Timing key as Venture Minerals hits its stride in 2021

Timed it! Ricky Ponting pulls Waqar Younis for four in a One Day International in 2000. Pic: Getty Images.

Timing is everything when it comes to resources projects. As it enters a new year, multi-commodity exploration/development play Venture Minerals appears to have its timing just right.

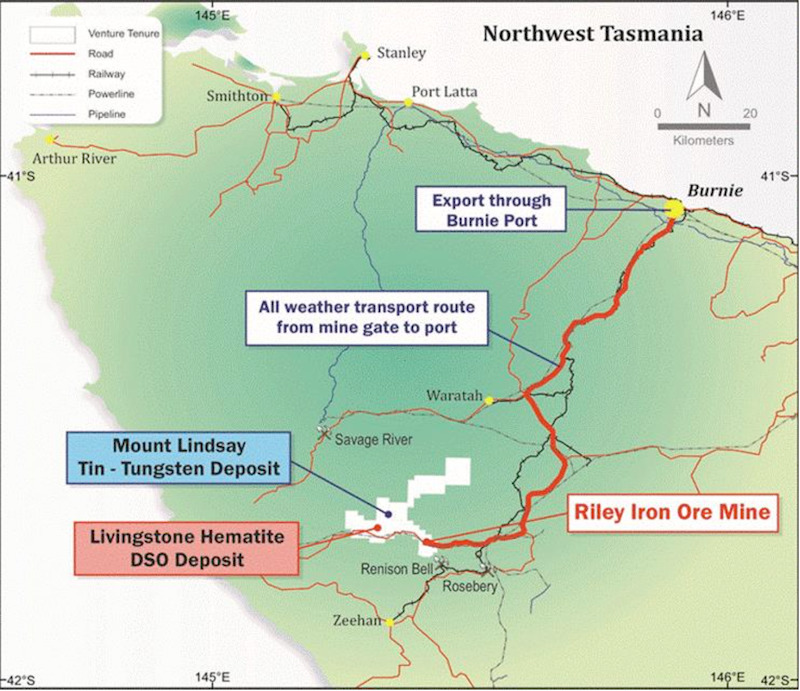

Venture (ASX:VMS) is the company at the helm of the Riley iron ore project on Tasmania’s west coast, which is fully funded to deliver first iron ore in Q2 of 2021.

It’s an ideal time to be developing an iron ore mine – earlier this week the commodity’s strong fundamentals and supply environment were likened to those seen in the 2000s, and we all know how that story played out (hint: well).

At Riley, Venture has immediately accessible ore reserves of 1.6 million tonnes at 57 per cent iron, with low impurities. The product is direct shipping ore – strip ratios are zero.

And while the project has a relatively short mine life of around two years, the iron ore price is currently floating at nearly double the US$90 per tonne prediction against which Riley was economic in a pre-feasibility study released in August 2019.

What does that mean for Venture and its shareholders? Cashflow.

Where the cash goes from here is probably the biggest question of all. Far from being a one-trick pony, Venture has a suite of promising exploration projects on its hands in hot commodity spaces.

There’s more potential DSO iron ore a short distance from Riley at the Livingstone project – you can hear more about that project here. There’s copper-zinc-gold at Golden Grove North, gold at Kulin, tin-tungsten at Mount Lindsay.

Venture is also in a joint venture with market darling Chalice Gold (ASX:CHN) over its South West nickel-copper-PGE project, where the latter is earning up to a majority interest through exploration spend and recently intersected massive sulphides.

It’s a fair commodity playbook when viewed in 2021 terms.

Speaking to Stockhead, Venture managing director Andrew Radonjic said the cashflow from Riley loomed as a key which could help unlock further value in the portfolio moving forward.

“Riley will ultimately provide the cashflow which will allow us to progress other things,” he said.

“We’ve got that many projects, I’d love to be exploring them all at the same time, but we’re just doing one at a time. Once the cash comes in, we’ll go from there.

“We’re probably looking at building a bit of a cash box up by mid-year, once a few shipments have gone out.”

By then, Radonjic expects to have put some drill holes into Golden Grove North, while results for 1000m of drilling at Kulin are expected to have come back.

“I think with those on hand we’ll have a fairly good idea of how to rank our projects at that stage,” he said.

“We also have the option as part of the South West joint venture with our friends at Chalice, where we can spend $3.7 million to maintain our 30% position on the project.

“If they’re successful finding another Julimar, as they’ve said is their main target at the Thor prospect, that could be substantial.”

Ranking a stacked deck

Riley aside, Golden Grove North and Kulin are the two 100% owned Venture projects receiving the most attention at present, and with good reason.

At Golden Grove North, ground-based electromagnetic surveying last quarter confirmed a high priority volcanic massive sulphide (VMS, ironically) drill target named Orcus.

Venture’s first drill hole at Orcus intersected 33 metres of disseminated to semi-massive sulphides with copper and zinc; a second hole hit 23m of disseminated to semi-massive sulphides with copper and zinc 50m down-dip of the first; and a third intersected 69m of disseminated and semi-massive sulphides with copper zinc, 50m down-dip of the second.

Results from reconnaissance style drilling at Orcus confirmed a VMS system, with assays for the above holes including:

- 5m at 1.3% zinc, 0.54% copper, 1.1 grams per tonne gold and 7g/t silver from 59m, including 1m at 6.1% zinc, 1.3% copper, 0.8g/t gold and 22g/t silver from 59m;

- 2m at 4.4% zinc, 0.87% copper, 0.94g/t gold and 17g/t silver from 100m, including 1m at 7.6% zinc, 1% copper, 0.17g/t gold and 20g/t silver from 101m;

- And 2m at 2.4% zinc, 0.34% copper, 1g/t gold and 4g/t silver from 152m, including 1m at 4.2% zinc, 0.47% copper, 1.6g/t gold and 8g/t silver from 152m.

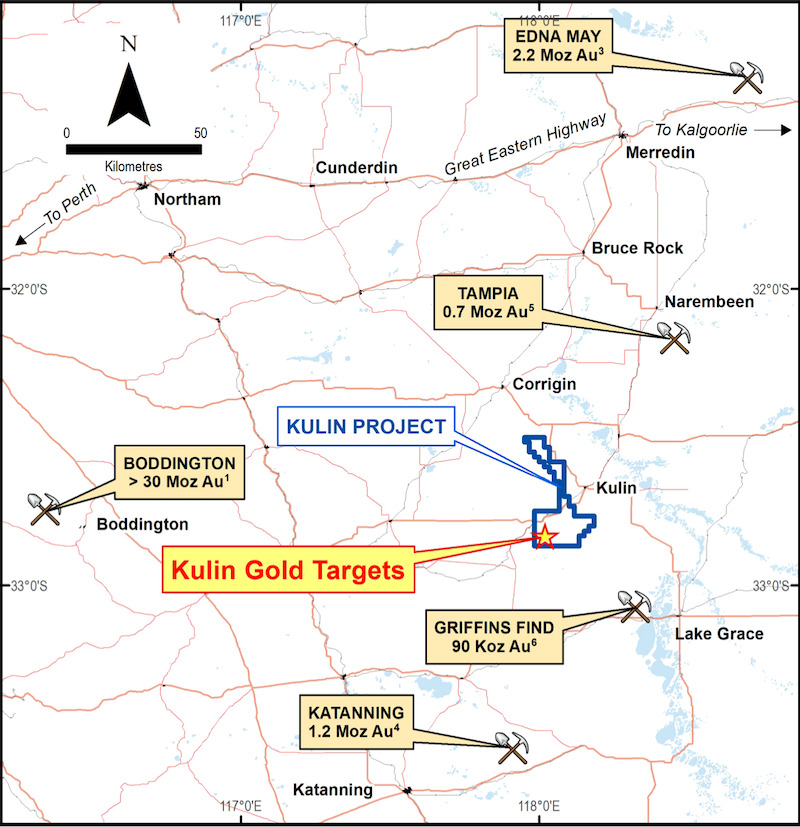

At Kulin, a trenching campaign carried out last year confirmed a potentially serious gold system, with intervals of up to 31 metres at 1g/t gold and 20m at 0.6g/t gold.

The project sits in good company, in the same province as the 30 million ounce Boddington deposit, the 2.2Moz Edna May deposit, the 1.2Moz Katanning deposit and the 700,000oz Tampia project.

Boddington, owned by Newmont Goldcorp, is currently the second-largest gold producer in the nation.

Maiden drilling is currently underway.

But with tin on a tear on the back of work from home demand, the big sleeper in the Venture portfolio could well be the long-held Mount Lindsay tin-tungsten project in Tasmania.

Located between the Renison Bell tin mine and the Savage River magnetite mine, Mount Lindsay sits in an excellent location with access to infrastructure.

Venture has completed around 83,000m of diamond core drilling at the project since 2007, and at a 0.2% tin equivalent cut off the project has a mineral resource of 45 million tonnes at 0.2% tin and 0.1% tungsten for 81,000 tonnes of contained tin metal and 3.2 million metric ton units of tungsten trioxide.

Radonjic said he felt tin was overdue a run.

“The demand supply metrics are starting to look very encouraging,” he said.

“The EV side of things and the shortage of tin has seen the price go up quite dramatically, and that’s because everyone’s buying tablets and laptops and more devices.

“These things need semiconductors and solder for all the circuitry, and tin is the main ingredient there – it’s an important part of the fourth industrial revolution, and you see it in energy storage, solar panels, wind power, electronics, electric vehicles, recycling.

“It’s just a big part of the whole game.”

Two for the price of one

The Venture value proposition as it stands, according to Radonjic, is essentially a case of two for the price of one.

“You’re getting a producer and an explorer with a pretty impressive range of targets,” he said.

“The company is already established in Tasmania, if you look at Riley, Livingstone and Mount Lindsay you can already see a track record there of success.

“I think we’ve been lying dormant for a while and waiting for an opportunity, and maybe this is our time to shine in the sun.

“I believe 2021 is going to be an exciting year for our company.”

This article was developed in collaboration with Venture Minerals, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.