What does the EU’s ban on ICE cars by 2035 mean for ASX battery metal companies?

By the end of 2021, the number of EVs on the world’s roads totalled 16.5 million, triple the amount in 2018. Pic: Getty Images

- Lawmakers in EU back plan to ban new ICE car sales from 2035

- ASX battery metal players are in the box seat

- As consumer EV demand grows, so too will battery metals

By the end of 2021, the number of electric cars on the world’s roads totalled 16.5 million, triple the amount in 2018 as sales continued to rise on a global scale. This has continued well into 2022, with sales hitting 2 million in the first quarter.

But perhaps the most interesting element to all of this comes as the European Parliament’s environmental committee gathered in support for an EU plan to ban new petrol and diesel car sales from 2035 – meaning a 100% cut in CO2 emissions by this date, making it impossible to sell new fossil-fuel powered vehicles in the 27-country bloc.

European industry, including carmakers Ford and Volvo, joined 26 companies in a public call to EU legislators ahead of the crucial vote claiming “the deadline of new fossil fuel engines is needed to ensure last cars and vans powered by internal combustion engines are off the road by 2050 – when Europe is required to reach net zero emissions.”

Batteries, batteries, batteries

Julia Poliscanova, vehicles and mobility lead for the European Federation for Transport and Environment, said this means there is strong certainty in the downstream market that A LOT more lithium-ion batteries will be needed.

“Over the next five years we are likely to see a lot more interest in lithium, graphite and other battery metals players – this means more investments, partnership offers from the EU auto industry and much pressure from their procurement departments to secure long-term contacts for critical materials.”

Some ASX battery metal plays such as European-based lithium play Vulcan Energy (ASX:VUL) have already started to notice the demand is much larger than what they are likely to be able to supply.

“On our side, we have already secured several off-take agreements out of Europe with automakers and battery makers who are now coming back to us asking for more volume for longer,” VUL chief commercial officer Vincent Pedailles said.

“So they are coming back to us, trying to renegotiate those contracts as early as 2025, which is when we are starting production.

“We are currently in the phase of readjusting some of those contracts if we can. When we negotiated the contracts at the end of last year, we saw that the demand was much larger than what we were able to supply.

“We negotiated more than 300,000t per year of lithium hydroxide when at the time we were only able to supply 40,000t and now volumes are even larger.”

Will car manufacturers stop making and selling ICE cars earlier?

Whether or not carmakers stop making ICE vehicles earlier depends on the individual carmaker strategies, Poliscanova says.

“Some are going all in to capture the EV market sooner, while others are trying to squeeze the most profit possible from the remaining ICE sales.”

According to the New York Times, at COP-26 six automakers including Ford, GM and Mercedes agreed to work toward selling only zero-emissions vehicles by 2035 in leading markets, while Toyota, Volkswagen and Nissan-Renault did not.

Those that signed the pledge accounted for roughly one quarter of global sales in 2019.

Stellantis CEO: shortage of EV batteries expected by 2024-25

Speaking to media earlier this week, Stellantis chief executive officer Carlos Tavares said he expects a shortage of EV batteries by 2024-25, followed by a lack of raw materials for the vehicles that will slow availability and adoption of EVs by 2027-2028.

He urged policy makers globally to stop aggressively moving targets for EVs forward, adding the only thing that helps car companies is stability.

“The speed at which we are trying to move all together for the right reason, which is fixing the global warming issue, is so high that the supply chain and the production capacities have no time to adjust,” he said.

While automakers remain divided on the issue, it is likely consumers will turn away from ICE cars sooner than 2035 once the law is confirmed in the coming months.

“As consumers choose their next car, they are unlikely to go for a petrol model in late 2020s or early 2030s as electric cars become cheap and widely available, while the resale value of an ICE is likely to drop and urban access restrictions make them harder to use,” Poliscanova explains.

“This is likely to increase the demand for battery metals even sooner than the regulatory deadlines.”

Battery metal projects in demand

Vulcan’s Pedailles says any project planning to start production around 2024 – be it nickel, cobalt, lithium or graphite – will have demand for their product.

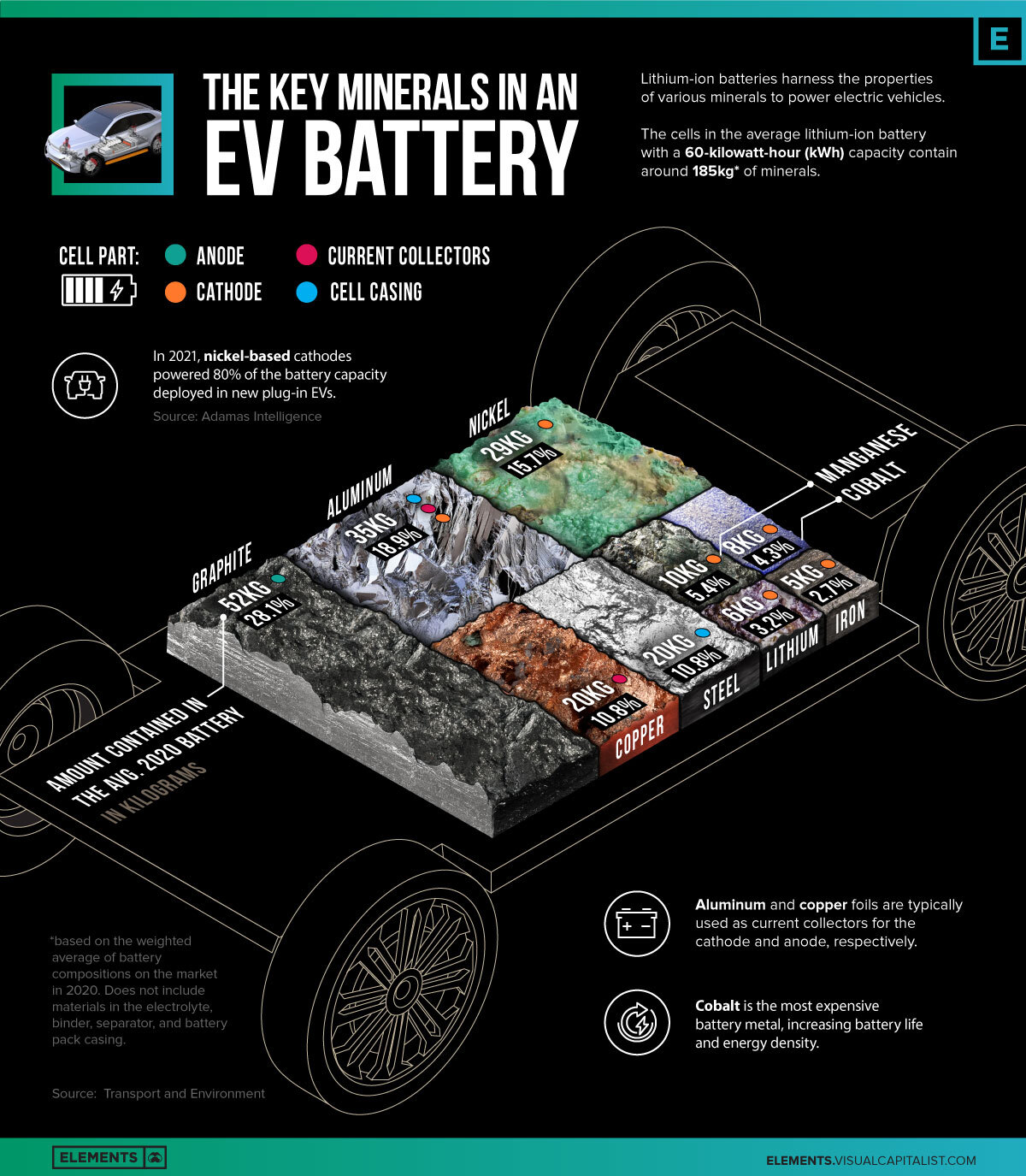

Graphite flies under the radar when discussing lithium-ion batteries but an EV battery contains around 50kg of graphite, more than twice the amount of lithium. VC Elements sums it up neatly:

It is the -100-mesh product (also known as natural graphite concentrate) used in the production of spherical graphite for anodes that has analysts predicting the graphite market will enter a period of unprecedented growth.

Back in 2012, BlackEarth (ASX:BEM) managing director Tom Revy said only around 3pc of the material captured the battery market – today that number has jumped to 20pc.

“By 2025, the biggest consumer of natural graphite will be batteries, where historically it has been the refractory market,” he said.

“And by 2030–35, the majority of natural graphite will be supplied to the EV market.”

Graphite producers set to benefit from this growing thematic include Renascor Resources (ASX:RNU), holder of the world’s second largest proven reserve of graphite and the largest graphite reserve outside of Africa, and Mozambique-based Syrah Resources (ASX:SYR).

Near-term graphite players include Walkabout Resources (ASX:WKT), Triton Minerals (ASX:TON), and Black Rock Mining (ASX:BKT).

For the lithium market, many countries are also eyeing the sustainability of batteries and broader supply chains as an important issue to address – such as with the new EU battery regulation which aims to ensure batteries placed in the EU market are sustainable and safe throughout their entire life cycle.

Pedailles says this is another competitive advantage for battery metal companies who have constructed their asset in a renewable way.

Near-term lithium companies set to benefit include Core Lithium (ASX:CXO), Lake Resources (ASX:LKE), Sayona Mining (ASX:SYA), Galan Lithium (ASX:GLN) and Argosy Minerals (ASX:AGY).

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.