White Cliff drills for cobalt as Asian battery makers seek greater supply

Mining

Mining

Special Report: White Cliff Minerals is accelerating its pursuit of cobalt at just the right time – when Asian battery makers are looking to shore up supply from early-stage Australian projects as the market gets tighter.

The company (ASX:WCN) has begun drilling for higher grade cobalt and nickel at its Coglia Well project in Western Australia.

Chinese battery recycler GEM — a $5.6 billion company listed on the Shenzhen stock exchange — secured a large chunk of global cobalt production after shaking hands with Swiss heavyweight Glencore in March.

Japanese and Korean battery makers are now seeking out Australian cobalt explorers with early-stage projects in a bid to catch up to China.

This is evidenced in recent deals such as a seven-year pact struck between South Korea’s SK Innovation and Australian Mines (ASX:AUZ), which doesn’t expect to be producing from its Sconi cobalt and nickel project until 2020.

Other ASX-listed players with early-stage projects are also in talks regarding potential supply deals.

Cobalt is in high demand because of its use in rechargeable batteries for electric cars. A billion electric cars are expected to be on the road by 2050 and cobalt demand is expected to grow eight-fold by 2025.

The price of the battery metal recently hit a decade-high of $US95,000 ($122,984) per tonne.

Right next door to Glencore

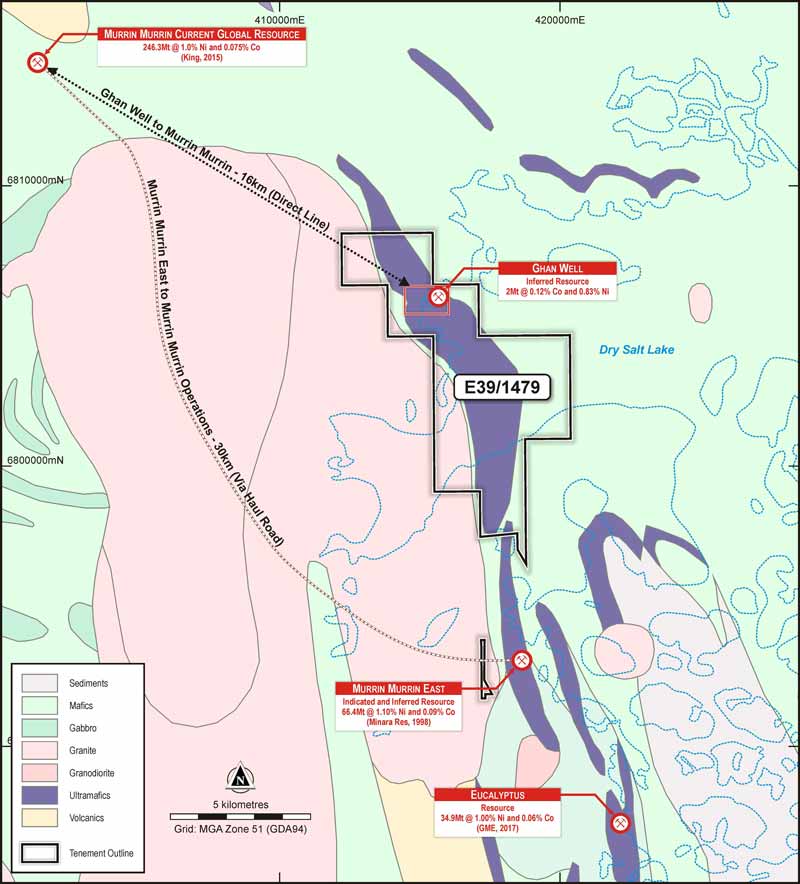

White Cliff’s Ghan Well prospect is right on the doorstep of Glencore’s operating Murrin Murrin nickel and cobalt mine and processing facility. The Coronation Dam and Coglia Well prospects are also in the same neighbourhood.

“The grades are quite good and there is the potential for us to drill the projects out to a substantial scale resource very quickly. The obvious off-take [sales] partner for us is Glencore as the ore could possibly be sold to their Murrin Murrin facility,” managing director Todd Hibberd told Stockhead.

Glencore is fast running out of high-grade ore at Murrin Murrin, which may provide an opportunity for White Cliff.

“The thesis is that if the grades are much higher than Murrin Murrin, the extra value of the ore feeds straight through to their bottom line,” Mr Hibberd said.

“Their processing cost doesn’t change on the grade of the material they feed, but their profitability does.”

The company is also looking to Asia for offtake and funding partners to assist with developing the projects.

White Cliff recently raised $1.66 million via a rights offer that was underwritten up to $1 million by well-regarded Perth stockbroker CPS Capital.

This gives the company sufficient capital to fund further exploration of its priority cobalt and nickel targets as well as continue exploration at its Aucu gold project in the Kyrgyz Republic.

This special report is brought to you by White Cliff Minerals.

This advice has been prepared without taking into account your objectives, financial situation or needs. You should, therefore, consider the appropriateness of the advice, in light of your own objectives, financial situation or needs, before acting on the advice.

If this advice relates to the acquisition, or possible acquisition, of a particular financial product, the recipient should obtain a disclosure document, a Product Disclosure Statement or an offer document (PDS) relating to the product and consider the PDS before making any decision about whether to acquire the product.