This expert says be patient, the money is coming for the small cap miners

Mining

Mining

Special Report: In the past three years, it has been the larger miners that have been bringing in the dollars, not so much the juniors. But that could soon change.

One expert says that it’s just a matter of time and the money will start to flood down to the smaller end of the market.

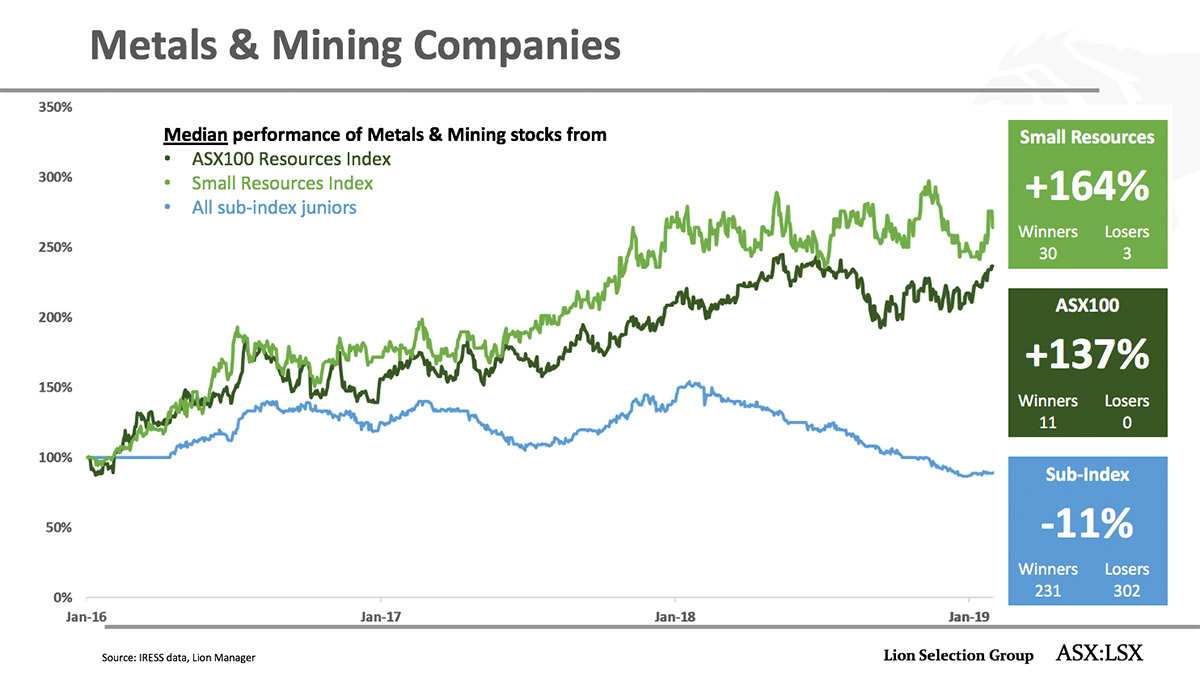

Lion Selection Group director Hedley Widdup told a gathering of delegates in Sydney today that over the past three years the big miners had put on a “brilliant performance”.

“Out of the circa 45 in that group most of those have been in positive territory for the last three years,” he said at the Resources Rising Stars conference.

“But it really has been limited to the big ones, and as any junior MD will tell you, the small space has not grown.”

Unfortunately for the little guys, they are down an average of 11 per cent.

“Now, there are some good ones within that as well and that’s going to skew the performance up for a few,” Mr Widdup explained.

“But if you look at the winners and the losers in that group, 300 of the circa 530 in that subset are trading at a lower share price than what they started January 2016 at.

“So, given three years, where funding has been coming back into the sector, this is still not lifting and I think this is the major disconnect.”

While the institutional money is loving the big guys, most of the money for the juniors is coming from retail investors.

What is interesting though is that it’s mostly investors taking a punt on exploration over development.

“If you think about that the risk profile of development, it is fairly well known, the risk profile of exploration is totally unknown,” Mr Widdup said.

“But it says there’s punting money there, and development maybe just doesn’t have the appeal to it.

“This will come in time, but this is why some of the better assets in the development space are the ones that are the most discounted.”

But those already invested in small miners can take heart – the money is close.

Mr Widdup said it’s logical that as time goes on, “filtered down investment appetite ends up in the juniors”.

“It hasn’t quite happened yet, but we are getting steadily and steadily closer and closer,” he said.

But until the institutions join the party – the discounts for juniors will continue, according to Mr Widdup.

So could now be the time to buy?

“Now when I go shopping and I see deodorants on special, I buy five bottles of it and I put it in the cupboard because I don’t want to pay full price,” Mr Widdup said.

“Take from that what you will.”

The Resources Rising Stars conference continues in Melbourne on Thursday.