This Canadian play is leading the electrification charge with battery metal gems

Mining

Mining

Just as Infinity Stones are critical to the plot of Marvel movies, Canada’s Infinity Stone Ventures is focused on delivering its own “gems”, projects critical to the world’s electrification efforts.

More specifically, the company is focused on delivering early to mid stage exploration projects in the battery metals space with particular attention on its Rockstone graphite, Buda and Galaxy lithium pegmatite, Zen-Whoberi copper-cobalt-PGE, and the newly acquired Thor manganese projects.

While split between the provinces of Ontario and Quebec, the company’s projects are all close to existing infrastructure – an important consideration when winter weather can cut off roads or in some areas be the only time that it is accessible through ice roads.

Speaking to Stockhead, chief executive officer Zayn Kalyan said that while most retail investors might put their money into exploration companies which focused on one metal or even one project, Infinity Stone Ventures offered a different approach.

“We really want to offer a diversified suite where we have multiple assets, taking multiple kicks at the can, we are de-risking the opportunity because you are investing in a suite of projects, some of which may have tremendous economic value, some of which may not,” he added.

The company’s proximity to the American battery supply chain is also a positive while the prevalence of hydropower in both Ontario and Quebec is another.

“It is renewable energy, so when we refine, that is going to us very green graphite,” executive chairman Michael Townsend noted.

Both provinces also top rated mining jurisdictions with Quebec rated sixth in the world by the Fraser Institute, while Ontario is at number 11 – and Townsend sees value there thanks to the low costs of labour and drilling.

“We are paying $100 a metre all in for drilling in Quebec, this is truck mounted drilling, just driving in and it is almost wheelchair access,” he says.

Kalyan added that Quebec also offered plenty of tax incentives including the ability to write off all exploration expenses and passing that through to investors.

“You can also get a credit back from the government for your expenditure as well for what you spend. It takes some time but will get your money back,” he explained.

So just what are the projects that Infinity Stone Ventures?

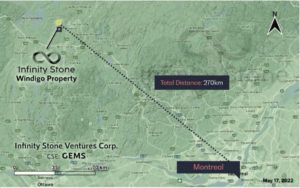

First up is the 680 hectare Zen-Whoberi project in Windigo about 80km from a railway and 300km from Glencore’s Horne copper smelter.

Historical drilling focused primarily on outcrops and returned significant intercepts including 22.8m grading 0.57% copper, 1.1 grams per tonne (g/t) gold over 1.2m and 0.8g/t platinum over 1.6m while several trench samples yield up to 5.07% copper, 0.59g/t gold, 3.9g/t platinum and 0.2g/t palladium.

Location of the Zen-Whoberi project. Pic: Supplied

Townsend noted the company had carried out a strategic assessment by carrying out a 2km by 2km geochemistry survey with samples taken every 25m.

“We got all those samples back about a month ago, plotted them, and where we got the highest samples, we went back in and took more samples within the 25m sample area,” he added.

“We are just plotting those now, they are saying we are getting very high elevated cobalt and nickel numbers that’s associated with the PGMs that we are seeing.

“The Zen-Whoberi anomaly is shaped like a tri-tip cut of beef, 500m wide on one end, 750m long and 180m wide on the other end and it is right up to surface with outcrops in three different areas, where they had drilled two of those areas previously.

“Very high grade on surface, Zayn and I were there two months ago, we were breaking rocks and the numbers were coming in real hot on pXRF – anywhere from 5-10% copper, we got a 17g/t silver hit, lots of interesting stuff on surface.”

Townsend noted that once this data is plotted on the geochemical map, the company should have drill targets within the next two to three weeks.

The company expects to start drilling in September before breaking in October for moose hunting season and returning in November and December when the ground freezes up – making it easy for rigs to be moved simply by skidding them.

Infinity Stone Ventures also holds the Galaxy lithium project, which covers 1,441 hectares about 45km west of Mont-Laurier and 140km north Gatineau with access to Highway 1 – the main Canadian artery which goes right through the property.

The early stage project is located below 30 pegmatite dikes, analysis of which shows anomalous quantities of lithium, tantalum, molybdenum, uranium and thorium.

More recently, the company’s sampling has returned up to 3.5% niobium with Townsend highlighting the discovery of a spodumene crystal as big as his iPhone.

“We don’t have any assays yet, but we will have them any day now,” he added.

Townsend is also excited about the company’s latest acquisition, the Thor project which has been extensively tested for manganese ore manganite and now the most advanced project in its portfolio.

Previous owners were looking for manganese to make steel with, leading them to drill 10 holes and carry out bulk sampling though the material turned out to be sedimentary-hosted sulphide manganese that was not ferro-grade.

Fortunately for Infinity Stone Ventures, this is exactly the kind of material which is sought after for making batteries which replace cobalt with manganese and require less nickel.

“This thing is at surface, it has got decline and shafts, we think it is something that can mobilise quite quickly and it is DSO quality so we don’t have to build a plant or anything,” Townsend noted.

“There’s a proven mineral system and all we are doing is applying modern exploration.”

While Quebec pips Ontario as a mining jurisdiction, the company’s projects in the other province are just as exciting.

Location of the Rockstone graphite project. Pic: Supplied

The company’s 785 hectare Rockstone graphite property is one of most advanced in its inventory with the discovery drill hole returning a jaw dropping 24m intersection grading 25% graphite.

Kalyan pointed out that Rockstone doesn’t just have high grades, it also has the right kind of morphology.

“Typically, when you have natural graphite, you have large flake graphite. But this kind of graphite is spherical, it is what goes into batteries so you can get density,” he explained.

“And we have done metallurgy on it and refined it to 96.1% purity, which is very pure but not quite battery grade, but we are actively working to get to 99.8%.

“We are working with one of the leading metallurgical labs in the world, they have indicated their belief that there is no issue in getting to that.”

He added that with all battery chemistries – lithium or otherwise – requiring graphite anodes, the graphite project de-risked Infinity Stone Ventures as market trends evolved.

Townsend noted that the company has 18 drill targets at Rockstone.

“We have applied for drill permits and we expect the permits in September, we just raised the funds to drill the property so we will be drilling in September and the first thing we will be doing is twinning that original hole which was drilled in 2011, so we are going to attempt to verify it,” he said.

“It’s right on road access on the corner of two highways and it is less than 50km way from Thunder Bay, Ontario, which is a major mining centre that is right on the Great Lakes, making it possible to ship products by barge to Detroit or Windsor, Ontario where the cars are made.”

Ontario also plays host to the company’s Buda pegmatite project, which consists of 68 mining claims covering 1,203 hectares about 50km west of Thunder Bay.

Seven lithium-caesium-tantalum pegmatites were identified by a previous operator while grab samples extracted from exposed pegmatite near Buda Station returned 210 parts per million lithium.

Infinity Stone Ventures is entering a phase of greater activity after raising C$500,000 recently.

“We are already working on these projects softly, but now we will have larger budgets to spend on these properties,” Townsend told Stockhead.

“I bet we can get 50% of them to the point where we can spend millions of dollars on them when the market comes back.”

He added that the Canadian-listed company will soon be listed on the US OTCQB, which is expected to increase the volume of trades.

The company is also working on an ASX listing, which is expected to take five to six months.

“The valuation that companies such as this are getting in Australia are 2-3 times what we get in Canada. Australia is about two years ahead of Canada in the battery metals sector and it is probably because of the Asian buyers who are very aggressive about securing supply,” Townsend explained.

“Compared to Australian companies, I think we are fairly inexpensive and fairly valued. We are in a new frontier with lots of news coming out.”

This article was developed in collaboration with Infinity Stone Ventures, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.