You might be interested in

Mining

REE Survival Guide Part 4 – These Aussie projects aim to be ready to supply refineries... and soon

Mining

REE Survival Guide - Part 1: Rare earths explorers are getting smarter - here’s what to look for

Mining

Mining

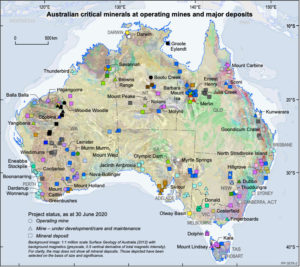

The breadth and depth of Australia’s critical minerals sector has been showcased in a new report aimed at investors wanting exposure to key metals for cutting-edge technologies.

Published by the federal government, the Australian Critical Minerals Prospectus 2020, lists 200 greenfield mining projects for 24 critical minerals found in Australia.

“Australia is lucky to have an abundance of critical minerals, our next challenge is to attract the necessary overseas investment to get projects up and running, including in high-value activities such as processing and manufacturing,” Trade, Tourism and Investment Minister, Simon Birmingham said.

The list of 24 critical minerals was compiled from similar lists published by the European Union, Japan and the United States and are used in high-tech equipment and products.

They include antimony, beryllium, cobalt, gallium, graphite, indium, lithium, manganese, magnesium, niobium, rare-earth elements, tantalum, titanium, tungsten, vanadium and zirconium.

Rare-earth materials are broken down into further sub-categories of light and heavy in the report.

China accounts for 63 per cent of global rare earths production and Australia 9 per cent.

The timing of the publication coincides with reports that China passed a new law at the weekend to tighten its control on exports of strategic raw materials, which may provide more opportunity to Australian mining companies.

The projects must have reached pre-feasibility study stage, and have a defined JORC mineral resource, but not have gone into the construction phase to be included in the prospectus.

Nine tungsten projects made the prospectus list, notably Thor Minings’ (ASX:THR) Molyhil and Specialty Metals International (ASX:SEI) with three projects.

Lithium is well represented in terms of Australian projects, with 10 listed including Altura Mining’s (ASX:AJM) Pilgangoora project and Galaxy Resources’ (ASX:GXY) Mt Cattlin asset.

Eleven rare earths projects in Australia are mentioned such as Arafura Resources’ (ASX:ARU) Nolans with a $1bn capital cost and Northern Minerals’ (ASX:NTU) Browns Range.

Nineteen cobalt projects are outlined in the prospectus ranging from Panoramic Resources’ (ASX:PAN) Savannah to Havliah Resources’ (ASX:HAV) Kalkaroo.

Among the 30 titanium projects are companies such as Iluka Resources (ASX:ILU) and US company Tronox Holdings, while Hexagon Energy Materials’ (ASX:HXG) McIntosh project in WA – with a target production of 900,000 tonnes per year of graphite concentrate – makes the graphite list.

For some minerals such as bismuth, gallium and indium there are currently zero advanced projects in Australia, according to the report.

Other listed minerals have only one or two greenfield projects for potential investors.

This category includes the minerals hafnium and niobium where only Australian Strategic Materials’ (ASX:ASM) Dubbo project is featured for each in the report.

This is the case too for helium with only one project listed, BOC and Linde Group’s Darwin operation.

Only one active project for chromium is listed in the report, Podium Minerals’ (ASX:POD) Range Well in WA, and likewise for platinum group elements in Panoramic’s Panton project.

All of the 24 minerals listed meet Geoscience Australia’s criteria of metals and minerals “considered vital for the economic well-being of the world’s major and emerging economies, yet whose supply may be at risk due to geological scarcity, geopolitical issues, trade policy or other factors”.

They are used in products such as batteries, EVs, superalloys, petrochemicals and in defence, health, space applications and telecommunications industries.

The Australian government wants to attract more investment right across the supply chain for the critical minerals sector including, exploration, extraction, production and processing.

“Businesses all over the world are looking to de-risk their supply chains and secure stable sources of critical minerals, and Australia offers a reliable and trusted option,” Resources, Water and Northern Australia Minister, Keith Pitt said.

Tesla is one such company taking action to source more raw materials for its EVs closer to home in America.

The prospectus is a joint project between the Australian Trade and Investment Commission, Geoscience Australia, and the Department of Industry, Science, Energy and Resources.

The report is intended to be an overview of Australia’s rich and diverse endowment of rare earth and critical minerals and is an updated version of a 2019 report.

Australia’s Critical Minerals Strategy outlines government policy on the sector and its three target areas of promoting investment, providing incentives, and connecting projects to infrastructure.