Guy on Rocks: End of destocking a bullish sign for battery metals

Oliver Hardy and Stan Laurel, circa 1935. Pic: Getty/ Archive Photos / Stringer

Guy on Rocks’ is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

Market Ructions

Not much news on the precious metals front other than Palladium’s extreme volatility continues, up US$150/ounce for the week or 6% to close at US$2,722. A lower US dollar along with lower US Treasures saw a late rally in gold which rose US$8 for the week closing at US$1788/ounce.

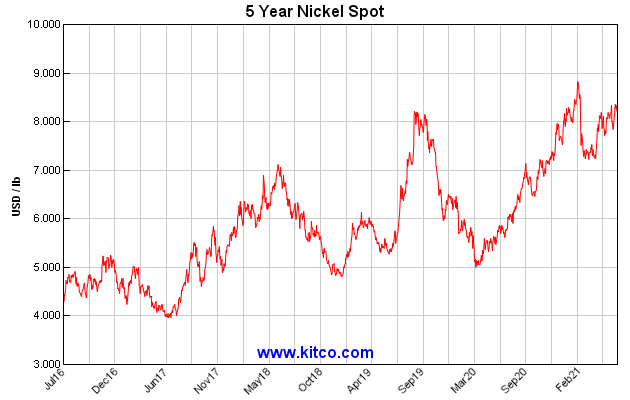

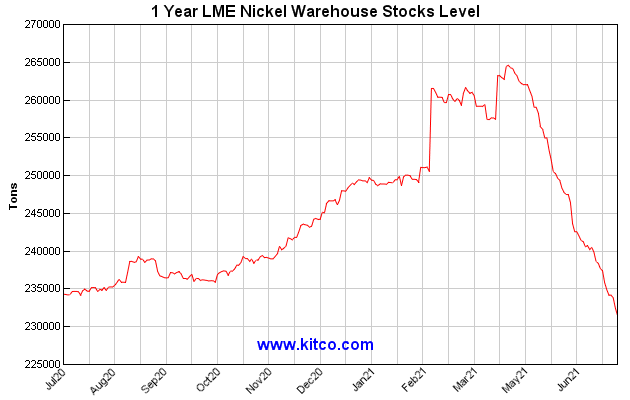

The de-stocking trend we have seen in the EV space that has characterised much of CY 2021 looks set for reversal as evidence by an 8% lift in cobalt in the last two weeks and nickel up 16% (figure 1) since April with LME stockpiles rapidly declining (figure 2).

Nickel-sulphate is also likely to follow this trend. As I have previously mentioned, many of the banks are projecting a significant increase in nickel supply but I am going to heavily discount this prediction given the difficulty in bringing High Pressure Acid Leach (HPAL) projects on-line.

In other news on nickel, Tsingshan’s announced recently that it intended to build a 2,000MW clean energy facility in Weda Bay in the next 3-5 years in addition to investing in a 5,000MW hydropower to ensure clean energy supplies.

Indonesian nickel laterite producer Silkroad also recently signed an offtake agreement with a Tsingshan subsidiary to supply 2.7mt of high-grade nickel ore.

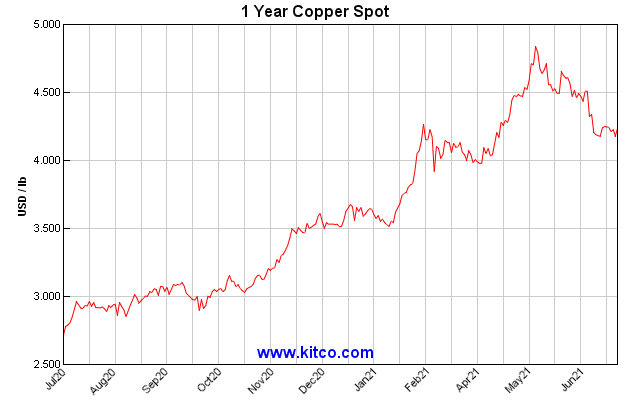

Copper (figure 3) consolidated last week to close at US$4.21 after hitting an all-time high of US$4.84 three weeks ago.

Copper futures, as we have seen in recent weeks, continue to have negative spreads however the end to the recent de-stocking should see an upward move in the copper price in the short term and a tightening of refined balance.

We are also keeping a close watch on political developments in South America, and it looks like the senate in Chile has backed off on the stiffer mining royalties which were due to be approved by the lower house shortly.

Citi (Citi Research, 29 June 2021) have upgraded their near-term outlook for copper in light of the recent sell-off and remain bullish on prices over the next 3-6 months.

This is tempered somewhat by the ongoing freight, microcontroller, other supply constraints such as power shortages in some regions in China, demand destruction, substitution, and the recent SRB copper inventory sales.

Citi’s China Copper End-use Tracker (CCET) rose by +5% y/y and +8% on 2019 levels.

By comparison, apparent refined copper consumption growth was soft at -14% y/y in May with patchy economic data from China including export PMI’s falling to 48, export growth missing expectations (27% vs consensus: 32%), industrial production (8.8% vs 9.2% consensus), and retail sales (12.2% vs 14% consensus).

Our star performer iron ore hit US$220/tonne (62% fines) during the week with 65-58% Fe-spread (figure 5) reaching a new all-time high of $94/tonne as steel margins come under pressure.

Citi Research (Metals Weekly, 29 March 2021) consider that the current premiums reflect steelmakers’ attempts to reduce coke consumption on the back of China’s coal squeeze and higher domestic coking coal price of $300/t, but also to meet tighter emissions targets.

This will no doubt force iron ore producers, at least for the short term, to think hard about their product mix. Anglo American for example are produce 65% iron ore from Kumba whereas BHP and Rio Tinto are averaging 61% and 60% respectively.

Morgan Stanley (Commodity Manual, 29 June 2021) is predicting a pull-back in the iron ore price to US$160 (62% fines) on the back of slowing Chinese steel output (MSe -5% 2H21 vs 1H), easing credit growth and weak new property starts (Apr-May -8% yoy), among other slowing industrial data.

Furthermore, a 9% (or 47Mt) increase in shipments from major producers in 2H21 vs 1H also supports a softer iron ore outlook. Even at these levels, the iron ore sector looks as strong as ever.

Company News

It appears the government of Cameroon isn’t too concerned about Sundance Resources’ (who were delisted from ASX on 21 December 2020) claim on the Mbalam-Nabeba iron ore deposit as they now appear to have signed a deal on Friday with two China linked companies to construct a railway from the coast to a large cross-border iron deposit.

As I mentioned earlier this year, Sundance has filed for international arbitration and billions of dollars in damages, saying Cameroon and Congo Republic have violated contracts by developing the Mbalam-Nabeba project with Chinese investors.

I think this will be a fascinating tug of war as Cameroon (among other developing nations) receive millions of dollars in grant money and aid from the world bank, one of the conditions however is that it must abide by international arbitration decisions.

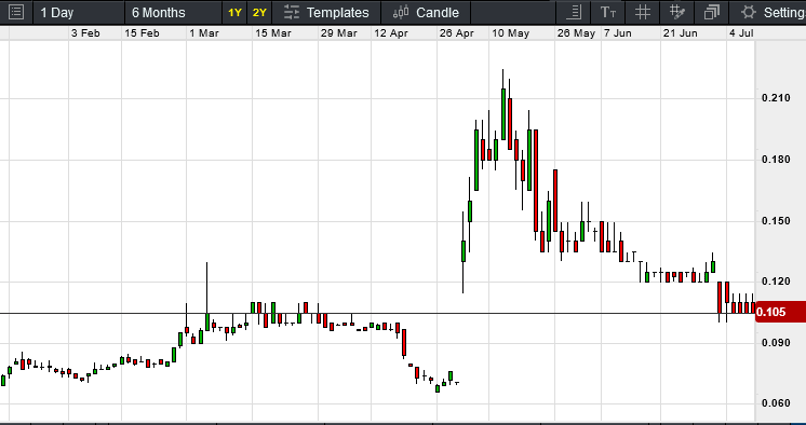

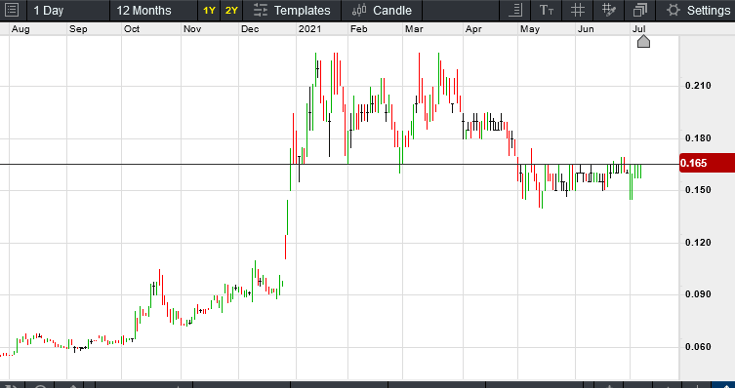

Odyssey Gold’s (ASX:ODY) Christmas in July turned out to be a visit from the Christmas grinch instead, cancelling their SPP at 12.5 cents after raising $10 million at 12.5 cents early in June 2021.

The stock dropped from around 12.5 cents to close at 10.5 cents on heavy volume of 26 million shares.

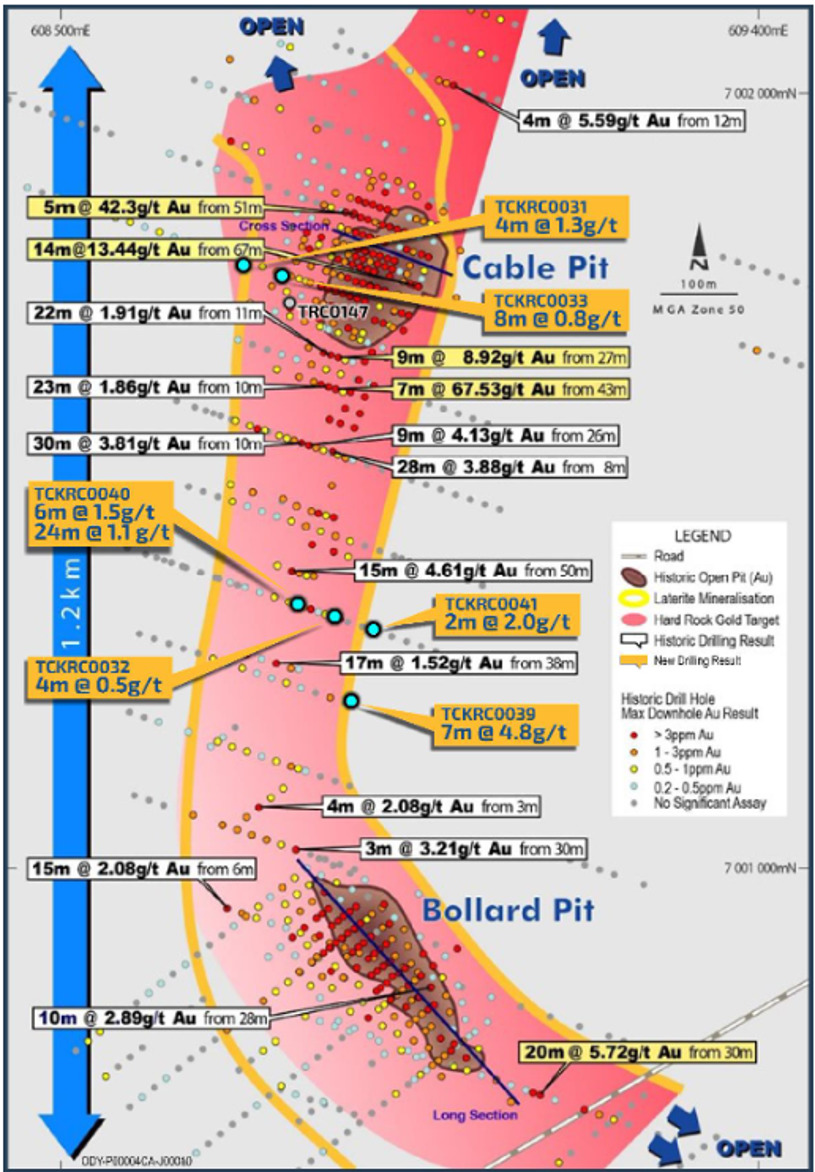

Appears the market didn’t like the drilling results announced to ASX on 2 July 2021 which I thought was a little harsh given there appeared to be reasonable continuity between Gable and Bollard Prospects with encouraging intersections including TCKRC0040 with 6m @ 1.5g/t Au from 114m and 24m @ 1.1g/t Au from 132m.

Better results from follow up drilling at Bottle Dump included 8m @ 1.9g/t gold (TCKRC0029 from 216m) which was a far cry from the 2.3m @ >600g/t gold but still a respectable result.

Results from a further 18 holes are due shortly and overall, the Tuckanarra Project is shaping up quite well.

At an enterprise value just over $50 million the stock isn’t cheap but significantly better than some of the recycled rubbish that has come across my desk over the last year or so.

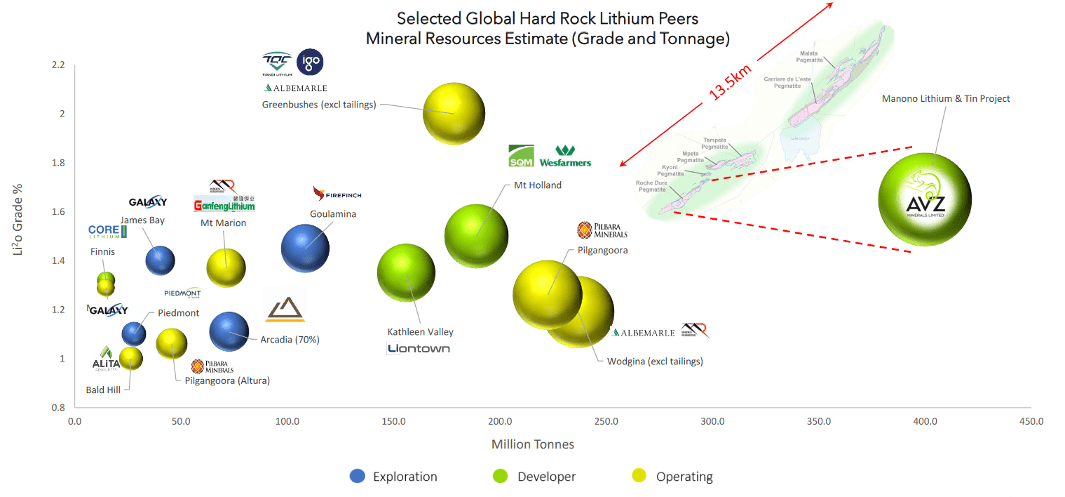

AVZ Minerals (ASX:AVZ) — which is developing the Manono lithium and tin project (60% option to increase to 75% interest) in the DRC — announced a $40 million capital raising on Friday at 13 cents per share to institutional investors (ASX Announcement 2 July 2021).

The project boasts an impressive set of financial metrics (notwithstanding the long distance to port) including a $US1bn post tax NPV10, 33% IRR, based on JORC proven and probable reserves of 93 million tonnes at 1.58% initially producing 700,000 tonnes of SC6 (spodumene concentrate) and 46Ktpa of primary lithium sulphate.

As far as hard rock resources, this is a world class project (figure 9).

The bulk of the placement will go to increasing AVZ’s stake in Manono to 75% ($26 million), completing the Manono Camp and deposit long lead time items and for working capital.

Speaking of the divergence in junior and large cap valuations, I am seeing a lot of overpriced resource plays turning up with exploration portfolio’s that has given them “first mover advantage” status.

This is entirely true as much of the unloved moose pasture has lain idle since the last failed exploration program over the last 30 years or so.

Overall, the junior resource sector is smattered with a lot of overpriced shells in my opinion (or mutton dressed up as lamb), so its buyer beware.

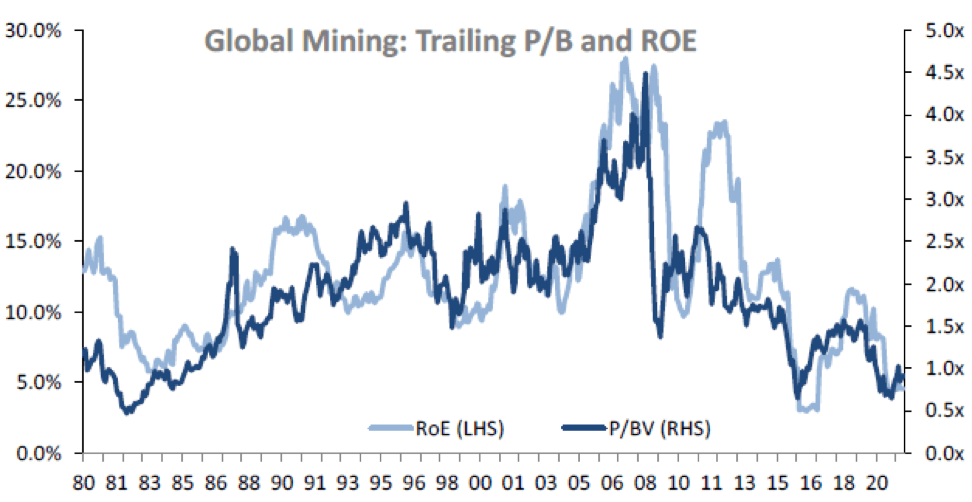

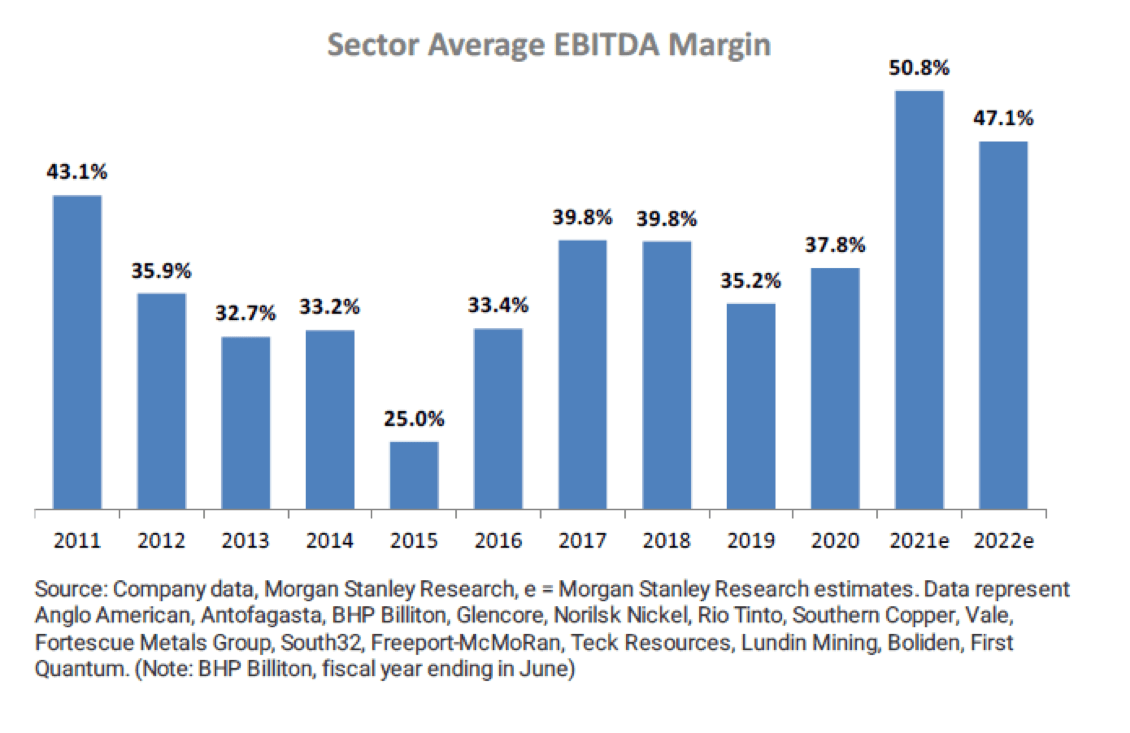

While we are seeing a lot of over-priced plays on the small end, the large cap stocks are trading on very modest price/book and return on equity multiples (figure 10) on the back of surging EBITDA margins (figure 11).

New Ideas

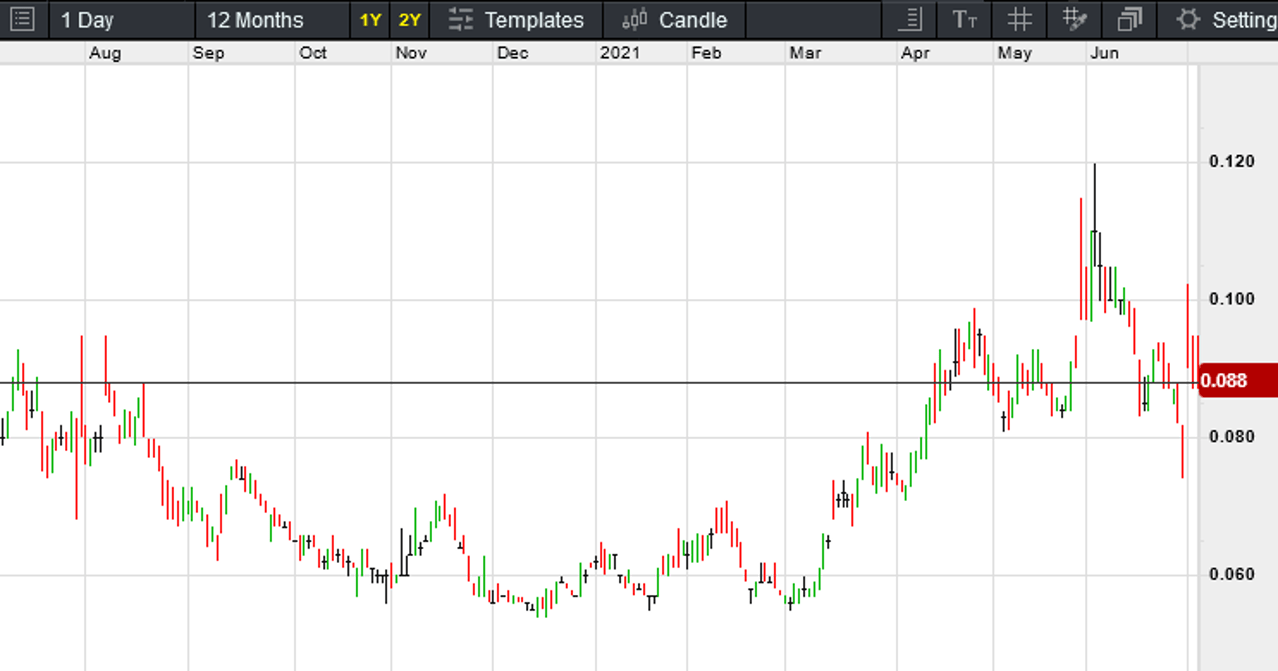

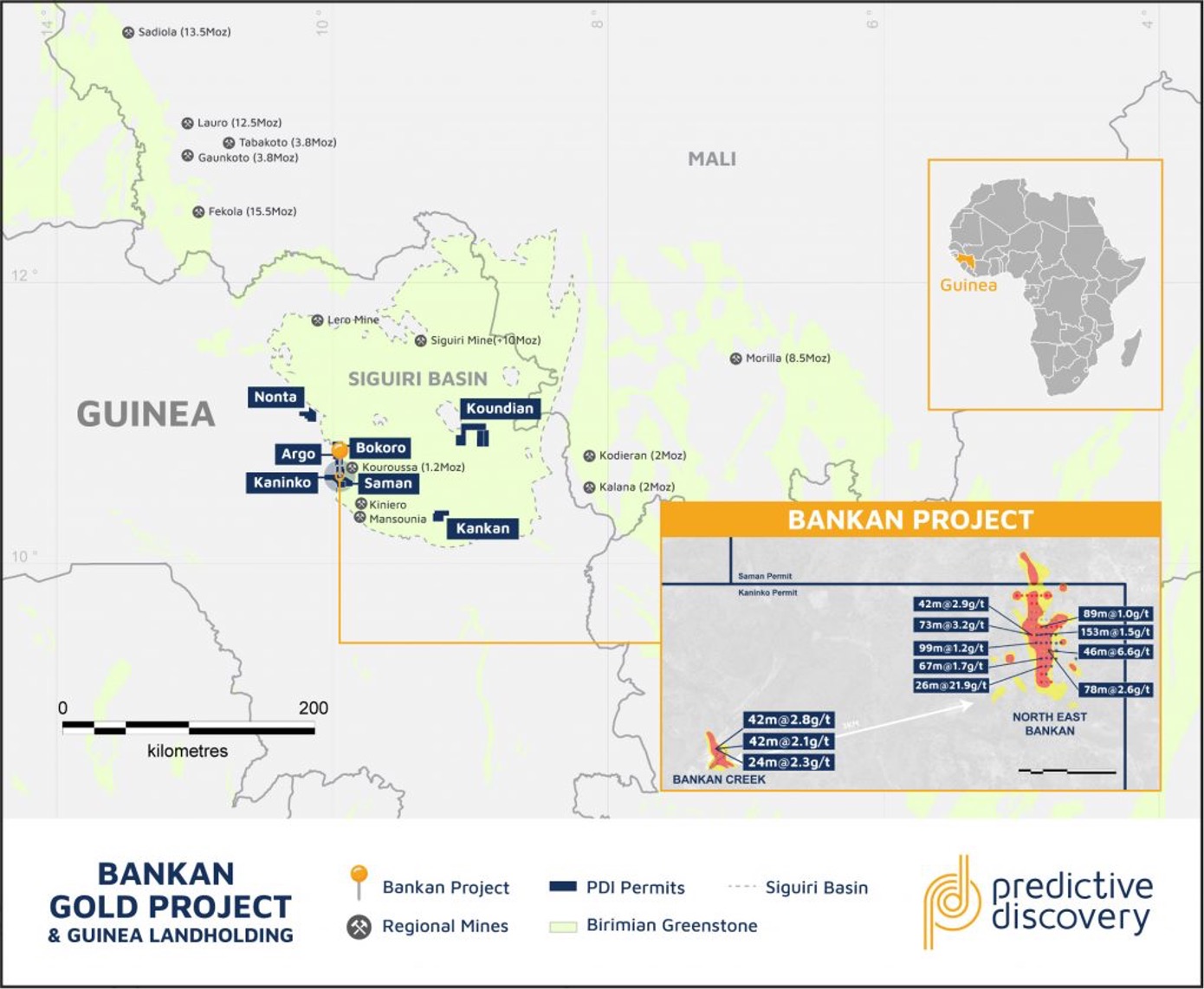

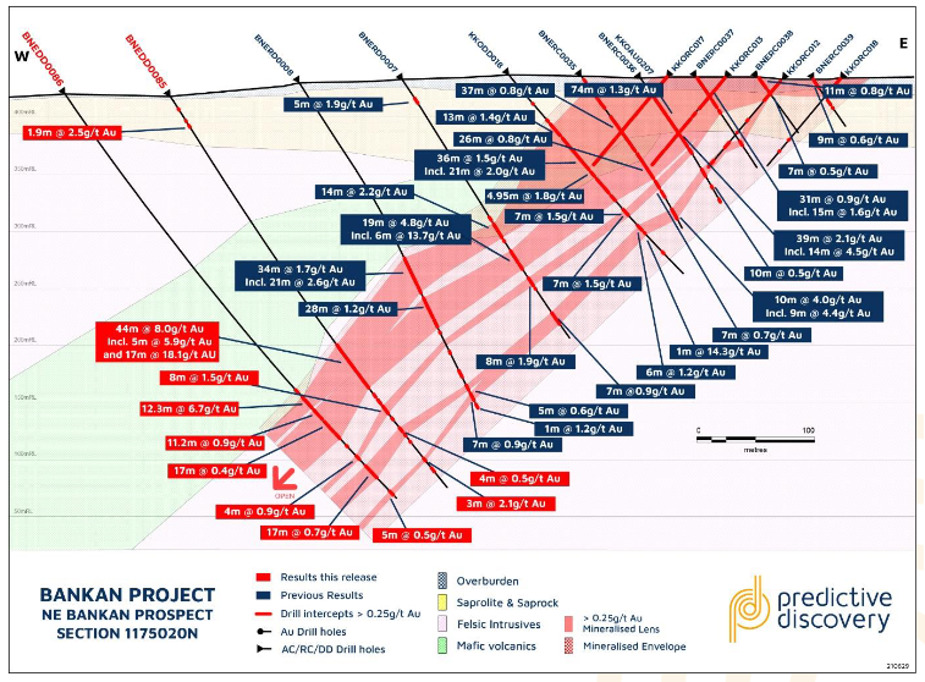

Predictive Discovery (ASX:PDI) is on track to publish a maiden JORC Resource at its Bankan Creek Project situated in the Siguiri Basin in Guinea (Figure 13).

Over 70,000 metres of drilling has been successful in the discovery of the NE Bankan Prospect comprising a 1.6km long zone of shallow, oxide, gold mineralisation that remains open at depth and along strike and the Bankan Creek Prospect, situated 3km west of NE Bankan.

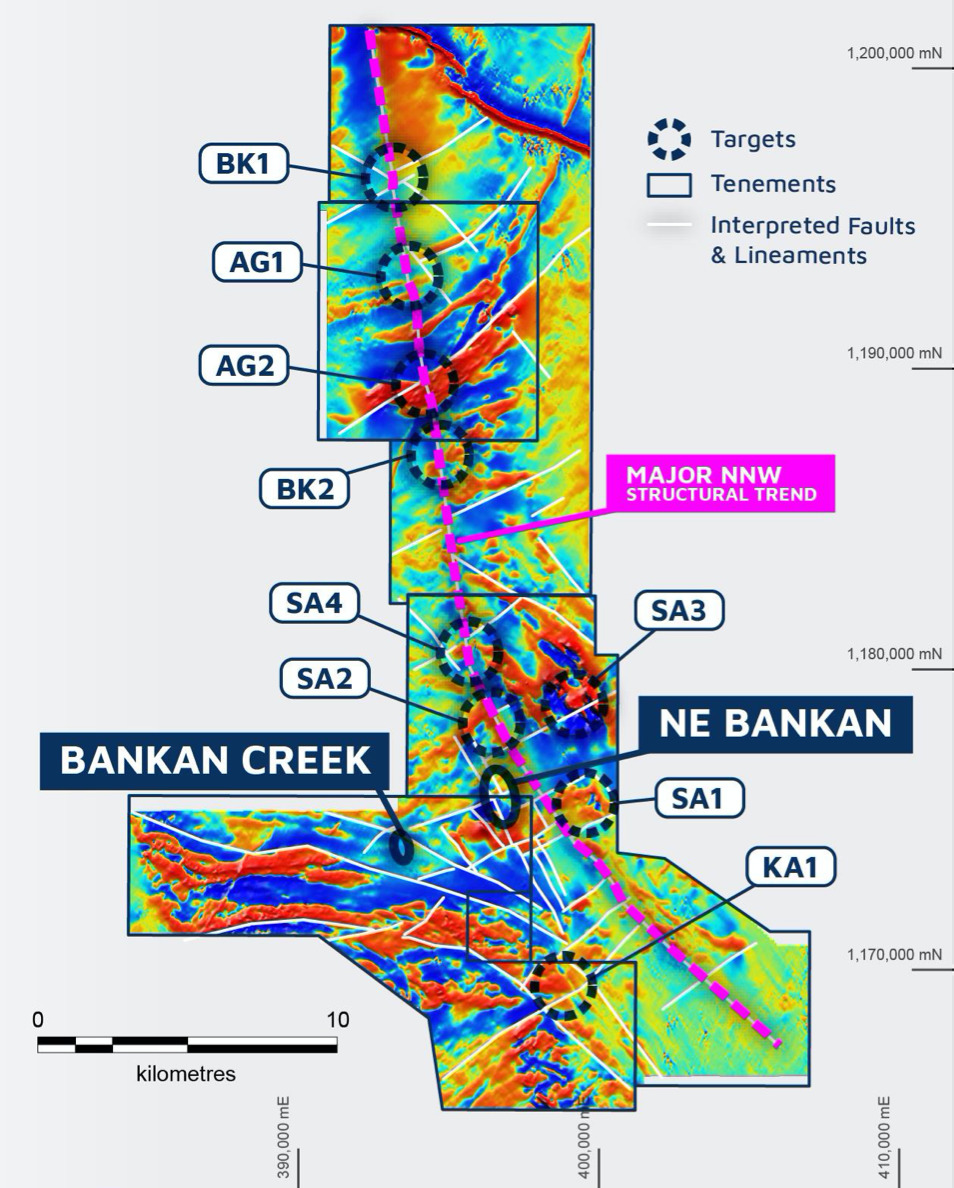

A recent completed magnetic survey has revealed a 35km structural corridor containing 9 high priority targets associated with cross cutting ENE-WSW striking faults (figure 14).

The company announced (figure 15) the results of a recently completed 1,060m diamond drilling project returning a number of impressive intercepts, including NE Bankan intercepts:

- BNEDD0085 with 44m @ 8.0g/t Au from 265m downhole;

- BNEDD0086 with 12.3m @ 6.7g/t Au from 338m downhole

N Bankan also returned some impressive intercepts including:

- BCKDD0008: 15m @ 4.0g/t Au from 48m downhole and

- BCKDD0016:12m @ 5.0g/t Au from 30m downhole.

I think PDI is on to something pretty big here at some decent grades so I will stop short of estimating a tonnage and grade however there is plenty of upside from the current market capitalisation of circa $110 million.

On that basis I will let the reader speculate as to what’s around the corner.

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.