Tin supply shortage looms as WFH trend increases electronics usage

Pic: Schroptschop / E+ via Getty Images

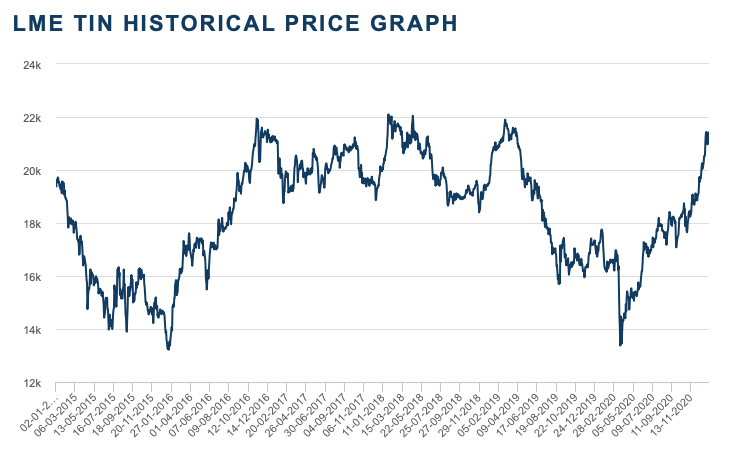

- Tin prices are up 59 per cent since their March 2020 nadir to $US21,298 per tonne

- Working-from-home trend has increased demand for electronics products that use tin

- Available tin stocks at LME warehouses are down to 730 tonnes

Tin is having a roaring time with cash buyer prices for the base metal sitting at a two-year high and there is evidence the market is facing a deepening supply shortage.

The base metal has continued to rally into 2021 and has hit a near two-year high at $US21,298 per tonne ($27,470/tonne) cash basis, according to London Metal Exchange data.

Some traders are talking about supply failing to keep up with market demand.

Evidence of this is that buyers in the US are having to pay a premium of up to $US500 per tonne on top of LME tin prices to secure deliveries of the metal.

The global pandemic of COVID-19 caused demand for tin to drop sharply in 2020 and a number of smelters in Asia and South America were forced to shutter.

That all changed again thanks to the work-from-home movement, and demand for tin – whose top use is as solder in electronics — is picking up again, worldwide.

“The work-from-home movement in Europe and the US has seen consumers purchasing more electronics in order to get online,” James Willoughby, a market analyst for the International Tin Association (ITA) told The Edge in Malaysia.

“Furthermore, being unable to travel and spending more time at home, consumers became more interested in improving their home electronics, including whitegoods,” he said.

The metal also has a growing number of new applications including in solar panels and batteries, and as a catalyst in hydrogen fuel cells, said the UK-based ITA.

Scientists in Korea have found that tin can be used in sodium-ion batteries with ‘outstanding’ energy performance that closely matches that of lithium-ion batteries.

Tin stocks down to low levels at LME warehouses

Stocks of the base metal in London Metal Exchange warehouses have dwindled to 1,660 tonnes, down from around 6,000 tonnes during early 2020, but that is only half the story.

Around 930 tonnes of the 1,660-tonne inventory in LME warehouses around the world has been pledged to buyers, so the actual available amount to cash buyers is only 730 tonnes.

US tin buyers rely 100 per cent on imports to the country, and industry sources told Metal Bulletin that consumers will have to wait until March for fresh tin supplies to arrive.

The Shanghai Metal Exchange also has stocks of tin, and while they were a healthy 5,500 tonnes last week, China is a net importer of the metal at around 12,000 tonnes per year.

As well as being the world’s largest consumer of tin, China is the largest supplier of the metal, followed by Indonesia.

Both countries are experiencing logistical issues in their supply chains for tin production and distribution, according to reports.

Indonesia’s tin producers wound back production in early 2020 after LME tin prices crashed to multi-year lows and are trying to catch up on lost production.

Mine supply shortfall forecast for 2020

Industry body the International Tin Association forecast a market shortfall of 5,200 tonnes in 2020 as mine production was impacted by the COVID-19 pandemic, reports Reuters.

The price of tin has risen strongly from its low last year of $US13.375 per tonne, according to London Metal Exchange data.

Overhead resistance in the tin market appears to be at $US22,000 per tonne, and the metal’s price has challenged this level several times in the past back to 2016.

If tin were able to climb above this price point, the next resistance level is around $US23,000 per tonne, and its peak price in the 2010s was at $US25,000 per tonne in January 2013.

There are a number of Australian tin companies on the ASX that have projects, including Australian Tin Mining (ASX:ANW) with its Taronga tin project in NSW.

Taronga tin deposit has the fifth largest undeveloped tin reserve in the world, containing 57,000 tonnes of tin and 26,000 tonnes of copper, for which a pre-feasibility study has been completed.

In a presentation the company said tin was identified by Rio Tinto as “the metal most impacted by new technologies” and its market is in deficit currently.

Venture Minerals (ASX:VMS) has its Mt Lindsay tin project in Tasmania close to the MetalsX (ASX:MLX) 50 per cent-owned Renison tin operation on the island state.

Interestingly, tin is not on the Australian government’s list of 24 critical minerals considered important because of their use in high-tech equipment like smartphones and other electronic products.

All of the 24 minerals listed meet Geoscience Australia’s criteria of metals and minerals “considered vital for the economic well-being of the world’s major and emerging economies, yet whose supply may be at risk due to geological scarcity, geopolitical issues, trade policy or other factors”.

ASX share prices for Australian Tin Mining (ASX:ANW), MetalsX (ASX:MLX) and Venture Minerals (ASX:VMS)

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.