Who Made the Gains? Few of February’s ASX miners and explorers made the 70%+ club

Pic: via Getty Images.

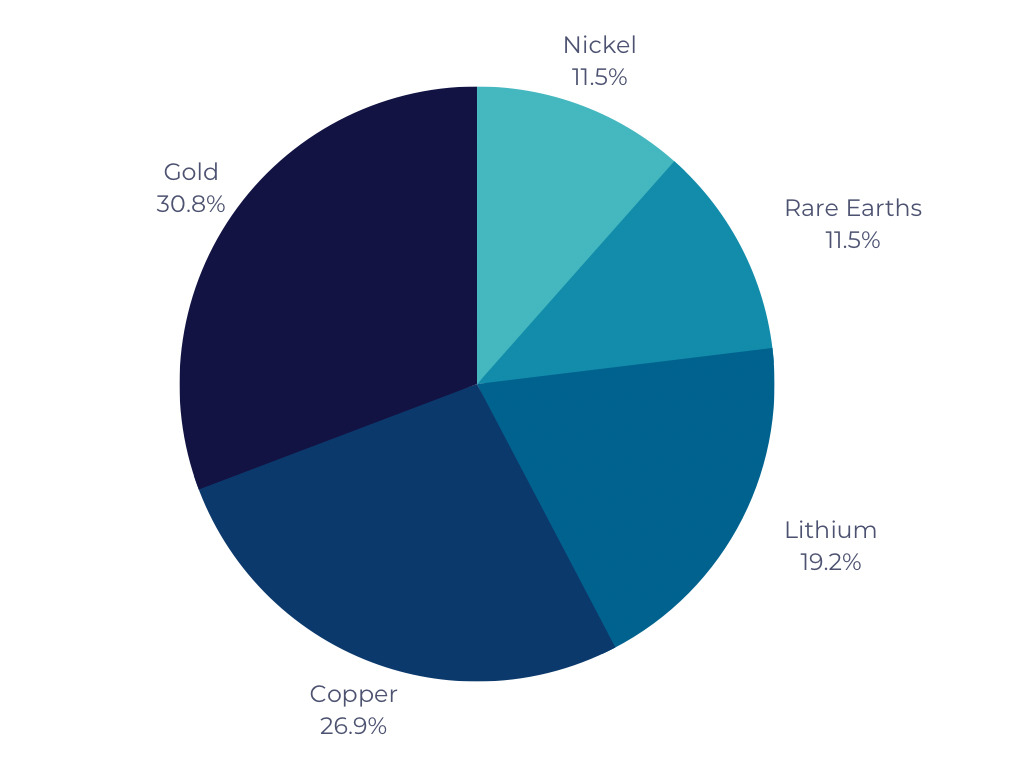

- Favoured commodities in February: Gold, followed by copper, lithium, nickel and rare earths

- No resources companies made gains of 100% or more, in fact only two managed 70%+

- Top ASX resources stocks for January: LDR, PSC, MTM, SLM and BUX

A bit of a flaccid month for ASX stocks in February, with no resources companies making a gain above 100%.

This means everyone misses out on a coveted spot in Stockhead’s ‘Bag Tally’ which is a completely unscientific measure of resources sentiment in any given month.

And ‘The 70%+ Club’ just doesn’t sound as cool.

While prices remain strong for metals like iron ore, coal, lithium, nickel and gold, just one major commodity tracked up and that was uranium – and there was not a single uranium player to be found about the top resources stocks for the month.

Last year March was a mad month of innumerable gains. Investors will be hoping for the same, though certainly not for the same reason, as Stockhead’s Josh Chiat points out, given last year’s surge was powered by Russia’s invasion of Ukraine.

Anyway, let’s take a look at which commodities and companies managed to sneak in some gains.

Here’s a breakdown of the five most popular commodities for February:

Here are the top 20 ASX resources stocks for February >>>

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

| Code | Company | % Month | Price | Market Cap | Commodity focus |

|---|---|---|---|---|---|

| LDR | Lode Resources | 88% | 0.235 | $16,592,311 | Gold, silver, copper |

| PSC | Prospect Res Ltd | 70% | 0.195 | $87,829,298 | Lithium |

| MTM | Mt Monger Resources | 69% | 0.145 | $5,987,543 | REE, gold, lithium, nickel |

| SLM | Solis minerals | 68% | 0.160 | $7,444,552 | Lithium, copper, gold |

| BUX | Buxton Resources Ltd | 68% | 0.210 | $35,008,553 | Graphite |

| CBH | Coolabah Metals Limi | 57% | 0.135 | $5,062,500 | Copper, gold, lead, zinc |

| RBX | Resource B | 56% | 0.140 | $7,704,427 | REE, lithium |

| KNB | Koonenberry Gold | 46% | 0.083 | $6,287,785 | Gold |

| OM1 | Omnia Metals Group | 41% | 0.240 | $7,263,101 | Nickel, copper, PGE, gold |

| PLG | Pearl Gull Iron | 41% | 0.045 | $7,038,731 | Iron ore |

| EQR | Eq Resources Limited | 40% | 0.063 | $80,546,782 | Tungsten, gold |

| RVT | Richmond Vanadium | 39% | 0.390 | $32,327,927 | Vanadium |

| PEK | Peak Rare Earths Ltd | 39% | 0.610 | $123,945,896 | REE |

| ADY | Admiralty Resources. | 33% | 0.008 | $10,428,633 | Iron ore, cobalt, nickel |

| RNX | Renegade Exploration | 33% | 0.008 | $7,453,470 | Copper, gold |

| SLB | Stelar Metals | 33% | 0.200 | $7,663,500 | Lithiu, copper, zinc, cobalt |

| BRL | Bathurst Res Ltd. | 33% | 1.085 | $196,143,775 | Coal |

| EQN | Equinox Resources | 31% | 0.210 | $9,450,000 | Iron ore |

| ALM | Alma Metals Ltd | 30% | 0.013 | $10,054,009 | Copper |

January Top 5

The explorer entered low orbit (and then floated back down, slightly) on an outstanding silver drill hit – 116.1m at 1003g/t silver equivalent from 90m, including 3.1m at 3325g/t silver from 201m – at the historic Webbs Consol project in NSW.

That’s not true width but still very thick, very high grade, and not too deep, three basic criteria punters should look at when evaluating drill results.

And MD Ted Leschke is pretty stoked.

“We are very excited about the recommencement of drilling at the Webbs Consol Silver – Base Metals Project,” he said.

Told you so.

“Drilling to date has discovered six mineralised lodes and revealed that the Webbs Consol mineral system ismuch more extensive than previous recognised.

“The company is well funded for the planned drill program and beyond.”

The plan now is to completed an additional 26 DD holes totaling approximately 5,000m to test extensions of the previously announced holes in addition to testing new targets.

On Valentine’s Day, better than roses or chocolates, the company announced Phase 1 RC drilling at its Omaruru lithium project in Namibia had been completed.

Omaruru is in Karibib region, which hosts multiple LCT-style pegmatites at surface and confirmed by several walk-up targets where previous drilling and historical artisanal workings have returned strong lithium intercepts.

“It offers outstanding potential to rapidly delineate a Mineral Resource estimate and make significant new lithium discoveries,” the company said.

All assays are expected to be returned, and initial geological interpretations complete, during Q1 2023 – which is pretty much what the company told the ASX after getting a speeding ticket shortly after the announcement.

PSC has $30.3m cash at the end of December “to support future growth activities anchored on its battery and electrification minerals strategy”.

MTM acquired the Canadian rare earths-niobium exploration project called ‘Pomme’ in late Feb, and is now cashed up to explore after raising $3m via placement at 10c per share, a small 4.8% discount to the last closing price on 23 February.

MTM directors will toss in a collective $70,000 as part of the placement, if shareholders approve.

Proceeds will be used in a maiden drill campaign and metallurgical testwork at Pomme, which it bought from TSX listed explorer Geomega Resources for ~$1m in cash and shares.

The company says it has similar geology to Geomega’s advanced 266Mt Montviel carbonatite REE-Nb deposit, just 7km away.

Just two holes were punched into Pomme back in 2012, but they both returned thick mineralised intersections interspersed with high grade chunks, including a highlight 508.3m @ 0.43% TREO, 413ppm Nb2O5 and 1.48% P2O5, from 73.7m depth.

MTM managing director Lachlan Reynolds say he will travel to the site from early March “to progress our maiden drilling program”.

The company had previously said fieldwork at Pomme, including diamond drilling, was expected to commence after spring thaw in May 2023.

Latin Resources spinout SLM listed December 2021 following a $6m IPO, with a focus on three large-scale copper exploration projects in Chile and Peru.

Underwhelming initial exploration results and poor share price performance over the ensuing year culminated in a lithium pivot last month.

The company is now acquiring 22 greenfields lithium exploration licences in Brazil in a similar geological setting to Latin’s Colina deposit, it says.

“Brazil is fast becoming a Tier 1 destination for hard rock lithium explorers and producers alike,” SLM CEO Jason Cubitt says.

“The value to be generated is significant in the short term through building an extensive portfolio of prospective lithium ground in the country to complement our copper exploration assets in Peru.

“Brazil is still very much in its infancy with lithium exploration and offers a junior explorer such as Solis an exceptional opportunity to discover a material asset.

“Having our largest shareholder, Latin Resources, in the country will expedite the commencement of exploration and building of the team needed to advance these projects.”

The company completed a short scout exploration RC drill program at its Graphite Bull in WA in Feb and says all five holes intersected graphite mineralisation.

BUX believes the targets indicate the project is a much larger system than previously thought, with a mineralised strike extent of over 1,880m now drill-confirmed.

Within this >1,880m strike extent, Buxton’s 2014 Inferred Resource of 4Mt at 16.2 % Total Graphitic Carbon (TGC) occupies a strike length of just 460m.

The company says this outcome – combined with recent and ongoing metallurgical testwork – “positions Graphite Bull as the most attractive graphite project in WA, possibly Australia.”

Assay turnaround is likely to be 4-6 weeks. Meanwhile, the company will complete visual estimation work to assess thicknesses and approximate grades intersected in this drilling.

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.