic Circle.

“There’s a greenstone belt which hosts Europe’s biggest gold mine, Kittila, as well as a recent copper-nickel-platinum discovery called Sakatti owned by Anglo American.

“You usually find a distribution of smaller deposits alongside the big ones. But in this case you have two representative tier 1 deposits of their type but very little else, which is unusual.

“The question we asked was – why?

“For various reasons that area has not experienced the kind of exploration a lot of other prospective areas have, so we chose to focus on Finland.

“We also went into Nevada, which is home to [gold majors] Barrick and Newmont for the same reason; to find those giant gold deposits.”

In late 2015 you said Finland was the place where “sleeping giants lie”. You even called it your next Fraser Range.

“We called Finland ‘the next Fraser Range’ in reference to what the Fraser Range was for us, initially, at Sirius.

“In the early Sirius days, we had Polar Bear and we had the Fraser Range. Polar Bear was the more conventional gold and nickel play, it was something the market understood.

“On the side we had the Fraser Range, an area people regarded as ‘moose pasture’.

“It was such an unusual place to go and explore at the time, that if we made too much of a noise about this ‘moose pasture’ people might think we were losing perspective.

“BHP, Falconbridge, WMC, Newmont, Anglo American and others had all explored the Fraser Range before us.

“For us to think we could do something those big guys couldn’t seemed a bit arrogant. So we just did it, quietly.

“And it’s the same with Finland. We started S2 with the Polar Bear gold project which we inherited from Sirius.

“This was our bread and butter, and then on the side we had Scandinavia. It couldn’t be more different that Western Australia, but that’s where we think there’s a lot of opportunity.”

What attracted to Finland the first place? It seems like a tough place to be an explorer.

“There’s a lot of dense pine forest, and it’s under snow for 50 per cent on the year.

“But there’s positives to that. We can drive around on the snow with drill rigs, and when the snow melts there’s no sign we were ever there.

“This means you don’t spend money on access tracks or rehabbing sites in the same way you do in Western Australia, which means you get more dollars in the ground.

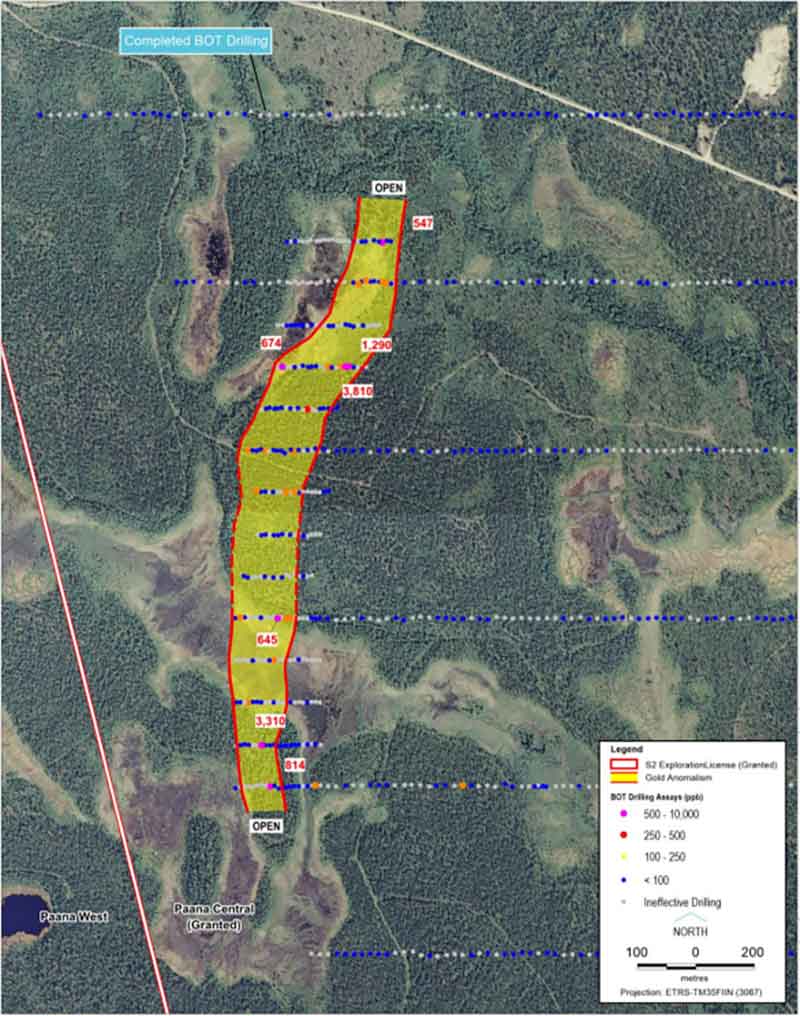

You’ve just defined a 1.3km-long gold anomaly with values up to 3.8g/t gold at your Aarnivalkea project. Is this significant?

“We hope so.

“In Australia [the rock] is deeply weathered, so you can afford to drill more sparsely just to get that initial sniff of mineralisation. In Finland it’s the opposite.

“There’s no deep weathering. Anything that was weathered has been scraped away by glaciers and had a thin layer of clay dumped on top.

“That means that when you drill that there’s no dispersion of mineralisation – you’re hitting fresh rock.

“So what you are looking for is very small. Statistically, very few holes drilled are likely to hit mineralisation. Not like Australia, where you have all the smoke around [a potential deposit].

“Once you get a number of positive hits like we’ve got, it shows that it is real mineralisation – not just enrichment from weathering.”

So how did it feel to hit that mineralisation?

“It was exciting. Unlike Australia, in Finland we didn’t have many case studies to compare our results to.

“The only operating gold mine of any importance in Finland is Kittila which is probably close to 10 million ounces of gold by now; a pretty good deposit.

“We were able to get the original Kittila base of till (BOT) results from the geological survey to try and understand how good our numbers were.

“When we looked at the two they were comparable; if anything, ours looked better.

“We don’t want to get overexcited because what you see isn’t always what you get, but at this stage it looks every bit as good as Kittila did.”

What’s your next steps?

“The next step is for us the drill that corridor out with diamond drilling in the way that you would with air core or RC in Australia.

“Which is more expensive, so you have to be confident that it’s something worth spending the money on.

“By July the ground will all be dried out and we will go back for a big systematic diamond drilling campaign along that corridor.

“We aren’t trying to get a home run first up. We will initially do 80m deep drill holes every few 100m along that corridor just to get a fix on it. Then we will tighten up, hopefully define the sweet spots and start going deeper. It’s going to be a big program.

“For the next 6 months this will be our main focus, but not our sole focus.”

What other projects are you working on?

“About four months ago some ground in the Fraser Range became available. We put in applications for four areas, as did up to 14 other companies including IGO, I believe

“The Mines Warden decides who gets it by basically putting numbers on ball and drawing them out of a hat. And we came out with 3 out of our 4 applications, despite being up to 14 other companies in the bag.

“And the one in Nevada is interesting. We are earning 70 per cent of an area that is surrounded on three sides by Barrick and by Newmont of the fourth.

“Barrick has three gold mines that have 50 million ounces of gold between them. And we are sandwiched in the middle, in an area where hardly had any drilling has been done.

“Barrick are currently drilling close to our southern boundary. They have a new deposit called Robertson which is already at about 3 million ounces.

“We drilled a couple of holes but the target is really deep; we are talking 800m to 900m deep, so you can’t just drill at will.

“We are just assessing what we are going to do there, but we will probably drill a few holes over the next 12 months.

“It’s worth us just tickling away with that one. If we get to depth and hit the right target — as they have around us – you can find some pretty spectacular things.”

- Subscribe to our daily newsletter

- Join our small cap Facebook group

- Follow us on Facebook or Twitter

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.