You might be interested in

Mining

Gold Digger: Overvalued or racing towards US$2500/oz? Will the real gold price please stand up?

Mining

Godolphin takes full control of its Narraburra project, where rare earths ain’t so rare at all

Mining

Mining

We know you’re all excited to get a taste of what commodities presented themselves as the ones to watch in the month of February after January gave us a delectable appetiser for what mining and metals investors could gorge on with China emerging from Covid to return to its previous strong levels of economic growth.

If those returns had your tail up, get ready to stop wagging them because the premium organic dog food is out the window after a barren February and the discount kibble is back in the pantry.

While prices remain strong for metals like iron ore, coal, lithium, nickel and gold, just one major commodity tracked in Up, Up, Down, Down was a winner and that was uranium … by half a per cent.

Last year March was a mad month of innumerable gains. Investors will be hoping for the same, though certainly not for the same reason, given last year’s surge was powered by Russia’s invasion of Ukraine.

This year is already looking more restrained, with many of the supply and demand shocks from Covid and the start of the war in Europe appearing to shake out, while metal heads wait for the long term trend of decarbonisation and electrification to boost demand for battery materials.

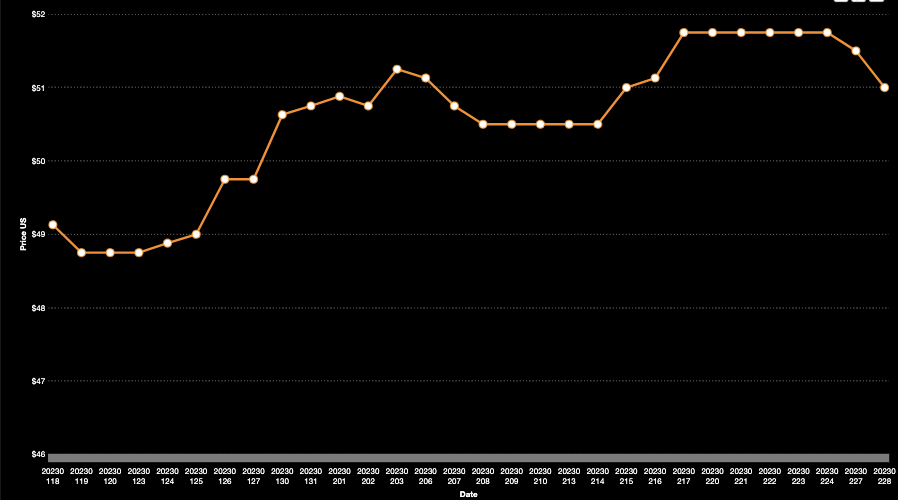

Price: US$51/lb

% Change: +0.5

It has been a long, cold nuclear winter for uranium miners, who have never really recovered from the devastating blow dealt to the industry by the reactor meltdown in Fukushima in 2011.

But those inside the sector are talking up its prospects as the push to replace fossil fuels with lower emissions energy sources gathers pace.

Three important factors are driving uranium spot prices to levels from where producers can begin to make plans about opening up or expanding production.

One, Sprott’s physical uranium trust continues to be a big buyer of spot pounds, ensuring utilities will be less able to rely on an arbitrage between spot and contract prices to fill their order books.

Two, utilities are expected to fall short on their contracting requirements very soon, prompting a need to secure additional supplies from producers.

Three, Western producers are seeing demand from new markets previously serviced by Russia’s massive enriching industry.

“The potentiality in 2023 for the uranium market and therefore uranium equities is profound,” Bannerman Energy (ASX:BMN) boss Brandon Munro told Stockhead’s Reuben Adams in a recent interview.

“There are some very high price scenarios that need to be taken seriously.”

Munro says the bear market from 2011 to 2020 could well be matched by a bull market of equal length, given the long contracting cycles seen in the uranium industry.

“The adage in commodities is that ‘the cure for high prices is high prices’, but it takes so long to get uranium mines permitted and up and running, that there isn’t the responsiveness to higher prices that you would expect to see in other commodities,” Munro told Adams.

“In uranium there is limited downside risk from current price levels, with a significant probability of upside risk.

“And there are some extraordinary upside risk scenarios that should be part of any investment decision.”

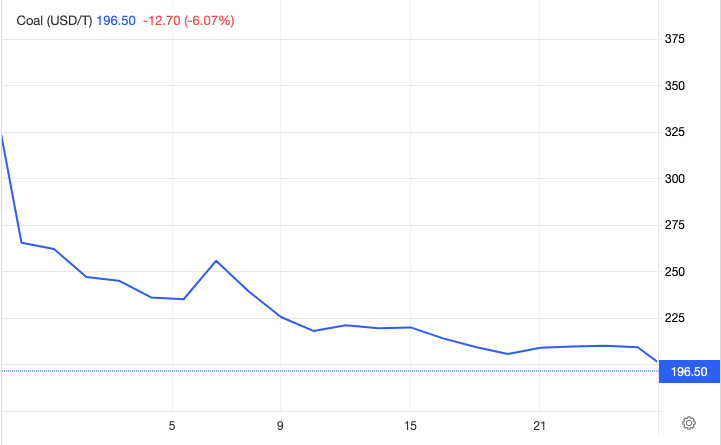

Price: US$192.85/t

% Change: -26.39%

Coal miners were the toast of the town last year, riding a wave of high prices that has flowed through into monster profits through the February results season.

Whitehaven Coal (ASX:WHC) locked up $1.8 billion in NPAT for the half year to December 31, while Yancoal (ASX:YAL) delivered $3.58b in profits for the full 2022 year, bankrolling a fully franked 70c per share, $924m dividend.

Coronado’s (ASX:CRN) profit rose 307.4% to US$771.7m for 2022, while New Hope (ASX:NHC) reported underlying EBITDA for the first half of $1.04b, up 89% on $554m a year earlier.

Smaller coal stocks also gathered momentum. Stanmore Coal (ASX:SMR), which has become embroiled in complaints its Indonesian owner could gain undue influence by taking the Singapore-listed subsidiary that owns a 64% stake in the Queensland coal miner, GEAR, private, raked in US$727m in profit on a massive lift in EBITDA from US$34m in FY21 to US$1.456b in FY22.

Blair Athol mine owner Terracom (ASX:TER) delivered a ~$180 million profit after tax for the half year and $60m, 7.5c per share dividend, taking its dividend yield for the financial year to 23% and payouts over the last nine months to $220 million.

The bad, or maybe better to say mixed, news for coal investors is that results talk about the markets of the past, not those of the present and future.

And a mild northern winter along with falling gas prices have combined to send thermal coal prices sinking for the second straight month. After a more than 30% drop in January, Newcastle high CV energy coal fell around 26% in February.

The situation was compounded for New South Wales miners by news the State Government would force miners to reserve around 5% of their production for local power generators to avoid a shortage in the local electricity grid at $125/t, below the cost of production for some miners like BHP (ASX:BHP) at its Mt Arthur operation in the Hunter.

For metallurgical coal producers it is a different story, with prices rising to trade at over US$370/t at month’s end of premium hard coking coal, with PCI and semi-soft coking coal for steelmakers also drawing high prices amid a shortage in product from bans on Russian imports in a number of markets.

China is also starting to let Australian coal back in, a positive signal for met coal prices given it is the largest steel market in the world. It sets the scene for what will likely be a competitive process for two Queensland met coal mines BHP has put on the market, Daunia and Blackwater.

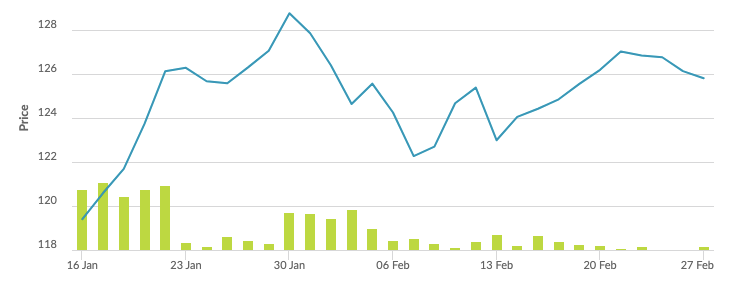

Price: US$125.81/t

% Change: -1.05%

Iron ore prices remain solid, trading down only 1% as analysts remain divided on where the steelmaking ingredient is headed.

Lower prices in the second half of 2022 saw BHP, Rio Tinto (ASX:RIO) and Fortescue Metals Group (ASX:FMG) all post lower profits and dividends in their February results prints, though they are still paying out over $15 billion to shareholders between them over the next month.

Despite the lower prices seen at times last year as China, the world’s key iron ore and steel market, fought wave after wave of Covid-19 with arduous and austere lockdowns, smaller iron ore miners also proved just about profitable.

Fenix (ASX:FEX), Champion Iron (ASX:CIA) and Mount Gibson (ASX:MGX) were among those still making cash, while Tasmania’s high grade standout Grange Resources (ASX:GRR) continued a recent dividend paying streak.

All will be looking pretty healthy at the full year if current benchmark prices, up 60% on lows of under US$80/t in October last year, hold throughout the first half of 2023.

While Commback and Westpac see iron ore falling to US$100/t over the course of the year if China’s property market fails to follow the rest of the country into an economic turnaround in 2023, other price forecasters such as investment bankers Goldman Sachs see Australia’s headline commodity heading higher to US$150/t next quarter on physical market deficits.

Recent price moves have been, as ever, dictated by machinations out of the Middle Kingdom, with a price run to eight month highs over US$130/t in the third week of February tamed after the Dalian Commodity Exchange moved to place trading limits on futures contracts and news of pollution crackdowns in steel hub Tangshan.

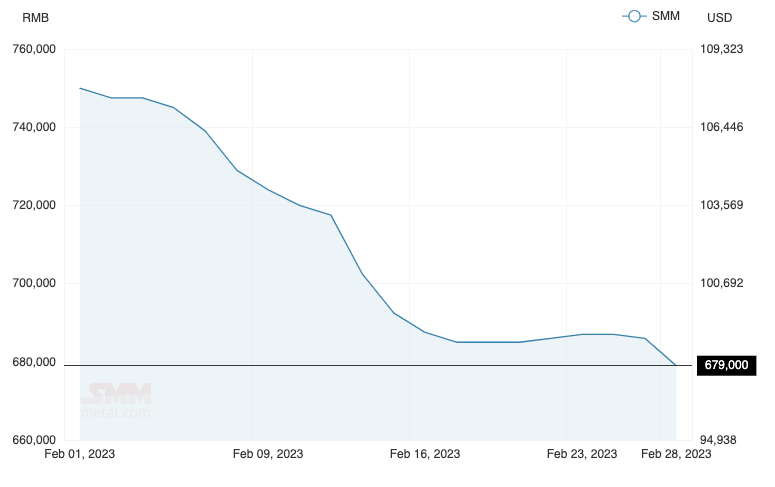

Price: US$97.93/kg

% Change: -11.2%

Rare earths were one of the boom and bust commodities of 2023, with NdPr prices storming to unforeseen records early last year before tumbling over 50% by late in 2022.

The materials are used in permanent magnets for electric vehicles and wind turbines, markets expected to drive a more than doubling in demand for magnet rare earths by 2030.

They rose in anticipation of Lunar New Year to over US$110/kg last month, but that ‘pent up demand’ has failed to eventuate, with prices retreating on lower than expected interest from customers.

Lynas Rare Earths (ASX:LYC) COO and marketing expert Pol Le Roux remains bullish on the rare earths market despite volatile pricing, saying this week prices for neodymium-praseodymium oxide remain high from a historical perspective.

“Two years back if NdPr is at US$85 you’d have to sign up. Two years ago, we would never imagined it’s US$85 … So first point is that the prices are pretty high compared to the last (few) years with the exception of probably six months in ’22,” he told analysts on Monday’s earnings call.

“Second, it is true that it went a bit down after the Lunar New Year because the demand did not increase as expected in China, right after the Lunar New Year, but the door is still open, you know that the production quotas will be announced sometime, no one knows and uncertainty is never very good.

“But for me prices are not of concern. They are pretty high, expectations are that we will stay stable over the next quarters. And in an environment again where the economy generally speaking and the demand in China specifically is not very high, having this kind of price for the current situation in China is very positive news.”

Lynas’ bigger concern currently is regulatory, with it launching an appeal to a decision that would prevent it from cracking and leaching imported concentrates at its Malaysian processing facility from July 1.

It is building inventory to avoid a production gap that could occur if its ramp up at a new $575m plant in Kalgoorlie is slow.

The concern is the decision could see the only major supplier of separated rare earths outside China have to curtail production.

At the same time there has never been a bigger impetus for others to join Lynas, with a host of ionic clay rare earths explorers on the ASX aiming to deliver maiden resources this year, Iluka Resources (ASX:ILU) ramping up work on a billion dollar plus refinery in WA, and Arafura Rare Earths (ASX:ARU) taking another step closer to an investment decision on its Nolans project in the Northern Territory.

Price: US8961/t

% Change: -2.84%

Copper was poised for a breakout after a rollicking start to 2023, up more than 10% in January.

But its revival fizzled as upside from China’s reopening and a catalogue of supply challenges out of major producers in South America and Indonesia failed to counteract a weakening macroeconomic picture across the rest of the world.

The long term case for copper is in its use in electric vehicles and decarbonisation. But it is worth stressing this is a long term narrative, and investors expecting immediate gratification of a copper bull market that rages from day 1 may be disappointed.

Refined copper use in 2022 was up around 3% worldwide in 2022 according to the International Copper Study Group, but remained below pre-pandemic levels in a number of countries.

The ICSG believes the refined market was in a 376,000t deficit and while LME and COMEX stocks fell 16% and 20% respectively, global exchange stocks were up 50,229t or 26.5% YoY at the end of December thanks to a 102% jump in Shanghai Exchange stocks.

While Chilean production fell 5% and Peruvian production growth was weak at 4.8% last year (though shutdowns early this year have crimped the industry amid a political and social crisis in the country), DRC production rose 26% thanks mainly to the new Kamoa-Kakula mine, Indonesian output lifted 28% and Chinese producers ramped up by 6%.

AIC Mines (ASX:A1M) boss Aaron Colleran told Stockhead that the short term story was of a market in balance, but the copper market long term would see major pressure on supplies.

“It’s easy to be bullish, but that’s a medium to long term view. In my view, what we’re seeing in the market at the moment is a real arm wrestle between the short term, the reality of here and now, versus that medium to longer term outlook,” he said in an interview with yours truly.

“There’s no doubt over the longer term, the world is short copper, and the copper price will have to go higher just on basic supply-demand fundamentals.

“Those fundamentals aren’t in place today. We’re not in a shortage of copper currently, or possibly over the next six months. So that’s the arm wrestle we’re seeing at the moment.

“The long term view that there will be a significant supply shortage and the copper prices is almost undoubtedly going higher to US$5 a pound, if not US$6 a pound.”

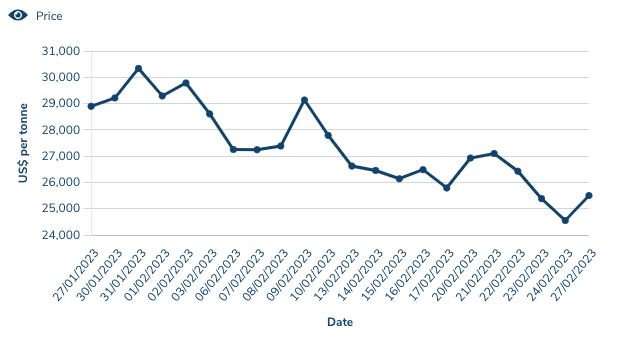

Price: US$24,794/t

% Change: -18.29%

Nickel prices held firm in the first month of the year after a wild and wooly 2022 which saw them hit short squeeze highs of over US$100,000/t in March before recording a creditable roughly 50% gain.

Prices remain at elevated levels, but this month’s pullback will be of some concern for anyone still operating at the margins, with smaller players in ramp up mode like Mincor Resources (ASX:MIN) and Panoramic Resources (ASX:PAN) still working to establish their nickel sulphide operations in WA.

At issue is, in part, price discovery since the LME’s bungled response to the short squeeze last year.

LME stocks have fallen in part because market participants are unwilling to place metal with the exchange, though the International Nickel Study Group reckons last year’s market shifted to a 112,000t surplus, the largest since 2014, Reuters columnist Andy Home says.

Price discovery levers have been hurt as a result of the loss of confidence in the LME, BHP’s chief economist Huw McKay said in the miner’s economics and commodity outlook last month.

“Reform of the LME’s metal delivery rules is long overdue. The LME short squeeze episode highlighted vulnerabilities that had been building for years,” he said.

Nickel is increasingly being used in electric vehicles, with class 2 nickel from nickel laterite mines that is sold as nickel pig iron heading into China’s stainless steel market.

However, Indonesian laterite producers are increasingly moving into the class 1 market where western producers previously assumed they’d have a premium and monopoly.

That shift has proven beneficial for at least one ASX-listed company, Nickel Industries (ASX:NIC).

The Tsingshan-backed Indonickel supplier expects to become a major player in the battery nickel space, having fielded site visits from OEMs including Tesla in recent weeks, by investing in HPAL and nickel matte capacity.

Price: US$75,000/t

% Change: -5.06%

Lithium pricing is a mysterious beast, not the least because there is no semblance of a unified spot price.

Many miners use multiple indexes from pricing agencies to triangulate a price for cargos of chemicals and spodumene, with demand varying across different products.

Fastmarkets for instance has seen prices fall, for the third straight month, for lithium hydroxide shipped to North Asia, though they remain at super high levels.

Its prices for carbonate, more commonly associated with shorter range LFP battery chemistries, have dropped further, to US$66,500/t.

Prices in the Chinese domestic market are down even further than those including Japanese and Korean sales, with hydroxide at around US$65,000/t and carbonate at around US$57,000/t.

Spodumene spot prices have also fallen from late 2022 highs of around US$8300/t to US$6750/t.

But before you cry that the sky is falling in, remember that margins remain strong and if you time travelled to tell miners four years ago they’d be getting paid in excess of US$5000/t on spodumene shipments they probably would have called in the police to get your crazy ass out of their house.

It is prices like those that propelled Australia’s four biggest lithium miners, Pilbara Minerals (ASX:PLS), Allkem (ASX:AKE), Mineral Resources (ASX:MIN) and IGO (ASX:IGO) to combined profits in excess of $2.5 billion in the first half of FY23.

Even mine developers are bullish about the outlook, despite the risk of heading into production at a time of falling prices. Just ask Leo Lithium, currently planning to ship DSO from the Goulamina mine in Mali later this year ahead of a mid-2024 start.

“(At Galaxy) we were selling lithium spodumene at US$350 a tonne, US$360. That was the trough price,” former Galaxy Resources boss and now Leo Lithium (ASX:LLL) MD Simon Hay said.

“What was the peak price, US$8300?

“It’s incredible — 20 times — so the whole industry has changed enormously, there is so much interest … customers, offtakers, investors, analysts, financiers, there’s so much interest and you read every day there’s a deal being done.”

Price: US$1829.87/oz

% Change: -4.89%

Gold was another commodity which enjoyed a strong start to the year, before stubbornly high inflation reared its head again, raising the risk of continued rate rises across 2023.

Cost pressures have also been evident across the listed gold space, crimping profits at all but the top performing precious metals stocks.

The big news in the industry was a move by Denver-based Newmont, the world’s biggest gold miner, on its Australian peer Newcrest (ASX:NCM).

Rejected by the Newcrest board, the $24.5 million all-scrip offer would have been the biggest in the history of the gold industry.

But Newmont is likely to make another bid, with experts suggesting the deal remains attractive thanks to NCM’s low costs, large scale operations and copper output.

Gold prices may have retreated, but many industry participants are bullish that safe haven demand will help gold prosper when the interest rate hikes go too far and economic growth wavers.

“Higher interest rates increase the opportunity cost of holding gold, lowering demand and hence the price,” Thorstein Pulleit from the London Bullion Metals Association said on a webinar this week.

“I don’t want to talk too much about macroeconomics at this juncture, but I want you to know that I believe central banks will overdo it, raising interest rates too much and damaging the economic cycle and financial markets to such an extent that their monetary policy tightening will need to end and be reversed later this year.

“This should also be a boost to the price of gold, combining this with my assumption that the current price of gold is already on the cheap side … I forecast an average gold price of US$2000/oz this year with an upside potential of up to US$2200/oz.”

Prices correct as of February 28, 2022.

Silver

Price: US$20.53 23/oz

%: -10.73%

Tin

Price: US$24,963/t 29,490/t

%: -15.35%

Zinc

Price: US$3000.50/t 3389/t

%: -11.46%

Cobalt

Price: US$34,180/t

%:-30.24%

Aluminium

Price: US$2373 2532.5/t

%: -6.3%

Lead

Price: US$2104/t 2136.5/t

%: -1.52%