‘This will launch us’: Hawkstone buys historic, high-grade gold mine as lithium’s fortunes lag

Mining

Mining

Hawkstone Mining (ASX:HWK) plans to buy an advanced, high-grade gold project in the US state of Idaho for $US510,000 ($761,008) as lithium languishes.

But that doesn’t mean Hawkstone is giving up on the key battery metal, managing director Paul Lloyd says.

The company’s shallow high-grade Big Sandy project is a lithium-bearing sedimentary horizon 11km long, 2km wide and up to 60m deep essentially from surface.

“[Big Sandy] is a major resource,” he says.

“Lithium will bounce back. But sentiment at the moment is down, and we have to keep the company moving.”

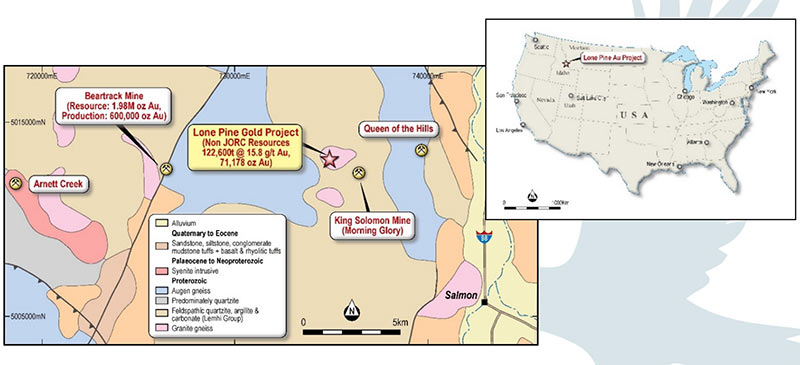

Enter Lone Pine. The historic gold project, last mined back in 1907, is related to the Trans-Challis Fault System; a 275km-long zone that has produced more gold than any other area in Idaho.

Nearby, TSX-listed Revival Gold is progressing the Arnett Creek and Beartrack mines back into production.

The Beartrack open pit heap leach mine produced about 600,000oz between 1994 and 2000, closing when gold prices plummeted below $US300/oz. This project currently has an inferred resource of about 765,000oz, Revival says.

Also neighbouring Lone Pine is the historic, WW2-era Queen of the Hills and the King Solomon mines, both held by Jervois Resources (ASX:JRV).

The advanced Lone Pine project comes with a non-compliant JORC resource estimate of 71,178oz grading over 18g/t based on historical work done in 1935, Hawkstone says.

Subsequent studies consider this initial estimate to be conservative.

Lone Pine has never been drilled, ever. This provides Hawkstone with a significant opportunity, Lloyd says.

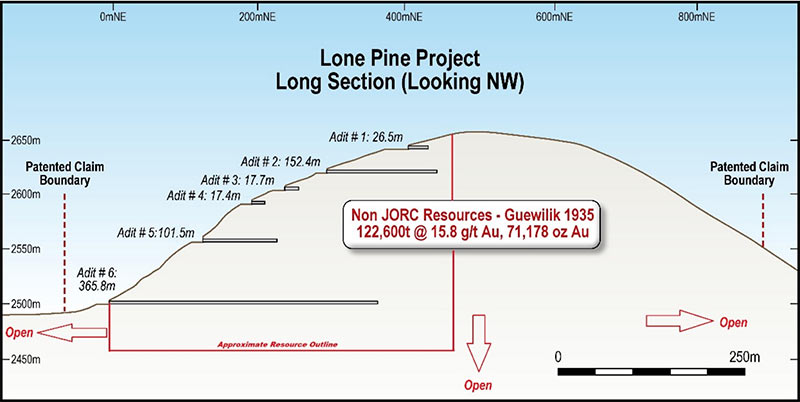

“If you look at the cross section, the old miners put six adits [underground mine entrances] into the mountain,” he told Stockhead:

“One of those, adit #6, is 350m long. They would not have mined that far into the mountain in the early 1900s if it wasn’t high grade. They certainly didn’t do it for fun.”

Between 2010 and 2013 current owner Inception Mining opened the portals of the #5 and #6 adits to do some trenching, metallurgical test work and bulk samples.

At the entrance to adit #5 the vein zone averaged 14.46g/t gold over 2.6m, but Inception never followed up.

Lloyd says there’s been no market for junior gold explorers in the US, which means assets like this just sit there, gathering dust.

“This will really launch us,” he says.

“Inception Mining has focused on the Honduras and done very little work on this project.

“As [Hawkstone technical director] Greg Smith said – ‘if this project was in Kalgoorlie it would look like a pincushion’.”

Smith knows what he’s talking about. The storied geologist was exploration manager for Moto Gold Mines, which was bought out for $600m after making a 22-million-ounce gold discovery in the DRC.

Hawkstone plans to drill immediately at Lone Pine to test this historic non-JORC compliant +70,000oz resource estimate.

A 400m, phase-one drilling program – five holes, 80m deep each – is expected to kick off in the second quarter.

But that’s just the start, says Lloyd. The initial program is only testing the near-surface stuff to 150-200m. The mineralisation remains ‘open’ in numerous directions.

“We will then follow that initial program up with a deeper program, later in the year,” he says.

“We have talked to a few underground contractors, one of whom subscribed to the upcoming placement.

“They said ‘the geology is so simple — just get a rig up there and drill it.’”