Tiny Babylon wins a contract with the world’s biggest miner

Mining

Mining

Mini mining services provider Babylon Pump and Power has won a $670,000 contract with the world’s biggest miner, BHP.

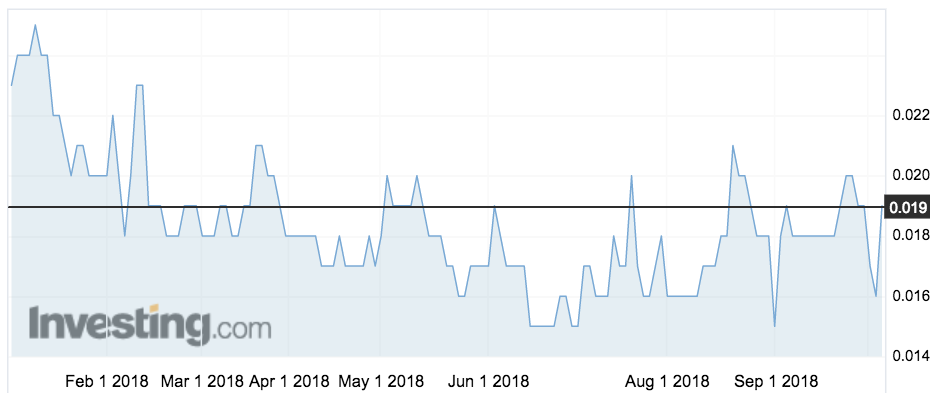

The news was unveiled today. The shares have risen from 1.6c on Wednesday to 1.9c today — just below they’re pre-listing issue price of 2c in January

The six-month contract is to install a power supply and de-watering equipment at an unnamed location, with commissioning expected in November. It could be extended.

Babylon (ASX:BPP) backdoor-listed onto the ASX earlier this year via a shell company called IM Medical.

The stock has so far largely traded below the pre-listing capital raising price since February.

It has a market cap of just $7 million.

Babylon has announced several contracts since its debut on the ASX, securing a $1.1m contract with a separate services provider to install and maintain power equipment at another BHP project in WA and a $550,000 power and pump deal for an oil and gas company.

The company raised $4.5m of a targeted $6m round before listing. It has scrambled for funds since, having only $506,000 in cash available at the end of June.

It secured $3m in convertible notes and a $1.5m loan from NAB in August, and said at the time the oil and gas and first BHP contract would add an extra $1m cash runway for fiscal 2019.

It made a $1.1m loss in the year to June 30 but revenue of $1.6m.