Industrial demand, flatlining mine production pushes silver deficit to second highest on record

Pic: Stockhead, via Getty Images

IN SHORT:

- Silver deficit to be the second highest on record in 2024: Silver Institute

- Driven by uptick in industrial usage (~50% of demand) and a flatlining supply picture

- Main emerging consumers on the industrial side are photovoltaic solar cells and fast chargers for EVs

- By 2050, 50% of silver demand is expected to be from solar cells

The silver deficit will be the second highest on record in 2024 as industrial demand reaches a new high, according to the Silver Institute’s latest World Silver Survey.

Silver has a few main roles to play: an affordable alternative to gold as a store of wealth (via physical bullion, silver ETFs); in jewellery; and an increasingly important industrial metal (solar panels, computers, mobile phones, cars and almost every appliance you can think of).

Silver’s fundamentals, meaning supply and demand, have looked good for silver bulls since 2020 when the latest round of deficits emerged.

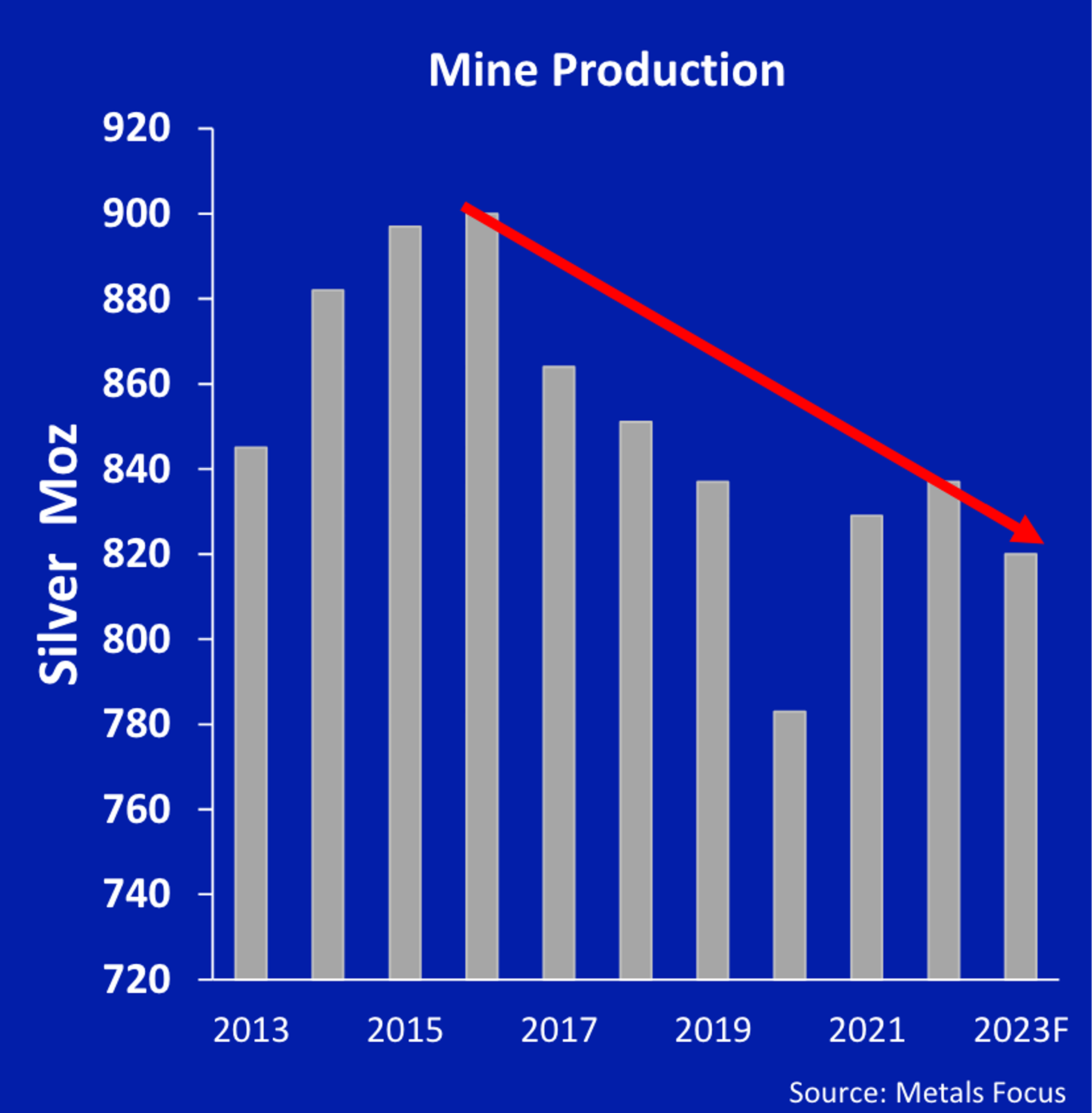

This has been driven by an uptick in industrial usage (~50% of demand) and an anaemic supply picture. In 2023, ~820Moz of annual production was dwarfed by consumption of ~1.14 billion ounces.

“Silver’s supply/demand conditions are expected to enjoy another strong year in 2024,” says Metals Focus, producer of the latest Silver Survey.

“Robust gains from PV applications and a decent performance in other segments are expected to see industrial demand reach a new all-time record.

“An uptick in discretionary spending and restocking should also boost jewellery and silverware demand.”

“Crucially, supply will remain little changed, with a marginal decline forecast for 2024. This will lead to a 17% rise in the market deficit to the second highest on record.”

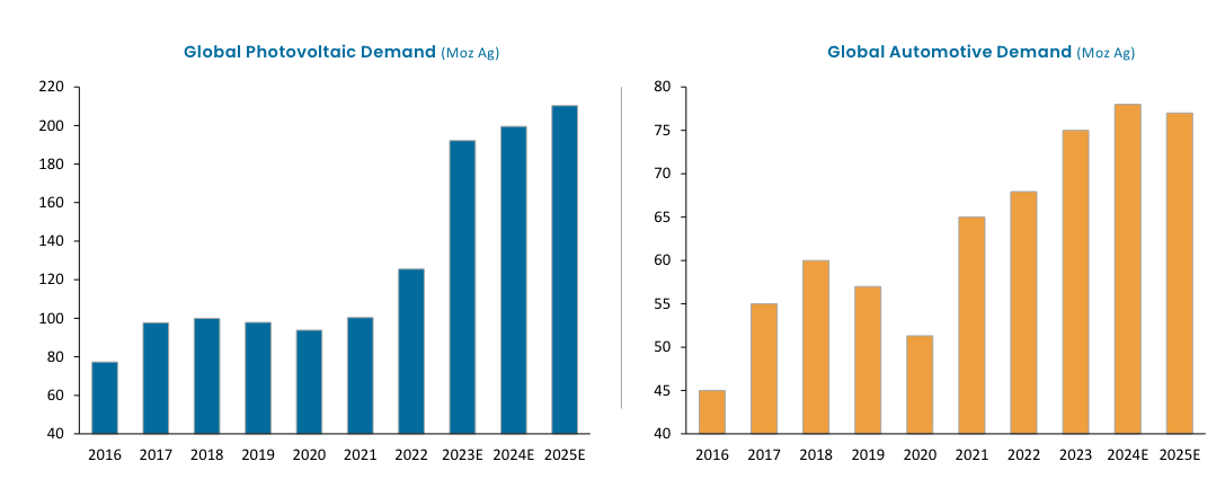

It gets better. The main emerging consumers on the industrial side are photovoltaic solar cells and fast chargers for electric vehicles.

Silver for solar installations (PV) and automobiles accounted for ~267 Moz or 22% of total demand in 2023.

By 2030, the automotive sector will account for 200Moz of demand. By 2050, 50% of all silver demand is expected to be from solar cells.

When silver boom?

Zealous #silversqueeze bros would have you believe a push though US$50/oz and beyond is only a matter of time.

And yet silver prices haven’t really read the memo, gaining a hard fought 9% over the past 12 months. Gold is up 18% in the same period.

For precious metals investors, gold has been the focus. And those physical silver deficits we mentioned? Negated by massive above ground inventories, says Metals Focus.

“At end-2023, stocks held in London and exchange registered vaults amounted to nearly 15 months of global supply and there are bullion inventories also held elsewhere,” it says.

“This is likely to prevent a physical squeeze from emerging in the short-term, in spite of the robust supply/demand conditions discussed above.”

This means investment demand, not physical demand, will likely remain the dominant price driver.

Here, the outlook also looks pretty good for silver.

“Looking ahead, recent speculative inflows into gold do create some downside risks for precious metals in general, which would extend to silver,” Metals Focus says.

“However, we expect any price weakness to be short-lived.

“Given that the Fed is still expected to start monetary loosening later this year (albeit at a slower pace than previous expected), we expect precious metals investor interest will be healthy in the second half of the year, which will ultimately be positive for the silver price.”

Where are all the silver stocks?

Many global leaders are diversified, with silver produced alongside a range of other precious and base metals.

The world’s biggest silver miner is 140-year old Mexican company Peñoles, which produced 72.4Moz in 2023 but derives just 30% of its revenue from the precious metal.

Likewise, US$7bn capped Pan American Silver (NYSE, TSX:PAAS) produced 20.4Moz silver in 2023 at all in sustaining costs (AISC) of US$18.17/oz, but also derived a big chunk of income from 883,000oz of gold production.

C$2.8bn capped First Majestic Silver (NYSE:AG, TSX:FR) also gets 50% of its revenue from gold.

Locally, the pickings are slim. The Cannington zinc-lead-silver mine in Queensland is Australia’s biggest silver producer (~12.5Mozpa), but owner South32 (ASX:S32) says zinc-lead-silver lumped together were responsible for just 8% of earnings last year.

Not the best way for investors to jump on board the silver thematic.

One of the biggest exposures on the ASX is Adriatic Metals (ASX:ADT) which produced first concentrate in February from its Vares silver (plus other stuff) operation in Bosnia.

ADT expects the mine to hit full production in the fourth quarter this year, just seven years after initial exploration began.

The US$189m development had a revenue mix consisting of ~50% base metals (like copper and zinc) and ~50% silver and gold when it was in studies a couple years back, when ADT used spot silver prices of US$24/oz as its benchmark.

Silver and gold now make up over 60% of its potential revenue mix, says CEO Paul Cronin. That could rise even further if silver and gold prices continue rising, as forecast.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.