Silver Surfer: Energy boffin Roscoe Widdup says silver is the metal that makes the grade

Silver is catching a major break from electrification and rising energy demand. Pic: Bruno Vincent/Getty Images

- Triple Eight Capital’s Roscoe Widdup thinks rising energy demand will be positive for nuclear, gas, renewables and the electricity supply chain

- Silver could be the best metal to fit that thematic

- Conditions are in place for continued gold strength

Copper seems to be the commodity on every fundie’s lips and every mining major’s wish-list.

But it’s not the metal Triple Eight Capital‘s Roscoe Widdup counts as his best bet right now to play the thematics of rising energy demand and electrification.

He’s pointing to less heralded silver, a precious metal increasingly shifting from investment to industrial use.

New York-listed Pan American Silver (NYSE:PAAS) is one of Widdup’s key holdings crossing both T8’s energy and gold funds, a pointer to silver’s unique character. The metal is currently trading on the spot market at US$30.44/oz, 30% above last year’s average of US$23.40/oz.

That’s followed gold, which has hit record highs this year. But Widdup says the technological tailwinds driving silver use in solar panels are vastly under-appreciated.

“Silver as a commodity is perceived to be gold’s poorest cousin and a precious metal, and we observe the reality is really two-thirds to three-quarters of the demand for silver is for industrial purposes,” he told Stockhead.

“Whereas in gold less than 10% of demand is from industrial sources.”

The biggest driver of demand in the silver market is photovoltaic solar, where Chinese producers are now shifting to technologies with increased silver consumption.

“At present that’s growing at about 20% per annum. That has been cyclical also, never forget the cycle, but the cycle is driven by the solar cycle but also the cell technologies that are proliferating within the solar industry,” he said.

“In solar they contain different amounts and concentrations of silver per watt of capacity, and what we observe is happening at the moment is we see an increasing intensity in the use of silver in the prevalent cell technologies.

“Last year, the majority of cells manufactured out of China, which is about 85% of global cell production, the majority of those were perc cells.

“This year more than 50% will be a combination of topcon and heterojunction cell technology – topcon and heterojunction are 30% and 100% more silver intensive per watt than perc and their proportion of production increases next year to become a significant majority.

“So we see the greatest source of demand for silver, the intensity of use increasing in the short term, which is a favourable position from a demand side.”

Finding balance

The silver market has already been in deficit for the past half-decade, a function of rising demand, weak prices and the fact silver is largely produced as a by-product of gold and other metals.

That means the supply side, heavily concentrated in Latin American countries including world leader Mexico, has seen underinvestment.

“As much as there’s plenty of silver sitting on the sidelines in tea sets, jewellery and bullion, that stuff can be quite sticky and the fact that we’re in a deficit is a really favourable dynamic,” Widdup said.

“The supply side has probably been underinvested in since the end of the film photography era.

“If you go back to the year 2000, it’s the peak of film’s consumption of silver, it’s a really critical component in old school film and at that time the film industry accounted for about 25% of total silver demand.

“Since the advent of digital cameras, that source of demand has fallen by over 90%.”

The project development pipeline is as dry as copper, he argues.

“People get really excited about copper and they point to falling grades, rising strip ratios, lack of big new discoveries, the cost and lead time to bring on new supply,” Widdup said.

“For the people who love copper, we would encourage them to look at silver.

“It has many of the same characteristics and a lot of that supply is centred in central and Latin America, (a) difficult part of the world to be doing business in these days.”

Gold can keep on going

Widdup says gold has been the best performing asset class of the last 25 years and has returned 8% per annum since the end of the gold standard in 1971.

“Our view is that the next 20 years are unlikely to be very different from the last 20.”

Gold “didn’t crack” during one of the steepest rate rises in history. While Widdup views ETF demand as the swing factor pushing prices up or down right now, he said the root cause of recent gains appears to be central bank buying.

Countries in the developing world are trading out of US dollars to avoid sanctions like those seen in Russia after its invasion of Ukraine, which left it unable to trade in the flagship global currency.

“Central bank purchasing doubled relative to the average that stood since the end of the financial crisis. The current level of purchasing is historically significant,” Widdup said.

“Central banks haven’t really been buying gold in these quantities since the ’60s or ’70s.

“That’s a really profound change that we believe has escaped most people in markets.”

There are specific characteristics T8’s gold fund looks at for its gold exposure.

Widdup estimates only around 60 gold miners are truly institutionally liquid.

Of those he estimates a third go backwards, a third are ‘going nowhere’ and a third are doing a “really good job of maintaining or incrementally increasing production” in a way that offsets cost inflation and maintains mine life.

Other factors come into T8’s decision making on gold stocks, including environmental management, western strength corporate governance and the avoidance of ‘idiosyncratic risk’. It doesn’t invest, for instance, in the “AK47” or “Coup Belt” countries of Africa’s Sahel region.

And in mining stocks, Widdup says investing in margins rather than the price is key.

T8’s sole ASX gold exposure is Perseus Mining (ASX:PRU), a +500,000ozpa producer with mines in Cote d’Ivoire and Ghana and development assets in Tanzania and Sudan along with a 19.9% stake in Guinea gold explorer Predictive Discovery (ASX:PDI).

PRU has built a massive cash pile and reliable free cash flow from its Sissingue, Edikan and Yaoure mines.

Energy rush

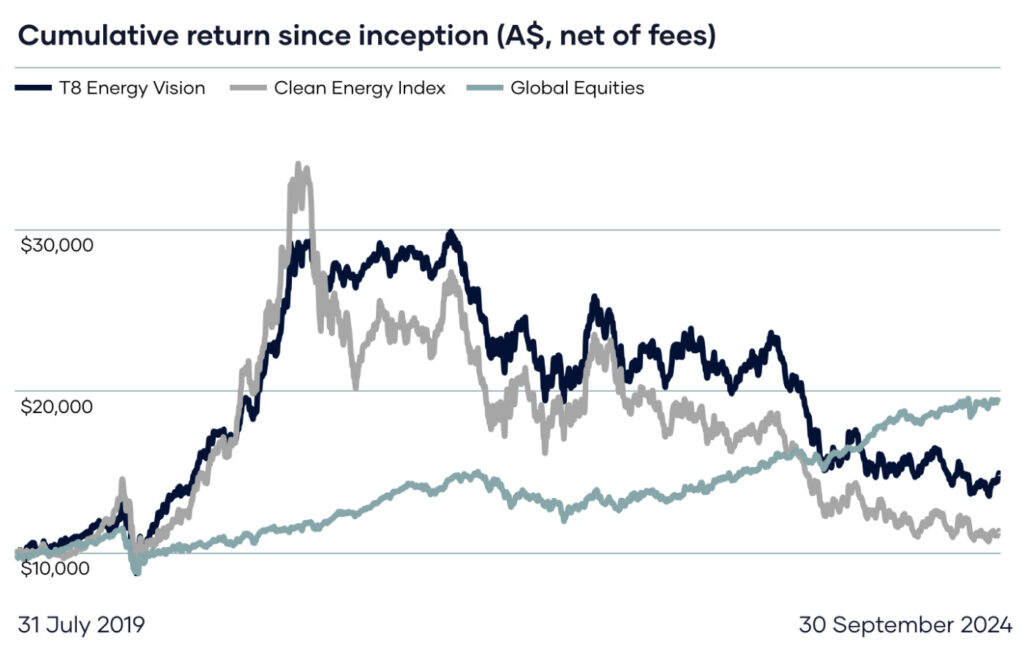

While T8’s gold fund is up 37.2% YTD, roughly in line with gold bullion and slightly above equities, its future energy fund T8 Energy Vision has had a tougher 2024.

But Widdup is positive on the growth outlook for all forms of electricity generation.

While nuclear and gas will seemingly be placed front and centre in the policy platform of returning US President Donald Trump, the rise of data centres in the United States has seen demand rise there for the first time in 20 years.

Widdup thinks the pace at which new infrastructure is required means it will be bullish for renewables as well, with the slower build time and capital intensity of nuclear meaning it’s a longer term solution.

T8 also invests across the supply chain including in companies working in niche but high barrier to entry areas like cabling, whose order books are starting to run into multiple years.

“We invest in these companies because they have got fantastic fundamentals and we specialise in energy because no one else does,” he said.

“And we believe there’s an extraordinary future for the energy complex and energy companies … there are some really interesting developments within the supply chain of what gets described as the grid.

“The products themselves are cables and electrical equipment, the sort of stuff that sits in those substations that we all drive past and we see where the power lines come in and go out of: Transformers, switch gears, breakers, things that most people have never seen or wouldn’t recognise if they saw it.”

It is, like all industries, cyclical. Utilities, for instance, were among those hardest hit by interest rate hikes as the US Fed fund rate moved from close to zero to up to 5.5% in under two years. But Widdup sees reasons to be optimistic about opportunities in the sector.

“They’re pretty consolidated industries and the companies have got very long histories and experience in producing those products to a very high quality,” he said.

“It’s traditionally been a low growth, very GDP correlated, low margin industry.

“And we observe that with the under investment in power grids the world over, with the investment in renewables, necessitating new grid connections and new transmission there is, we believe, like many other parts of the energy industry, a period of secular growth ahead of it.”

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead.

Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.