Who Made the Gains? Here are June’s top 40 miners and explorers

Pic: Getty

What happened to the most talked about commodities in June?

Star performer iron ore hit US$US220/tonne (again) late in the month to be up ~38% year-to-date.

The benchmark lithium price in index was up another 2.9% month-on-month, according to Benchmark Mineral Intelligence.

A year ago, Aussie lithium spodumene producers were in dire straits and accepting sub-$US400/t.

Prices have now punched through $US600/t, with Chinese major Ganfeng now expecting prices to keep rising back to the 2018 level of +$US1,000/t.

Copper prices softened ~8% in June after hitting record highs in May, but Citi have upgraded their near-term outlook in light of the recent sell-off and remain bullish on prices over the next 3-6 months.

Nickel, meanwhile, continued to shrug off Chinese scare tactics to surge past $US18,500/t.

Gold did it tough, posting its worst month since November 2016 in June.

On a positive note, experts say the drop in gold equity valuations could create a buying opportunity.

And guess what investors? There’s still a tonne of money to be made in coal – especially the steelmaking stuff — as the dark clouds surrounding the sector in 2020/ 2021 begin to lift.

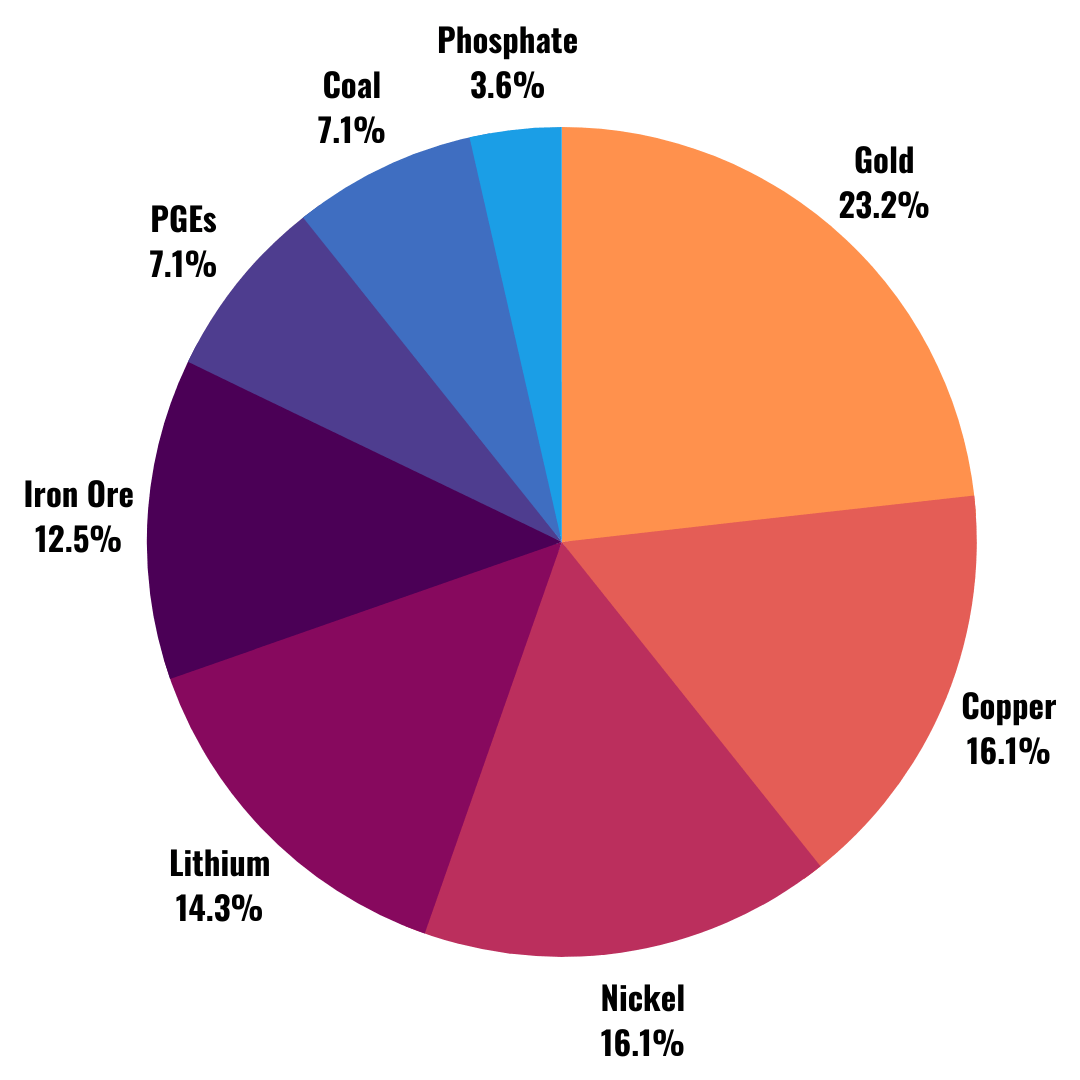

What were the top 40 resources winners for June searching for?

Here are the top 40 ASX resources stocks for the month of June >>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop

| CODE | COMPANY | MONTHLY RETURN % | PRICE | MARKET CAP | COMMODITY | WHERE |

|---|---|---|---|---|---|---|

| GBE | Globe Metals & Mining | 313 | 0.165 | $ 76,877,191.55 | Niobium | Malawi |

| COD | Coda Minerals | 251 | 1.315 | $ 107,769,145.75 | Copper, Gold | South Australia |

| FTZ | Fertoz | 190 | 0.145 | $ 26,696,339.91 | Phosphate | Canada |

| RAG | Ragnar Metals | 167 | 0.072 | $ 24,313,312.01 | Nickel, Copper, Gold | Sweden, WA |

| CVS | Cervantes Corp | 118 | 0.008 | $ 12,432,099.71 | Gold | WA |

| SYA | Sayona Mining | 91 | 0.082 | $ 422,603,020.75 | Lithium, Gold | Canada, WA |

| TRN | Torrens Mining | 79 | 0.26 | $ 17,735,883.88 | Copper, Gold | South Australia, VIC |

| LSA | Lachlan Star | 72 | 0.055 | $ 69,933,199.00 | Nickel, Copper, PGE, Gold | WA |

| CAP | Carpentaria Resources | 65 | 0.215 | $ 102,284,238.68 | Iron Ore | NSW |

| POS | Poseidon Nickel | 52 | 0.105 | $ 294,988,559.46 | Nickel | WA |

| PSC | Prospect Resources | 50 | 0.225 | $ 84,010,655.93 | Lithium | Zimbabwe |

| INF | Infinity Lithium | 46 | 0.105 | $ 42,278,728.38 | Lithium | Spain |

| ASM | Australian Strategic Materials | 45 | 7.29 | $ 1,016,998,783.74 | Rare Earths, Zirconium, Niobium, Hafnium | NSW |

| BRL | Bathurst Resources | 45 | 0.45 | $ 76,928,230.35 | Coal | New Zealand |

| AQC | Australian Pacific Coal | 44 | 0.18 | $ 9,087,265.80 | Coal | NSW |

| LTR | Liontown Resources | 42 | 0.81 | $ 1,473,479,084.61 | Lithium, Nickel, Copper, PGE | WA |

| STK | Strickland Metals | 42 | 0.044 | $ 32,351,111.50 | Gold | WA |

| GLN | Galan Lithium | 41 | 0.91 | $ 222,630,668.26 | Lithium | Argentina |

| VAR | Variscan Mines | 39 | 0.079 | $ 21,022,454.90 | Zinc, Lead | Spain |

| VMS | Venture Minerals | 38 | 0.145 | $ 192,730,996.04 | Iron Ore, Tin, Tungsten, Nickel, Copper, PGE | Tasmania, WA |

| BCI | BCI Minerals | 38 | 0.565 | $ 338,553,555.65 | Salt, Potash, Iron Ore | WA |

| LKE | Lake Resources | 33 | 0.345 | $ 365,010,802.82 | Lithium | Argentina |

| GWR | GWR Group | 29 | 0.33 | $ 99,919,526.19 | Iron Ore | WA |

| EMH | European Metals | 28 | 1.545 | $ 200,624,375.93 | Lithium | Czech Republic |

| BUX | Buxton Resources | 25 | 0.15 | $ 20,408,314.80 | Nickel, Copper, Gold | WA |

| PLL | Piedmont Lithium | 24 | 1.045 | $ 616,978,241.00 | Lithium | US, Canada |

| CRN | Coronado Global Resources | 24 | 0.87 | $ 1,458,514,745.10 | Coal | US, QLD |

| VR8 | Vanadium Resources | 24 | 0.062 | $ 25,943,534.51 | Vanadium | South Africa |

| NAG | Nagambie Resources | 23 | 0.087 | $ 43,494,114.10 | Gold | Victoria |

| AHQ | Allegiance Coal | 21 | 0.68 | $ 192,050,746.24 | Coal | US, Canada |

| MNB | Minbos Resources | 21 | 0.075 | $ 34,802,467.28 | Phosphate | Angola |

| AAU | Antilles Gold | 20 | 0.082 | $ 20,695,864.22 | Gold | Cuba |

| CTM | Centaurus Metals | 19 | 0.805 | $ 276,701,886.86 | Nickel | Brazil |

| JNO | Juno | 19 | 0.19 | $ 25,775,020.19 | Iron Ore | WA |

| DTR | Dateline Resources | 19 | 0.095 | $ 35,888,739.00 | Gold | US |

| QPM | Queensland Pacific | 19 | 0.16 | $ 192,295,612.00 | Nickel, Cobalt, Iron Ore, HPA | QLD |

| TRM | Truscott Mining | 18 | 0.039 | $ 5,340,720.22 | Gold | Northern Territory |

| DKM | Duketon Mining | 18 | 0.325 | $ 39,362,148.80 | Nickel, Copper, PGE | WA |

| AIS | Aeris Resources | 18 | 0.2 | $ 441,470,551.60 | Copper, Gold | South Australia, NSW, QLD |

| FEX | Fenix Resources | 17 | 0.37 | $ 173,979,150.40 | Iron Ore | WA |

The Top 3

In June, the Malawi government recommended Globe Metals & Mining (ASX:GBE) receive a mining licence in a “significant step forward for the company’s goal of becoming a niobium producer”.

Alloys containing niobium are used in jet engines and rockets, beams and girders for buildings and oil rigs, and oil and gas pipelines.

The company surged +310% on the news to its highest point in about nine years.

Meanwhile, junior joint venture partners Coda Minerals (ASX:COD) and Torrens Mining (ASX:TRN) hit 200m of “intense IOCG alteration”, including ~50m of copper sulphides at the ‘Elizabeth Creek’ project in the Stuart Shelf region of South Australia.

This could be huge.

Iron oxide copper gold ore deposits (IOCG) — like BHP’s Olympic Dam mine or more recent Oak Dam discovery — can be tremendously large, and simple-to-process concentrations of copper, gold and other economic minerals.

Small cap phosphate miner Fertoz (ASX:FTZ) is also running hot, up 190% over the month.

The catalyst appeared to be positive results of a two-year field study around quality and yield from the phosphate fertiliser product, which has resulted in a steady stream of orders from new and existing clients.

Full charge

Canada-focused lithium play Sayona Mining (ASX:SYA) gained another 91% in June for an eyewatering year-to-date gain of 880%.

In June, a Canadian court approved Sayona’s ~$107 million acquisition of the mothballed North American Lithium (NAL) operation, which will be integrated into the nearby Authier project to create a world scale lithium hub.

The wider lithium cohort also continue to perform well — June winners Prospect Resources (ASX:PSC), Liontown Resources (ASX:LTR), Lake Resources (ASX:LKE), Galan Lithium (ASX:GLN), European Metals (ASX:EMH) and Piedmont Lithium (ASX:PLL) are now up 50%, 95%, 360%, 150%, 28%, and 175% respectively in 2021.

At the coalface

The coal sector was hit by a confluence of shit in 2020 and early 2021. COVID-19, followed by China’s ban on Australian coal, was a one-two punch.

The irony is that while the price of Australian met coal fell to ~$US100 per tonne, Chinese steel mills were forced to pay up to $US265 per tonne for lower quality domestic coal — and much higher prices than benchmark for other imported coal.

But things appear to be coming good for ASX coal stocks.

In June, Bathurst Resources (ASX:BRL) (+45% in June) announced it would exceed 2021 financial year (FY21) earnings guidance of $55.4m as prices recover.

During the last quarter the premium coking coal benchmark price surged from $US110/tonne to a recent high of US$182/tonne, it says.

Other met coal miners and explorers in our top 40 for June include Australian Pacific Coal (ASX:AQC), Coronado Global Resources (ASX:CRN), and Allegiance Coal (ASX:AHQ).

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.