Titanium Sands’ Mannar mineral sands development is world class

Mining

Mining

HMS prices have risen since the Covid-19 pandemic and a recent 2023 study placed a super-sturdy NPV of $545m on Phase 1 of the Mannar mineral sands development. This valuation puts ASX-listed Titanium Sands at over 30c per share – a huge 5000% uplift on the current price.

Heavy mineral sands rutile, ilmenite and zircon contain minerals useful for a variety of industrial purposes.

Of these, Ilmenite is the most important feedstock in the production of titanium dioxide (TIO2), used in products people use daily such as paints, fabrics, plastics and paper, sunscreen, food and cosmetics.

The main end market is pigments – used in stuff like house paint, automotive coatings and other protective coatings — where demand and pricing will generally follow the health of the global economy.

Things like rapidly growing construction sectors, rapid urbanisation, and increasing disposable income boost this market, and resultant demand for Ilmenite.

During COVID, for example, lockdowns led to a two-year period of elevated demand due a boom in do-it-yourself (DIY) projects and home building in North America, Australia, and Europe.

Prices are still elevated. That’s great news for advanced project developer Titanium Sands (ASX:TSL), which owns the Mannar HMS project in Sri Lanka.

Attractive as the economics of the Stage 1 development look – and we’ll talk about that in a moment — prices of zircon, ilmenite and garnet have remained robust in 2023.

Non-executive director Jason Ferris told Stockhead that prices of mineral sands have increased significantly since the Covid pandemic, and have created robust returns in the study of the project parameters.

“We have been waiting to release numbers since the initial 2020 study (light), however needed the higher confidence Indicated resource rather than Inferred resource, the project now has that” he says.

“It was a silver lining because the market prices from 2020 to now have increased because of demand. It was quite a fortunate thing for us to happen.”

Managing director Dr James Searle adds that Mannar is world class in terms of size, project life, feedstock ilmenite quality, and amenability to very low-cost dredge mining.

“It will be very cost competitive with similar ilmenite feedstock projects,” he says.

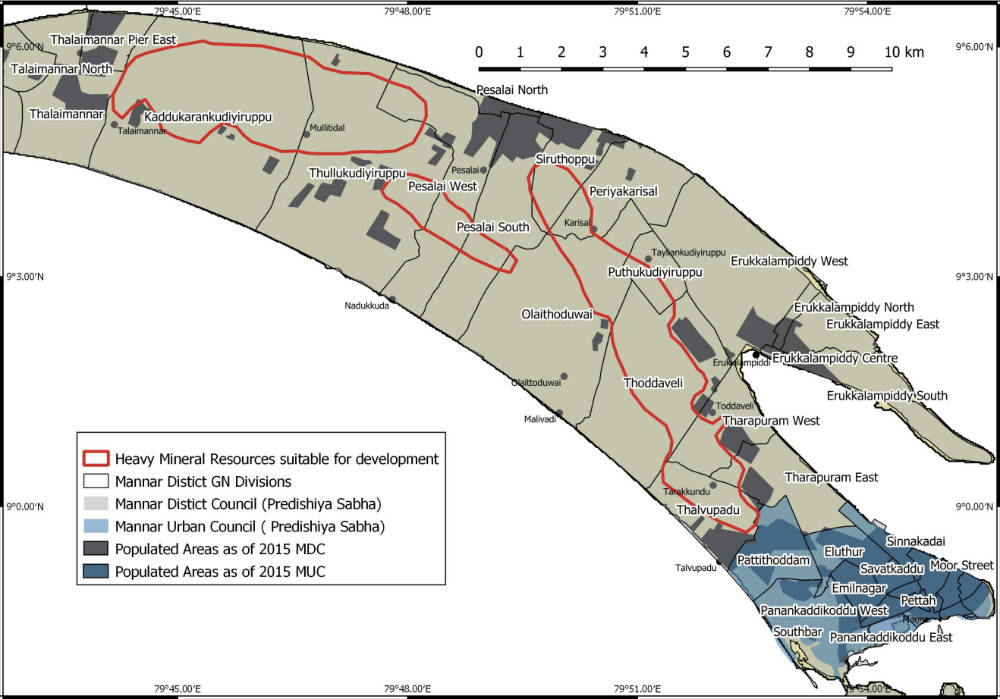

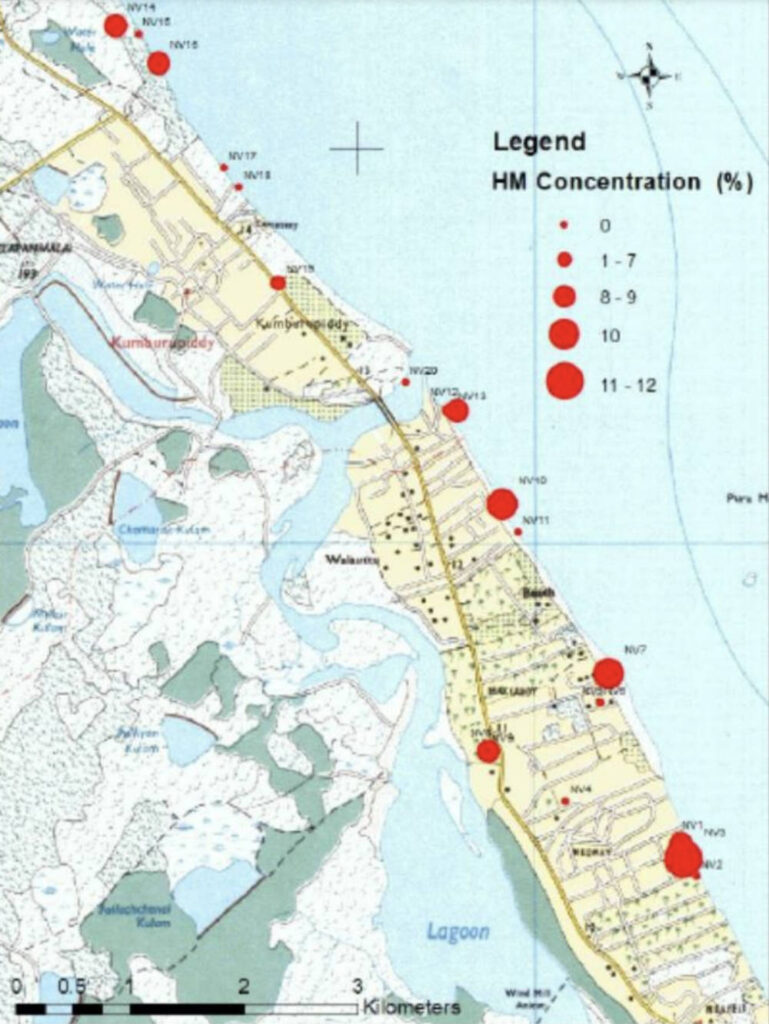

There are many things going for the Mannar project, starting with the very substantial resource of 318Mt grading 4.17% total heavy minerals with ilmenite making up the bulk of the resource.

Of this, 145.7Mt at 4.28% THM is contained within the higher confidence Indicated category.

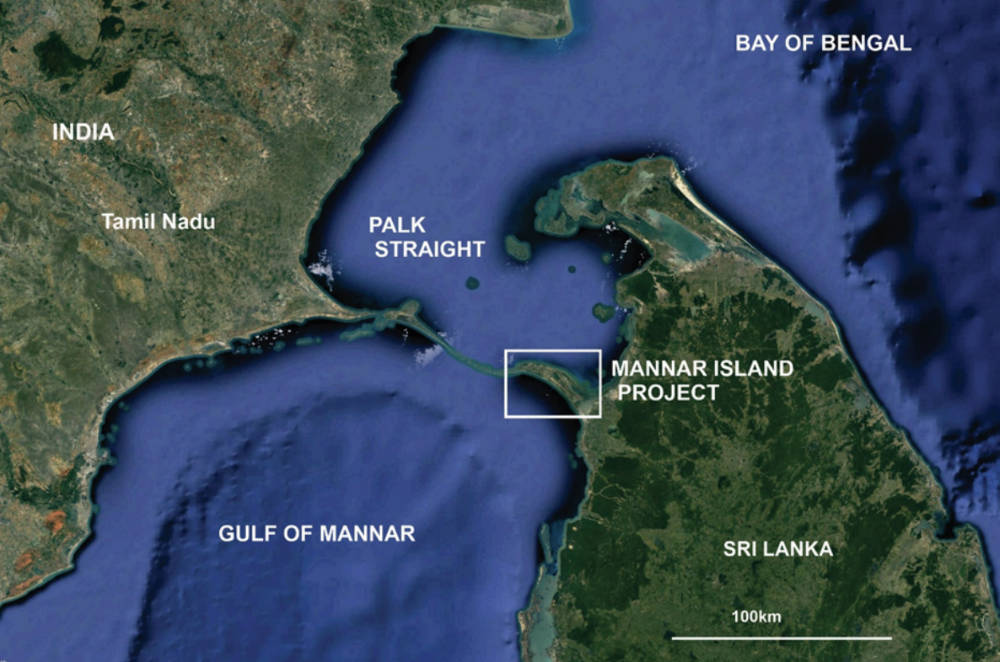

Located on Mannar Island, the project also benefits from ready access to road infrastructure, rail infrastructure, access to water and power, and close proximity to the port of Trincomalee.

The Scoping Study outlined very attractive economics for a Stage 1 dredge mining operation that will extract mineral sands from a 8km by 1km high grade zone with a resource of 82Mt at 6.03% THM.

These resources are exposed at surface with no barren overburden.

The dredge will feed a floating wet concentration plant that would feed a centrally located mineral separation plant to produce a high-quality ilmenite product.

This Stage 1 development, which will access just 35% of the total resource, will process 4Mtpa of material for 20 years to deliver highly attractive net present value and internal rate of return – both measures of a project’s profitability – of $545m and 52% respectively from gross revenue of $2.01bn.

This is significant given that the NPV works out to about 30c a share, which compares very favourably with the company’s share price of 0.6c.

Capex is also a very palatable $122m with payback in just under two years while the revenue to operating cost ratio of 2.75 is highly competitive with other ilmenite feedstock producers globally.

There are also opportunities for up to two further expansion stages.

While Sri Lanka already has a government-owned mineral sands deposit – Lanka Mineral Sands – that has been operating for 50 years, Titanium Sands is positioning Mannar to be the first independently foreign funded mineral sands project to export mineral sands in bulk from the country.

“There was a recent legislation change in the government of Sri Lanka to allow export of mineral sands for the next two years with limited conditional restrictions,” Ferris said.

“If we can get our mining licence put in place, which we are currently working on, we will be the first company to export mineral sands in bulk out of Sri Lanka, creating a whole new industry for the economy of the country.”

He added that with the Sri Lankan government looking for value-added industry, the company was in discussions on potentially building in-country infrastructure that can extract different minerals and develop new products.

Mannar may be the company’s main asset, but it certainly isn’t the only arrow in its quiver.

Titanium Sands has reached a binding terms sheet to acquire James Global, an associate company of major Colombo Stock Exchange-listed JAT Holdings.

James Global holds the 19km Exploration Licence EL/391 along the north-eastern coast of Sri Lanka that hosts widespread occurrences of HMS.

JAT Holdings has various businesses including supplying finishing and furnishing solutions including coatings and paints and accessories to local and international markets and the direct sourcing of titanium dioxide-based pigments used in its products.

Both Titanium Sands and JAT Holdings intend to form a joint venture for the further exploration and development of ground held by James Global.

An initial 50 or more holes will be drilled as part of the due diligence on the James Global ground. This could include additional exploration permits introduced to James Global by JAT Holdings.

Subject to the results of this initial exploration, further work could be carried out to define a maiden resource.

As part of the joint venture JAT Holdings will also assist with Sri Lankan management and operational matters for the company’s Sri Lankan subsidiaries.

Ferris said the acquisition and JV came about both to expand its mineral sand holdings in Sri Lanka as well as to leverage its exploration equipment that was sitting unused on Mannar Island.

“JAT Holdings is also one of the largest listed companies in Sri Lanka and are very well connected and respected in country,” he said.

“We have brought them in as a JV partner to assist not only on the James Global asset but also for the next stage of the Mannar Island project, from exploration into production.

“JAT Holdings founder and managing director Aelian Gunawardene, whose business imports titanium-based products so they can produce paints, considers the JV to be a strategic arrangement.

“He wants to eventually be able to source his own titanium-based products from his own involvement with Titanium Sands.

“If he can access and value add our minerals sands in Sri Lanka, then his personal business will benefit hugely.”

Dr Searle added that while the management of Titanium Sands brought experience in mining project delivery from exploration through to production internationally, financial management and legal strategy and planning, it is now supported by in-country management and a very strong and well regarded Sri Lankan JV partner.

Once Titanium Sands secures a mining licence for Mannar, it will look for a JV partner to jointly take the project to the next level through access to funding, offtake and production experience.

The focus is currently on completing the environmental impact assessment, which addresses things like hydrology, migratory flight paths of birds, all other environmental issues, issues with removing sand and how it affects the water table.

“Once that document is completed, we can then get central environment authority approval – a local Mannar district approval, and once that has been given the mining licence can then be issued,” Ferris said.

“That’s our immediate focus.

“Concurrently, we are in discussions with offtake and strategic partners.”

He flagged the example of Capital Metals, which signed a strategic partnership and offtake agreement with China’s Lomon Billions (LB Group) – one of the biggest mineral sands companies in the world – in May.

Under the agreement, LB Group will fully fund the project to achieve 1.65Mtpa mining rate capacity and processing to final products as well as guaranteeing 100% of the offtake in return for a 50% stake in the Eastern Minerals project in Sri Lanka.

“That would be something that we would be seeking to achieve as well,” Ferris said.

Once the mining licence is secured, Ferris expects the company to proceed with a feasibility study though he believes that this will require less effort to complete compared with a similar study for a deep mining gold project.

“Mannar is a shallow resource, you can pick up the soil with your hands and the mineral sands are there,” he said.

“It really is a different model than your normal deep mining model. The dredge facility we have got can go down to 20m but we are aiming to only go down 12m.

“According to our studies, that is sufficient for the volume we require for a 4Mtpa operation.”

This article was developed in collaboration with Titanium Sands, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.